Secure, fast, and timely reporting - as a service

As capital markets operations continue to grow in size and complexity, financial institutions can no longer rely on aging technology stacks with key person risk. Modernizing the technology landscape with vendor-managed SaaS delivers the growth engine of tomorrow, and enables the institutions to face fresh digital competition by launching new products faster than before.

Key Features

-

Develop, run, and manage standard or customized regulatory-reporting solutions on Nasdaq AxiomSL without maintaining underlying technology infrastructure

-

Single-tenant application model for complete data isolation from other clients

-

Secure network connectivity, and technical and application management services

-

Continuous deployment of regulator-driven changes and documentation with Regulatory Change Services (RCS)

-

Industry-accredited security protocols and delivery frameworks and best practices

-

Continuous integration and deployment pipelines for Infrastructure as Code, and core software

-

Multi-layer infrastructure resiliency, potentially across multiple geographic locations

-

Disaster recovery best-practices for recovery point objective (RPO) and recovery time objective (RTO) service-level commitments

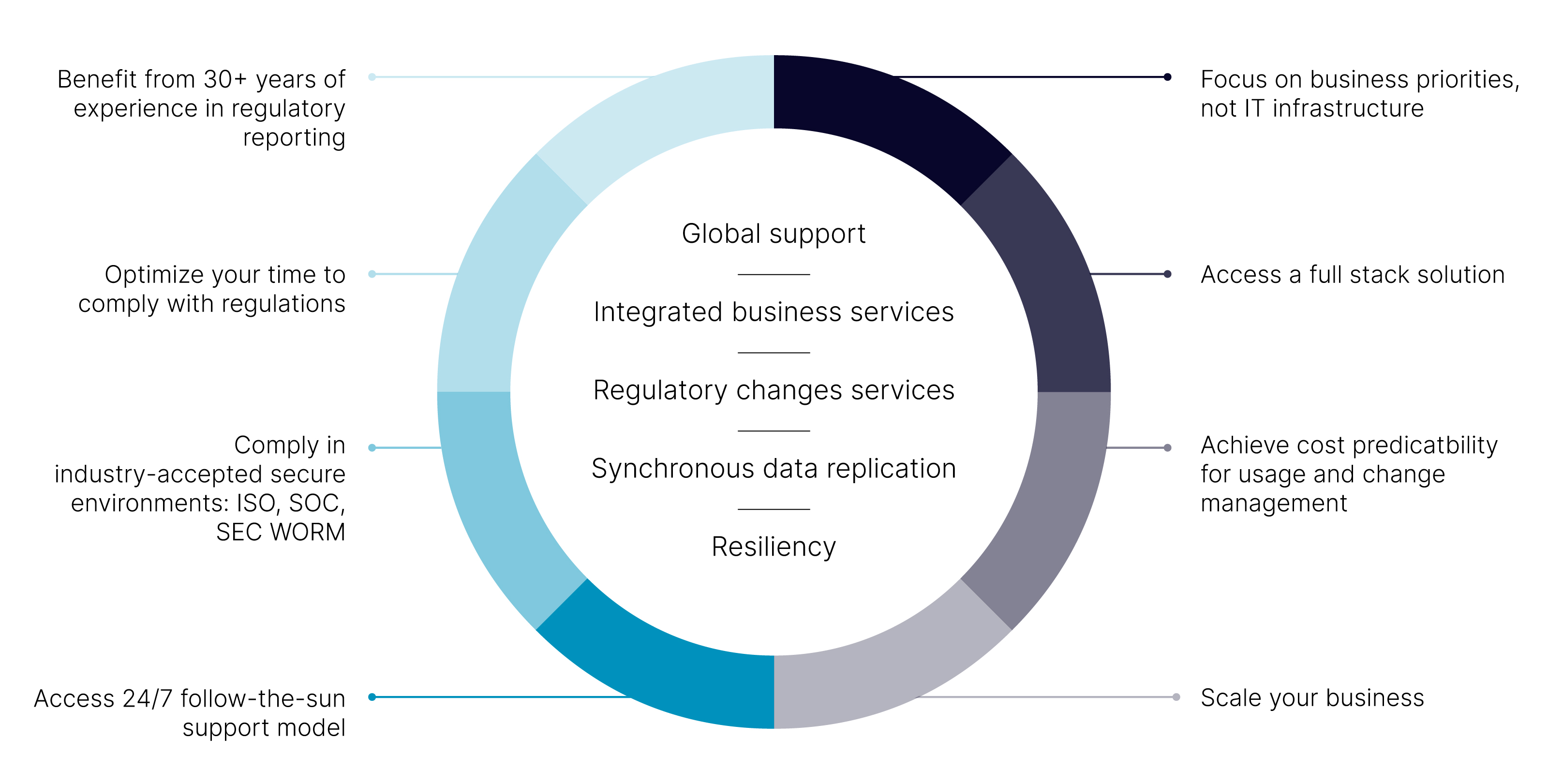

Benefits

Resource Library

Related Content

US Regional Bank Exploits Nasdaq Calypso Cross-Platform Ecosystem for Front-to-Back Risk and Nasdaq CapCloud for Agility

Category III bank and regulatory solutions client expands its relationship to the capital markets with Nasdaq Calypso SaaS for Basel III Endgame compliance. Download the pdf to read more.

Nasdaq RegCloud Transition in Numbers

Read about the benefits of replacing inflexible on-premises applications and automating inefficient and error-prone manual processes through a managed SaaS regulatory reporting solution. Improve user productivity, increase agility, and reduce the risk of noncompliance.

-

Thought Leadership

Nasdaq RegCloud Transition in Numbers

Read about the benefits of replacing inflexible on-premises applications and automating inefficient and error-prone manual processes through a managed SaaS regulatory reporting solution. Improve user productivity, increase agility, and reduce the risk of noncompliance

Please check your inbox for your copy of the Nasdaq RegCloud Transition in Numbers

Nasdaq RegCloud SaaS

Discover how deploying Nasdaq RegCloud® can reduce non-compliance risks, boost efficiency, and maximize resources for optimal cost savings and ROI.

-

Brochure

Nasdaq RegCloud SaaS

Discover how deploying Nasdaq RegCloud® can reduce non-compliance risks, boost efficiency, and maximize resources for optimal cost savings and ROI.

Please check your inbox for the your copy of the Nasdaq RegCloud SaaS brochure.

The Total Economic Impact Of RegCloud

In this report, Forrester® dives into the significant ROI potential of transitioning to Nasdaq RegCloud compared to sticking with on-premises solutions

-

Thought Leadership

The Total Economic Impact Of RegCloud

In this report, Forrester® dives into the significant ROI potential of transitioning to Nasdaq RegCloud compared to sticking with on-premises solutions

Please check your inbox for your copy of the The Total Economic Impact Of RegCloud.

Get started with Nasdaq

Get In Touch

Take the next step in optimizing your regulatory compliance. Complete our short form now to learn how Nasdaq RegCloud can streamline your processes and reduce risks. Don't wait – enhance your compliance strategy today!

Someone from our team will get in touch with you soon.