Nasdaq Fund Network

Nasdaq Fund Network (NFN) offers fund data services that deliver transparency to investable products to help ensure professionals and non-professionals can make more informed decisions with their assets. NFN facilitates the collection and dissemination of performance, Net Asset Value (NAV), valuation, and strategy-level reference data for over 35,000 products to 100 million+ investors.

How it Works

AS ONE OF NASDAQ’S LONGEST-STANDING PRODUCTS AND SERVICES, THE NASDAQ FUND NETWORK WAS ORIGINALLY LAUNCHED IN 1984 UNDER THE NAME ‘MUTUAL FUND QUOTATION SERVICE’ WHERE IT GAINED SUCCESS AS THE SOLE VENUE IN THE U.S. TO PROVIDE SEARCHABLE SYMBOLS FOR MUTUAL FUNDS. TODAY, NFN HAS EXPANDED TO BRING MORE AWARENESS AND TRANSPARENCY TO SEVERAL OTHER ASSET CLASSES. IT HAS BEEN INSTRUMENTAL IN HELPING PRODUCT ISSUERS GAIN POPULARITY WITH INVESTORS IN A TRANSPARENT MANNER.

While the name has changed, our value proposition has not. NFN delivers the same market-tested services to enhance discoverability, transparency, and reach for investment products, helping asset managers and issuers grow assets.

-

Enhanced Discoverability: Each product is registered on the network with a unique symbol to help increase discoverability on market data platforms and financial web portals to make searching easier for investors

-

Greater Transparency: Use performance and valuation data to better position your products against peers to gain wider market visibility

-

Amplified Reach: Reach one million+ institutional and retail investors daily through the NFN distributor network

Our Partners

Luma Financial Technologies

In June 2022, the Nasdaq Fund Network announced an agreement with Luma Financial Technologies, a multi-issuer structured products and annuities platform. By assigning identifiers to structured products for the first time, Luma and the Nasdaq Fund Network are collaboratively bringing these investment vehicles into the same spotlight as stocks, ETFs and mutual funds.

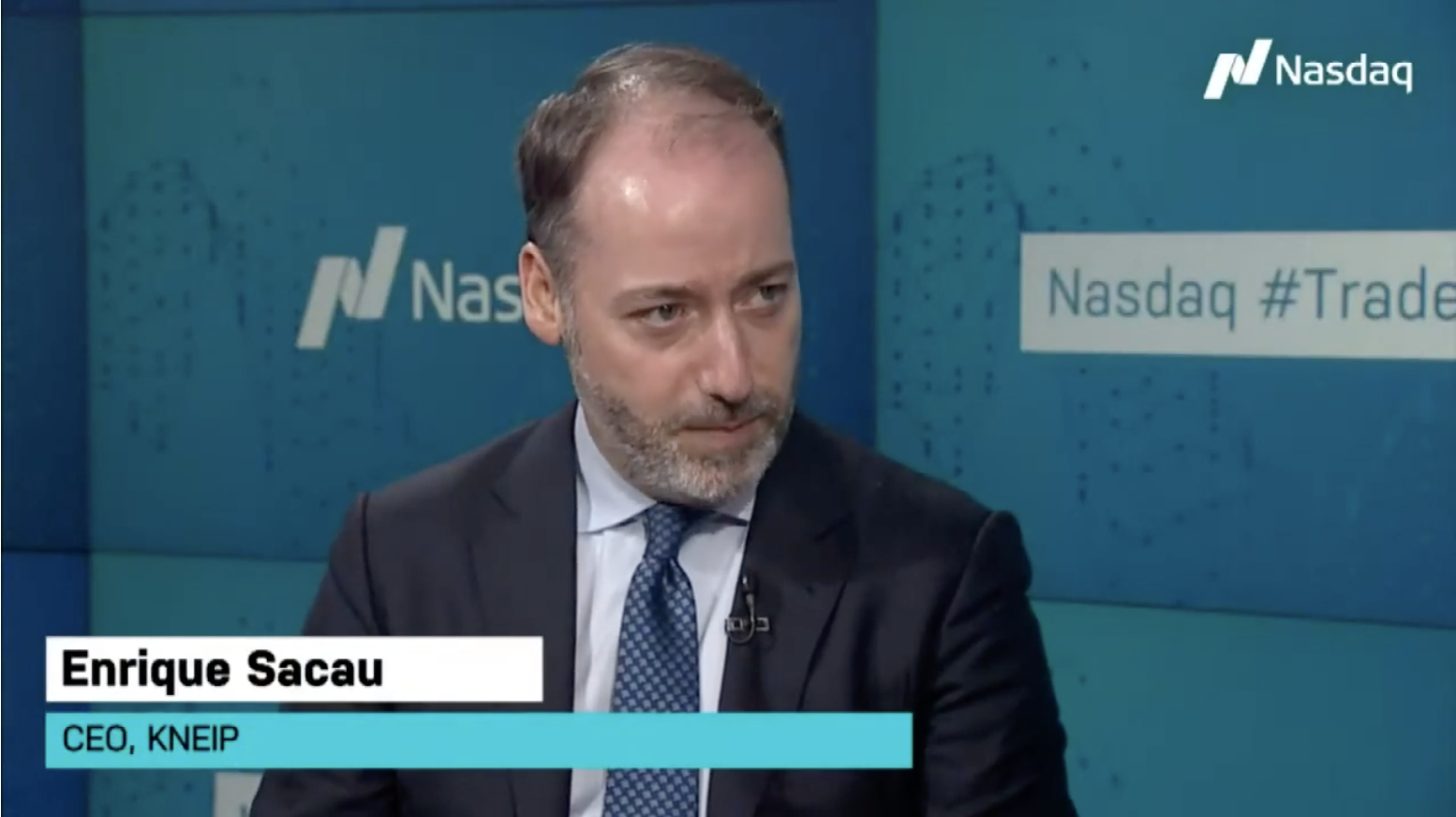

KNEIP

In November 2021, Nasdaq Fund Network partnered with KNEIP, a leader in the fund data management and reporting solutions, to register funds in Europe. Together, we now publish EU UCITS, providing enhanced transparency and accessibility of investment products in Europe with standardized 5-character symbol.