Nasdaq Execution Platform

For full outsourcing and operations of internal marketplaces

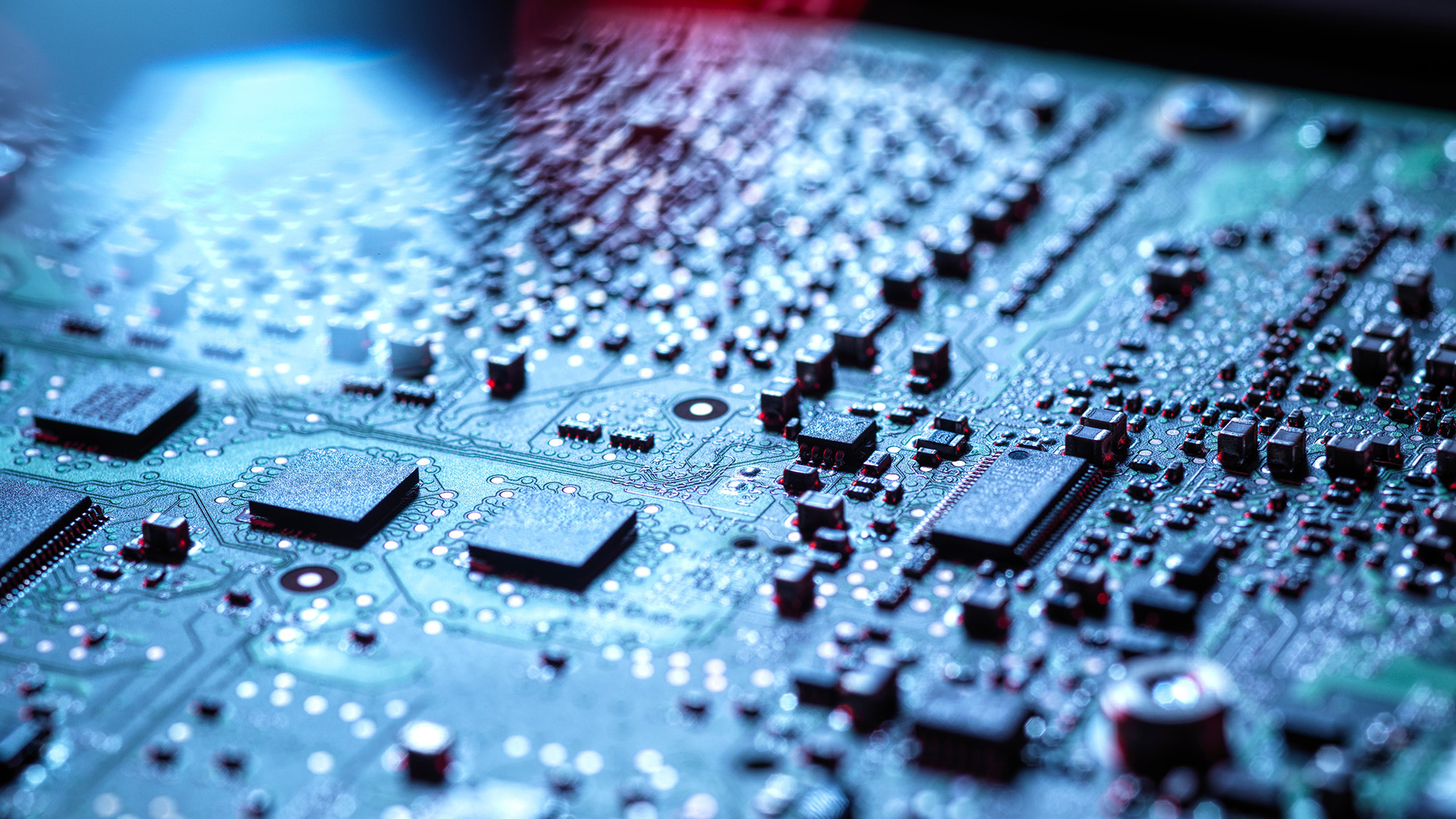

Trading infrastructure technology requires continuous investment to remain competitive. By leveraging Nasdaq's proven technology and services, you can focus on differentiation rather than on upkeep of operations and keeping pace with functional updates and regulatory changes.

%20Exceeds%20Market%20Returns%3A%20Some%20Facts%20to%20Consider%20%7C%20Nasdaq&_biz_n=5&rnd=97168&cdn_o=a&_biz_z=1743104359724)

%20Stock%3F%20%7C%20Nasdaq&_biz_n=6&rnd=880864&cdn_o=a&_biz_z=1743104359725)