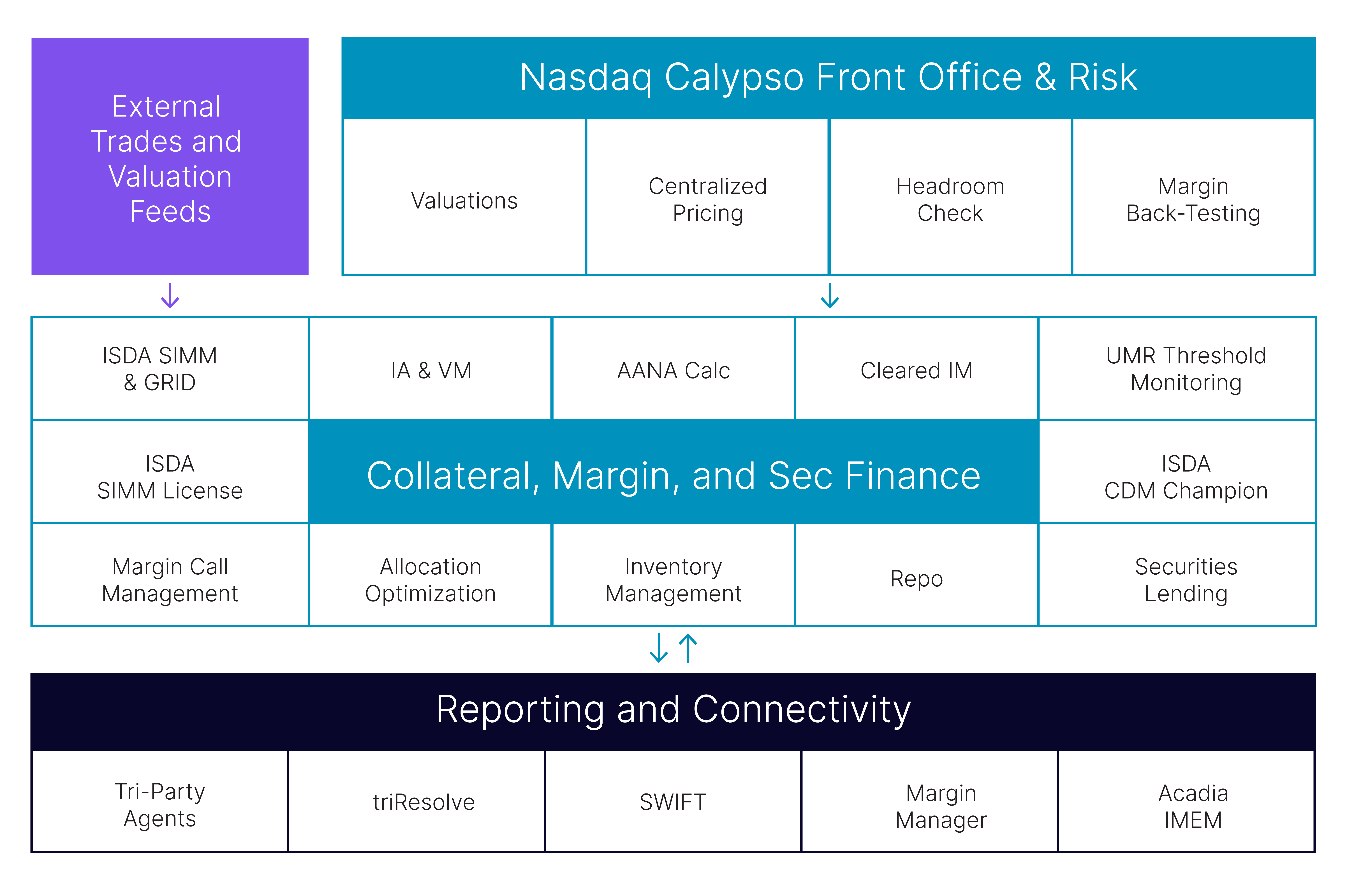

Nasdaq Calypso Collateral, Margin & Securities Finance

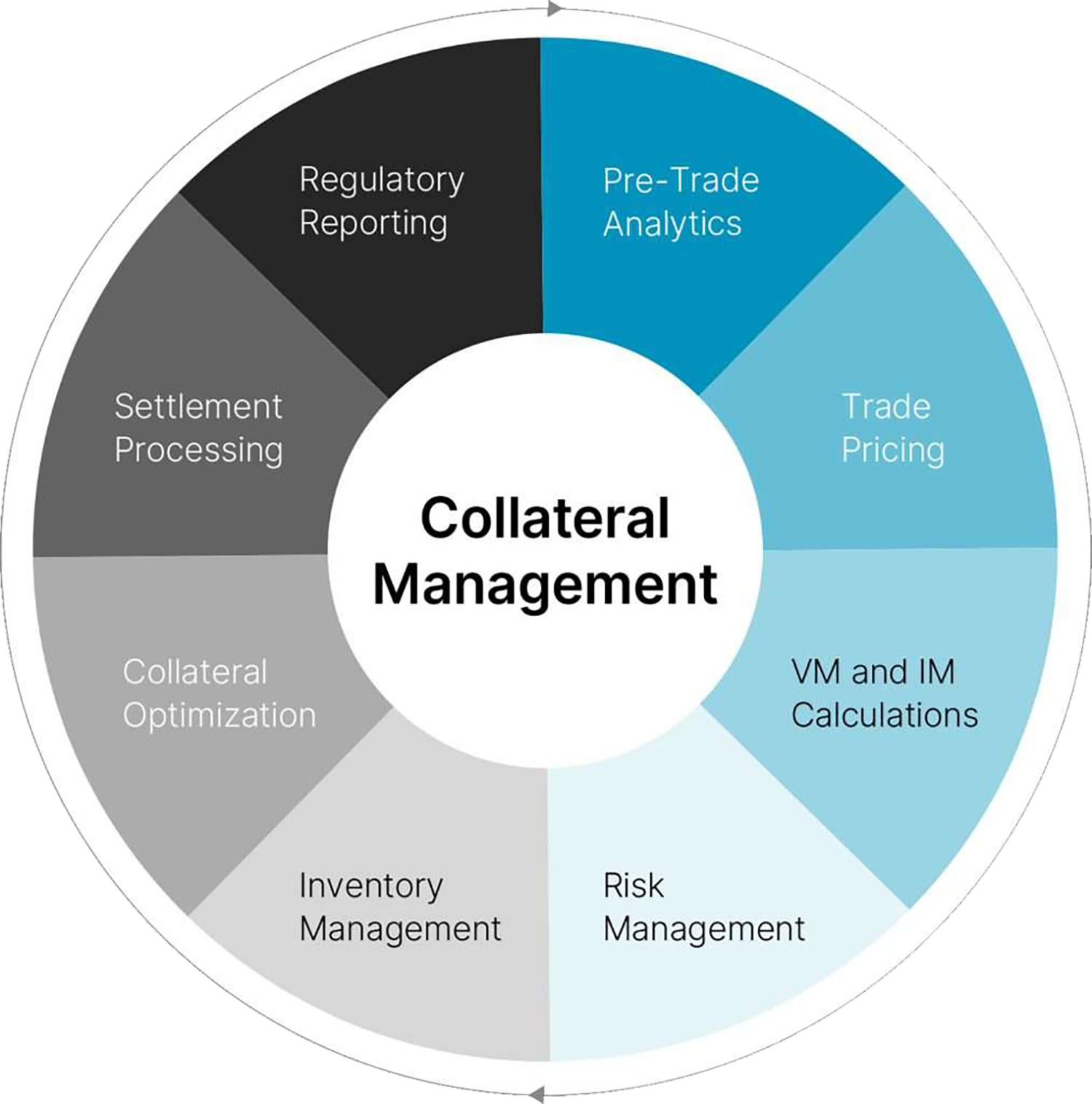

A single cash and security inventory to optimally manage margin calls, allocate collateral, and trade securities finance transactions

The growing need to integrate the collateral function with the treasury and capital market trading solution is driven by new pricing, hedging, and counterparty risk best-practices, and by larger regulatory frameworks including UMR, SA-CCR, and SFTR.