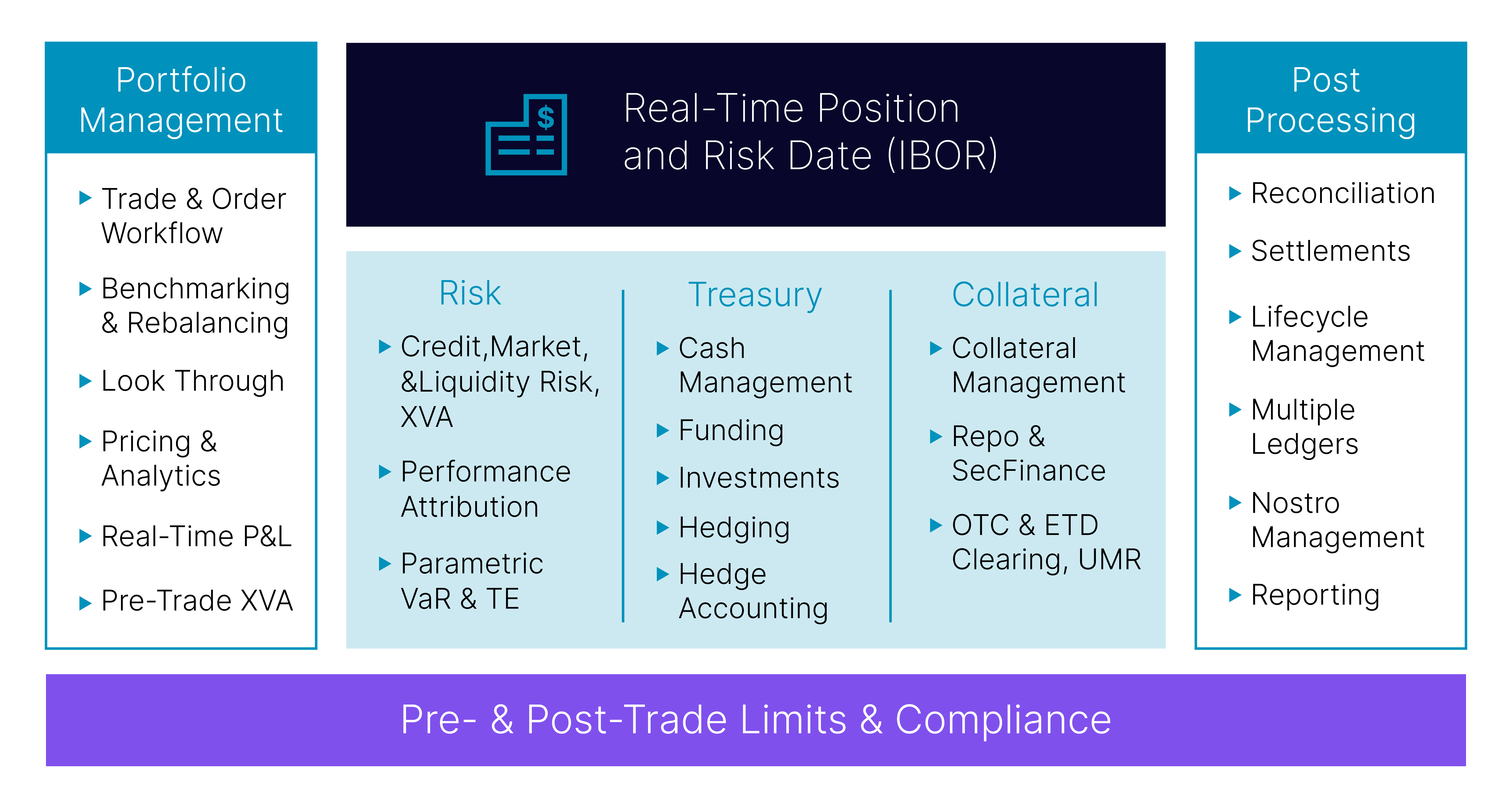

Nasdaq Calypso Front Office

Trading and portfolio management to make better decisions

Facing lower returns, the front office is severely pressed to cut costs, boost performance, comply with ever-increasing regulatory requirements, and deliver exceptional client service. Meanwhile, businesses must be able to add products quickly and support new product types like carbon trading in the burgeoning ESG arena, while managing flow products efficiently.