Leading the World in Carbon Removal

Puro.earth: The World's Leading Carbon Removal Platform

Growing Nasdaq's ESG offering to support corporate client sustainability efforts

Transitioning to a net zero emissions economy is crucial to mitigating the worst effects of climate change. But it won't stop there. To truly make a difference, we must actively decrease CO2 concentrations in the atmosphere, aiming for pre-industrial levels through net-negative emissions.

In 2021, Nasdaq acquired a majority stake in Puro.earth, the world's leading platform for engineered carbon removal. Puro.earth are scaling the Carbon Dioxide Removal (CDR) industry by connecting buyers with suppliers physically capturing CO2 from the atmosphere and stabilizing it in a durable storage.

Together, we will fuel a global scale-up phase of carbon removal that will create a world where companies are part of the change to combat climate change, while bringing trust, integrity and transparency to the solution.

Learn how Puro.earth has partnered with Standard Chartered Bank and SEB to increase capital allocation for negative emissions to support more offtake transactions between buyers and sellers.

Learn how Puro.earth has partnered with Standard Chartered Bank and SEB to increase capital allocation for negative emissions to support more offtake transactions between buyers and sellers.

Carbon removal, also called net-negative emissions, negative emissions and carbon dioxide removal (CDR), is physically capturing CO2 from the atmosphere and stabilizing it into a durable storage.

Puro.earth provides carbon removal as a service to corporations looking to neutralize carbon emissions by identifying processes that remove CO2 from the atmosphere, co-creating carbon removal methodologies with stringent requirements and verifying the operations.

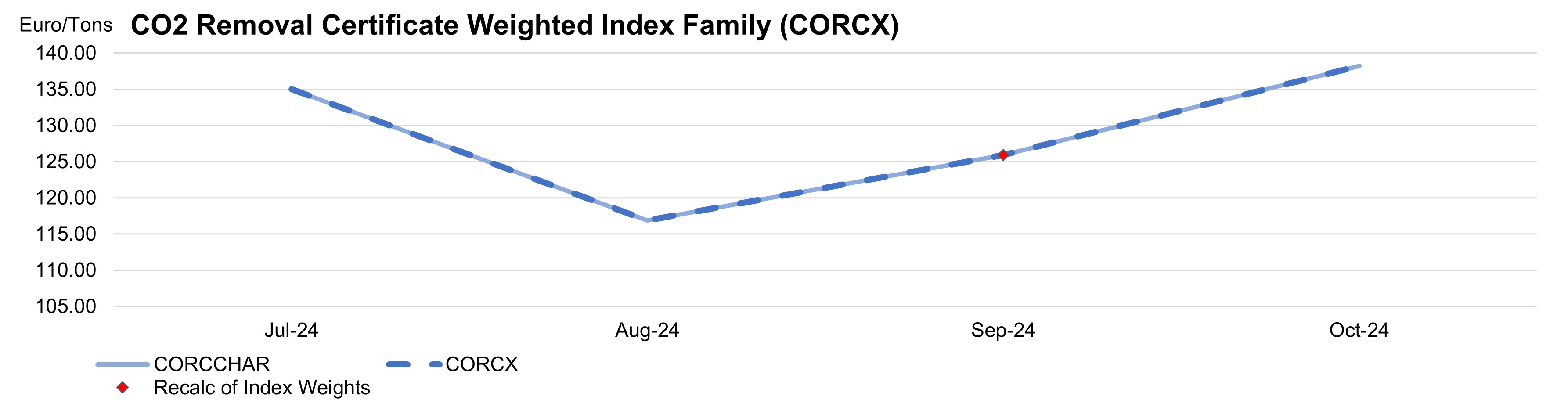

The CORC Index family is the world’s first indexes to focus exclusively on tracking the price of carbon removal from the atmosphere.

Nasdaq in collaboration with Puro.earth have created three commodity reference price indexes, based on Puro.earth's Carbon Removal Certificates (CORCs). The objective is to increase transparency in the carbon removal market, helping corporates understand the cost of cutting their carbon emissions and supporting more informed project financing decisions.

The Index family consists of a composite index that tracks the price of all carbon removal transactions as well as a separate index for biochar and bio-based construction materials.

| 10/1/2024 | 1 month change | 6 month change | YTD change | ||||

|---|---|---|---|---|---|---|---|

EUR | EUR | % | % | % | |||

| CORCX | 138.21 | 12.34 | 9.80% | 15.70 | 12.82% | 0.40 | 0.29% |

| CORCCHAR | 138.21 | 12.34 | 9.80% | 15.70 | 12.82% | 0.40 | 0.29% |

Nasdaq's ESG newsletter, bringing you the latest updates and insights on all things ESG.

Disclaimer:

Nasdaq Copenhagen AS or any of its affiliates (“Nasdaq”) assumes no liability for loss or damages related to or arising out of the use of the CORC Removal Reference Price Index family (the “CORC Index”). Nasdaq expressly disclaim all warranties of accuracy, completeness, merchantability or fitness for a particular purpose with respect to the CORC Index. Neither Nasdaq nor any third party make any express or implied warranties or representations regarding the results which may be obtained as a consequence of the use of CORC Indexes or regarding the value of CORC Indexes at any given time. Nasdaq shall in no case be liable for errors or defects in CORC Indexes, nor obliged to provide notice of or otherwise publish errors in CORC Indexes

CORC Indexes is provided by Nasdaq Copenhagen AS and shall not without Nasdaq Copenhagen AS's prior written consent be used:

As reference for the issuance of a financial instrument;

As reference for the determination of the amount payable under a financial instrument or a financial contract;

As reference by a party to a financial contract;

For measuring the performance of an investment fund, of defining the asset allocation of a portfolio, or of computing the performance fees;

For any other purpose which may qualify Nasdaq Copenhagen CORC as a benchmark in accordance with regulation (EU) 2016/1011 of the European Parliament and of the European Council on indices used as benchmarks in financial instruments and financial contracts.

Please be aware that from January 2023, Puro.earth will increase the minimum threshold for carbon removal durability to 100 years. This mean that the CORCWOOD will no longer be part of the CORC Carbon Removal Price Index Family and no individual reference price will be calculated for this method. This change will also affect the CORCX index as no method other than biochar meets the minimum threshold.