Trading Technology Powering Exchanges Globally

Nasdaq’s powerful matching engine enables marketplaces across the globe to offer efficient, fair, and resilient trading in a wide range of asset classes and instrument types. Its proven performance, combined with flexible deployment and service options and a range of available add-on services, allows markets to keep pace with ever-changing market requirements and capitalize on new opportunities as they arise.

Developed out of unparalleled market expertise

Nasdaq operates leading securities markets in the United States and Europe and is the technology partner to 130+ market infrastructure operators globally. Our deep understanding of the needs and requirements of market operators today, and as they evolve, is embedded in our solutions and the base for our continuous product investments and roadmaps.

-

Nasdaq operates leading securities markets in the United States and Europe and is the technology partner to 130+ market infrastructure operators globally. Our deep understanding of the needs and requirements of market operators today, and as they evolve, is embedded in our solutions and the base for our continuous product investments and roadmaps.

Comprehensive product support beyond the trade

Our trading technology supports the full range of trading functions from price formation through order matching in any asset, anytime, and anywhere. In addition, our broader portfolio of interoperable marketplace technology solutions enables seamless integration with pre- and post-trade risk technology, market surveillance, and other critical services surrounding the trade.

-

Our trading technology supports the full range of trading functions from price formation through order matching in any asset, anytime, and anywhere. In addition, our broader portfolio of interoperable marketplace technology solutions enables seamless integration with pre- and post-trade risk technology, market surveillance, and other critical services surrounding the trade.

Flexible deployment and service options

We offer multiple service and deployment options to provide an optimized setup for each customer and enable controlled transitions to a modern and dynamic infrastructure leveraging cloud and edge computing. Our managed services and SaaS offering allow market operators to focus resources on value-adding activities rather than software and hardware maintenance.

-

We offer multiple service and deployment options to provide an optimized setup for each customer and enable controlled transitions to a modern and dynamic infrastructure leveraging cloud and edge computing. Our managed services and SaaS offering allow market operators to focus resources on value-adding activities rather than software and hardware maintenance.

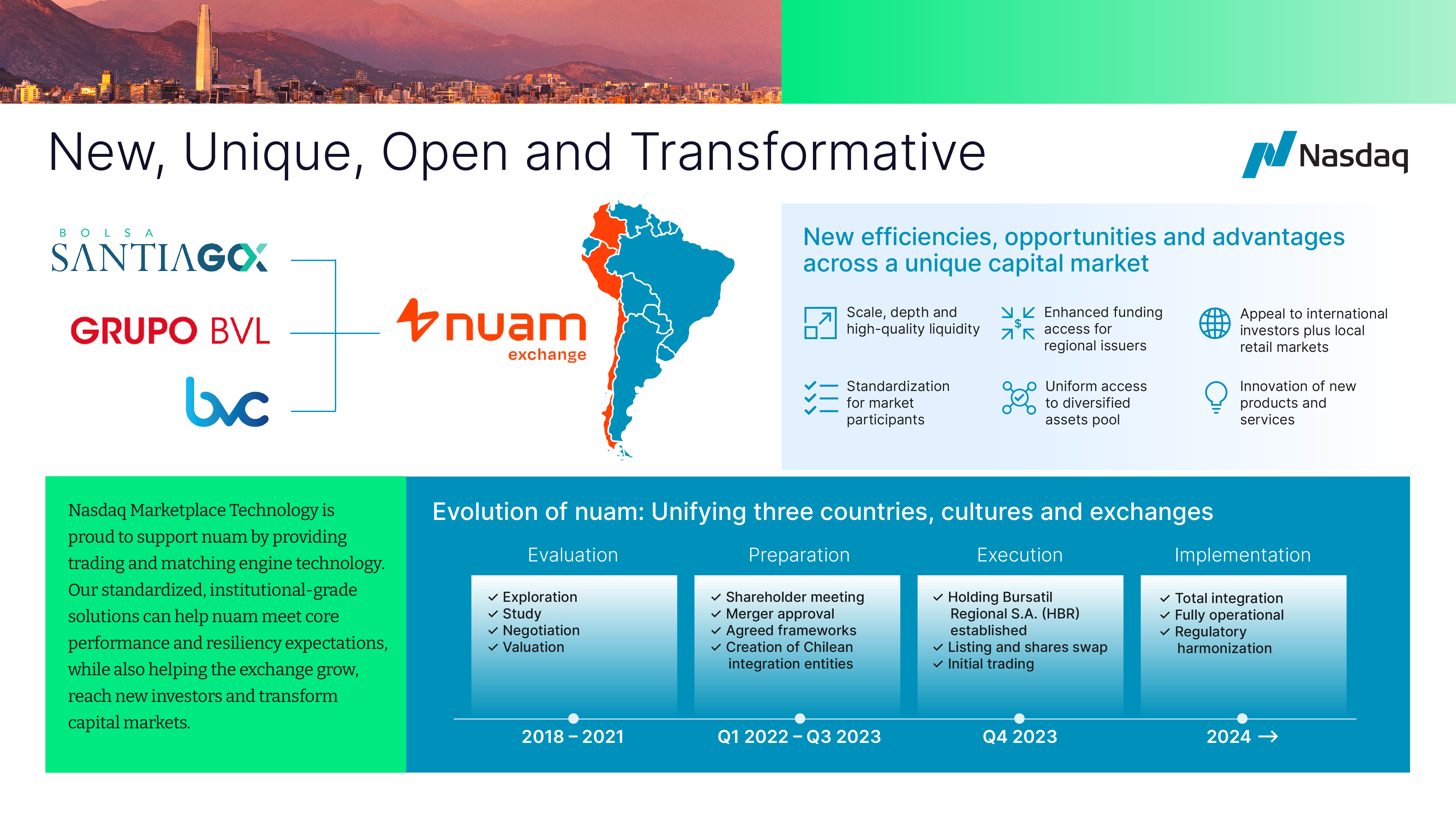

nuam exchange Is Building a Unique Capital Market in Chile, Peru and Colombia

Exchange Trading Technology Features

-

Comprehensive coverage

A matching engine for all asset classes — from equities, futures and options, bonds, foreign exchange, and commodities to exotic derivatives and digital assets. A wide range of market models and order types support order- and quote driven markets as well as request for quote, auctions, multi-parameter matching, complex trading strategies, and trade reporting.

Robust, high-performance matching

Optimize your market for ultra-low and consistent latency with maximum uptime. Road-tested under the most demanding market conditions with a track record of high availability, Nasdaq's matching engine continually raises the bar in performance. The technology features among the lowest latency in the industry at sub-40 μSec, with our fastest production implementation at 14 μSec latency door-to-door.

Scalable for marketplaces of all sizes

Supports marketplaces from small to big, horizontally scalable to manage growing transaction volumes, onboarding of new clients, and addition of new instruments and asset classes to your market without impact to latency.

Easy onboarding

Facilitates efficient client onboarding and system integration with widely adopted interfaces based on global standards for order entry and market data, including FIX, ITCH, and OUCH, as well as a user-friendly trading user interface.

Robust regulatory frameworks

Adopts best-in-class international practices within a robust regulatory framework, risk protection mechanisms, and safeguards based on Nasdaq’s comprehensive experience of operating markets and delivering technology to marketplaces in 50+ countries.

Purpose-built cloud services

Leverage the benefits of operating in the cloud, including elastic scalability, resilience, client connectivity, and economies of scale. Nasdaq’s trading technology can be deployed in public and private cloud environments to operate 24x7x365, as well as on-premise and with hybrid setups.

Comprehensive coverage

A matching engine for all asset classes — from equities, futures and options, bonds, foreign exchange, and commodities to exotic derivatives and digital assets. A wide range of market models and order types support order- and quote driven markets as well as request for quote, auctions, multi-parameter matching, complex trading strategies, and trade reporting.

Robust, high-performance matching

Optimize your market for ultra-low and consistent latency with maximum uptime. Road-tested under the most demanding market conditions with a track record of high availability, Nasdaq's matching engine continually raises the bar in performance. The technology features among the lowest latency in the industry at sub-40 μSec, with our fastest production implementation at 14 μSec latency door-to-door.

Scalable for marketplaces of all sizes

Supports marketplaces from small to big, horizontally scalable to manage growing transaction volumes, onboarding of new clients, and addition of new instruments and asset classes to your market without impact to latency.

Easy onboarding

Facilitates efficient client onboarding and system integration with widely adopted interfaces based on global standards for order entry and market data, including FIX, ITCH, and OUCH, as well as a user-friendly trading user interface.

Robust regulatory frameworks

Adopts best-in-class international practices within a robust regulatory framework, risk protection mechanisms, and safeguards based on Nasdaq’s comprehensive experience of operating markets and delivering technology to marketplaces in 50+ countries.

Purpose-built cloud services

Leverage the benefits of operating in the cloud, including elastic scalability, resilience, client connectivity, and economies of scale. Nasdaq’s trading technology can be deployed in public and private cloud environments to operate 24x7x365, as well as on-premise and with hybrid setups.

Meet Our Customers

Meeting end-to-end investment needs

Modernizing the Thai Capital Market

Market Infrastructure Insights

-

Safeguard market integrity and expand your business with add-on services that integrate seamlessly with our trading technology

How Nasdaq Helps

Get Started with Nasdaq

Get In Touch

Get in touch to learn about Nasdaq's Trading Technology solutions for market operators.

We've received your information.

Someone from our team will contact you soon.

In the meantime, visit our FAQs for answers to additional questions you might have.

Resource Center

Learn More About Nasdaq's Exchange Trading Technology

-

-

Report

FMIs and the Cloud: Building the Business Case

For FMIs, cloud transformation can be challenging to assess using a traditional total-cost-of-ownership (TCO) framework. In a new paper from Celent, commissioned by Nasdaq, a rethought TCO equation is argued for that captures the holistic costs of FMIs “standing still.”

Please check your inbox to read the report.

-

Whitepaper

Planning for Cloud: Regulatory Considerations for FMIs

As market infrastructures advance their cloud strategies and relationships with cloud service providers (CSPs), it’s vital they bring regulatory stakeholders in early and often. This report highlights the increasing adoption of cloud tech among FMIs, who are using it to foster innovation, improve efficiency, and enhance resilience in capital markets.

Please check your inbox to read the whitepaper.

-

Factsheet

Nasdaq Exchange Matching Technology Factsheet

With over 50 years' experience of operating electronic exchanges, Nasdaq offers multi-asset trading technology purpose-built for efficient and robust matching across a broad spectrum of market models and needs.

Please check your inbox for your copy of the Nasdaq Exchange Matching Technology Factsheet.

-

Thought Leadership

2024 Outlook: State of Cloud Adoption at FMIs

Based on lived experience in migrating three markets to the Cloud and on insights and observations gathered from delivering mission-critical market infrastructure solutions worldwide, Nasdaq has compiled a new viewpoint paper aimed at providing the 2024 Outlook for Cloud in Market Infrastructure.

Please check your inbox for the report.

-

Guide

Choosing Deployment Model for Your Trading Platform

When setting up a new trading platform or modernizing an existing infrastructure, it's as important to consider deployment and operational models as the software solution itself, Download the insider's guide to deployment selection.

Please check your inbox for the guide.

-

Case Study

Case Study: Stock Exchange of Thailand

Learn how the Stock Exchange of Thailand is modernizing its capital markets with the help of Nasdaq technology.

Please check your inbox for the case study.

-

Whitepaper

Market Infrastructure Modernization Whitepaper

Learn more about the intricacies of infrastructure modernization, cloud adoption and how to lay the groundwork for long-term success.

Please check your inbox for the whitepaper

-

Report

CIO Market Infrastructure Survey 2021

Celent interviewed CIOs and senior technology leaders of global market infrastructure to understand their focus, priorities, and investments around the creation of their future platform. Download the report to take part of their insights.

Please check your inbox for the report.

-

Report

CIO Priorities in Capital Markets Infrastructure

Please check your inbox for the report.

-

-

- Indonesia Stock Exchange Partners with Nasdaq to Upgrade Market Infrastructure

- 5 Reasons Why Financial Market Operators Are Turning to SaaS

- nuam exchange and Nasdaq Form Strategic Technology Partnership to Develop New Marketplace in Latin America

- SET Launches New Trading System Leveraging Nasdaq Technology to Meet End-to-End Investment Needs

- Recapping ASIFMA Tech & Ops 2023 and AWS Exchanges Cloud Forum

- Bolsa Electrónica de Chile’s CEO on Moving Operations to the Cloud in 2024

- Bolsa Electrónica de Chile Upgrades to Nasdaq Marketplace Services Platform

- Nasdaq Trading & Matching Technology Wins FOW Solution of the Year Award

- Dhaka Stock Exchange Extends Technology Partnership with Nasdaq

- Abu Dhabi Securities Exchange (ADX) to Launch Derivatives Market, Leveraging Nasdaq Technology

- Risk Markets Technology Awards Winner 2019