ABCs of U.S. Stock Market Acronyms

Those of us who work in the U.S. Equity markets use a lot of jargon and acronyms. Today we’ll try to explain some of the more common and important terms and why it’s important not to confuse one with the other.

We recently explained Reg NMS. That’s the rule set that explains how U.S. equity markets work. But within Reg NMS are some other important terms, from SIPs and TRFs to NBBOs, as we detail below:

Three Tapes, based on listing exchanges

In the beginning, stock exchanges were manned by humans with telephones and paper tickets to confirm trades. That worked for the brokers on the actual trade floor, but the public outside still needed a way to see what was happening to stock prices. That’s where “ticker tapes” came in. Actual rolls of tape with tickers and trades printed on them in a stream. These data could also be transmitted over phone lines to brokerage houses around the country.

Back then, each exchange had their own listings and a ticker tape for the stocks that traded on their own floor. Consequently NYSE had its own “tape” for all its listings.

These days, tapes are still associated with a stock’s “primary listing” venue (that’s the exchange that sets the official opening and closing price). Today, we have three tapes:

- Tape A: covers all NYSE listed stocks

- Tape B: covers “regional” exchange listings, including BATS, NYSE American, ARCA and IEX

- Tape C covers all Nasdaq listed stocks

A breakdown of the listings by market cap (see Chart 1 below) shows tape B is comprised of mainly ETFs. That’s because although NYSE American (AMEX) has some small company listings, there are more than 2,100 ETFs, many of which list on Arca and BATS.

Tape C, belonging to Nasdaq, has the most listings, including some of the largest U.S. companies (including AAPL, AMZN, MSFT, GOOG/GOOGL, FB and NFLX), as well as many emerging growth stocks.

Chart 1: Number of U.S. companies on each “tape” by market cap

Source: Nasdaq Economic Research (Data from Dec 2018)

UTP for Unlisted Trading Privileges

In 1994, we saw the introduction of the Unlisted Trading Privileges Act, or UTP. This allowed stocks to trade on any venue, regardless of their primary listing exchange.

Because of this, while AAPL lists on Nasdaq, it can trade anywhere in the liquidity pie. This has, over time, given rise to exchanges that exist just for trading, separating the listings business from the broader exchange platform.

Chart 2: Stocks can trade anywhere, regardless of where their primary listing is

Source: Nasdaq Economic Research (chart shows market share of all volume for Oct-Nov 2018)

SIP is a modern day “tape”

SIP stands for Securities Information Processor. Each “SIP” is basically an electronic form of the old “tapes.”

They provide the prices and volumes for quotes and trades, electronically.

However because of UTP, SIPs have a lot more work to do than the old fashioned tapes, as they need to aggregate the quotes and trades from all venues for each ticker on the tape that the SIP tracks (for more on that see NBBO below).

Just as the old tapes were based on the primary listing exchange, so are the SIPs – even though after UTP was enacted, a stock can trade in almost any venue. There are two SIP operators running the three tapes:

- SIAC operates all Tape A and B stocks, and is based out of NYSE’s data center in Mahwah, New Jersey

- Nasdaq operates all Tape C stocks and is based in out of Nasdaq’s data center in Carteret, New Jersey

We recently talked about how fast the SIPs are – in the time it takes you to blink, they can put quotes and trades together about 3,000 times.

Table 1: SIPs and tapes are based on primary listings.

Source: Nasdaq Economic Research

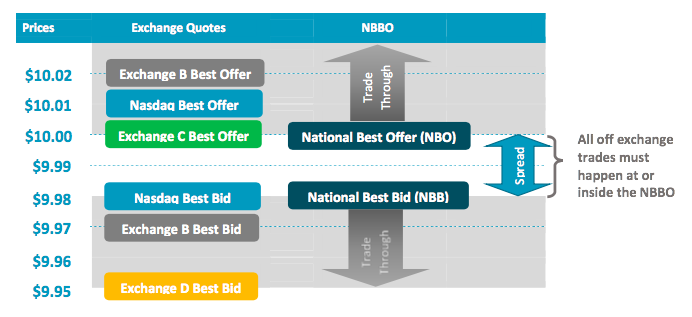

NBBO is the National Best Bid and Offer

In simple terms, the NBBO represents the best buy price and the best sell prices in the entire market, nationally, at any point in time.

The NBBO for each stock is published by the SIP that is responsible for that ticker’s primary listing. However, since UTP was created, multiple exchanges can now have quotes in any stock at any time, so the SIP has a lot more work to do than the old tapes.

- First it needs to get the best bids and offers from each exchange

- Then it needs to work out what exchange has the best bid (highest price to buy)

- And what exchange has the best offer (lowest price to sell)

- And then send that compiled NBBO out, with details of what price and which venue has the best bid and offer

Table 2: SIPs compile the NBBO based on all the exchanges quotes in a specific security.

Source: Nasdaq Economic Research

The NBBO performs a number of other very important functions built into Reg NMS:

- Rule 605 computes execution quality based on the quoted spread. The spread is the gap between the best bid and best offer. This represents the explicit cost that a market order must pay for an immediate fill. It is sometimes measured in cents (or ticks), although we often convert this to basis points to measure this “cost” in a consistent way across stocks.

- Rule 611 prohibits trade-throughs. A trade through would occur if someone paid $10.01 for the stock above even though a better $10.00 offer exists. This ensures that all investors get the best price available across all venues, the NBBO.

- NBBO applies to off exchange trades too. Even though off exchange trades don’t contribute too directly to price discovery, as the bids and offers remain “hidden,” those trades are still held to the best prices shown on exchanges. That protects all investors as ensures they get, at least, the best price publicly available.

- NBBO setters contribute to SIP revenue allocations. The SIP revenue formula is a topic for another post, but in short, 50% of the revenues from selling SIP data are reallocated to exchanges who set NBBO. That’s important because it means the economics of incentivizing lit quotes is shared, even with investors trading off exchange who also benefit from the lit exchange prices.

- SIP compiles this for everybody. Although there are some who unfairly criticize the SIP, we shouldn’t take it for granted. What it provides: A single, unified source of all venues’ best prices, compiled for, and available to all investors for a fraction of the cost of a trade, which also holds all routers and off-exchange traders accountable – is the envy of equity traders around the world as well as traders in other asset classes where, sometimes, even prices are difficult to obtain. (As a reminder, we outlined various ways to reform the SIP through our TotalMarkets initiative, covered here.)

TRF prints trades from off-exchange trades

While we’re talking about off-exchange trading, let’s cover how the TRF works.

NMS Rule 601 only allows exchanges to print trades directly to the SIP. However, broker-dealers consummate trades “off exchange” all the time—manually and electronically, on an agency and principal basis.

TRF stands for “Trade Reporting Facility.” It provides a mechanism for brokers and Alternative Trading Systems (ATSs) to send trade details to exchanges, to print to the SIP, electronically. That in turn ensures that the SIP includes all quotes AND trades, including all off-exchange trades.

There are two TRF’s: one run by Nasdaq and the other by NYSE.

However, in contrast to the SIP, the TRF has nothing to do with the listing exchange. In fact most brokers send all their trades to one TRF, and the TRF then works out which SIP to send each trade to, based on the tape the ticker needs to report on. This can add to geographic latency, but it only affects trades done, not quotes available.

Importantly, the TRF represents all off exchanges trades, whether they are executed manually, at a wholesaler, or on an ATS. The TRF adds to around 35% of all traded volume.

ATS’s: Dark pools are a fraction of the TRF

ATS stands for “alternative trading system.” These electronic venues are colloquially known as “dark pools.” They work within the confines of the NBBO, with resting limit orders, but are not exchanges. Rather than being governed solely by the Exchange Act of 1934, they are also governed by Reg ATS which was introduced in 1998.

This allows ATSs to operate very differently to exchanges, as many of the disclosures in the new Form ATS-N filing show.

- Almost all ATS quotes are “hidden”, hence the term “dark pools”

- Bids and offers can rest in ATSs, but trades must comply with the NBBO

- Reg NMS rule 610 that requires exchanges to offer “equal access” to all customers, doesn’t apply to ATSs

- Instead, ATSs can segment flow and arrange customer interactions

It’s a common misconception that ATS = TRF. In fact dark pools represent just 12% of market-wide volume, or just over one third of off-exchange trading (the TRF). For more on ATSs and how they report trades, see our recent post Slicing the Liquidity Pie.

Go here to sign up for Phil's newsletter to get his latest insights on the markets and the economy.