Time is Relative: Where Trade Speed Matters, and Where It Doesn't

As markets have become more modern, with automated trading playing a central role, the speed of trading has accelerated as technology has improved. But the speed of light hasn’t changed. It has remained constant at (roughly) 186,000 miles-per-second.

That speed is also not unique to stock-markets; it is about how fast wireless messages travel in all networks, even from our phones. That speed is also important, because the major U.S. exchanges’ data centers are located as far as 35 miles from each other. So even though it doesn’t take long to ship messages between exchanges, it’s not instantaneous. At the speed of light, messages take at least:

- 180 microseconds to cover the 35 miles from NYSE to Nasdaq data centers.

- 90 microseconds to cover the 17 miles from Cboe to Nasdaq data centers.

Milli, Micro and Nano

As recently as 2015, the industry referred to “fast” in milliseconds. These days most trading is done in microseconds (denoted as “µs”). You don’t need a science degree to quote latency metrics, but it helps to remember the order (in descending increments) is milli, micro and then nano.

Table 1: How seconds compare to milli, micro and nanoseconds

Microseconds are extremely fast. To put it into context, we can’t see or think in microseconds.

Studies have shown that:

- The blink of an eye takes 300 milliseconds, or around one-third of a second

- The average reaction time from a visual stimulus is around 250 milliseconds

So even if the SIP took 50 milliseconds to update, it still wouldn’t impact the reaction speeds of a retail trader.

Stop Saying the SIP is Slow

Some people say “the SIP is slow.” Data shows that’s not true.

The SIPs publish latency metrics here and here, and that data shows that SIPs are running in low-microsecond speeds.

This means SIPs operate much quicker than trade messages can travel from one exchange to the other. They are also much faster than the time it takes matching engines to process all the trades, orders, amendments and cancellations.

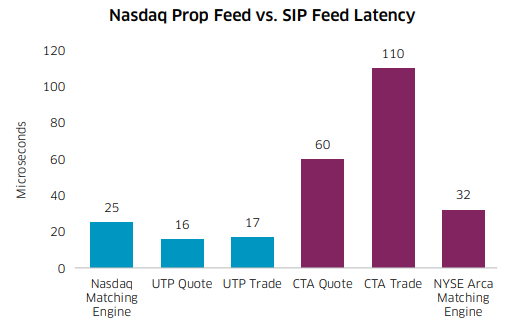

Chart 1: SIPs now process the NBBO faster than matching engines can process trades and quotes.

Source: Nasdaq Economic Research, UTP Plan, CTA Plan

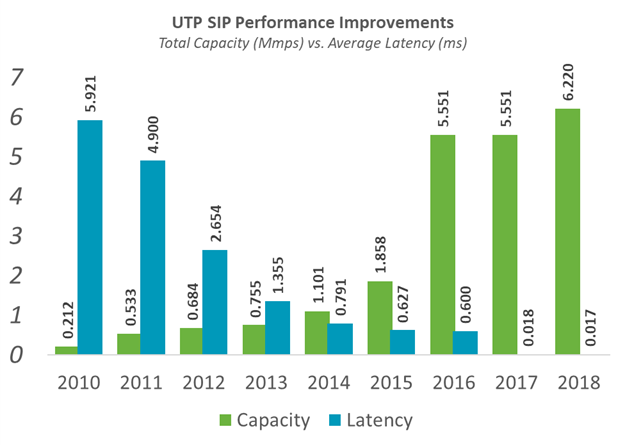

Importantly, as all trading has gotten faster, so has the SIP. Processing has improved from around 5,921µs in 2010 to just 18µs in 2018. At the same time, the capacity also increased exponentially with the UTP SIP now able to process around 5.6 million messages per second.

Chart 2: Tape C (UTP) SIP speeds and capacity have improved exponentially

Source: Nasdaq Economic Research, UTP SIP data

Time is Relative

Keep in mind that much of the technology we take for granted in 2019 accelerated only recently. For example, the iPhone wasn’t created until 2007, around the time Reg-NMS was established. It didn’t even have 3G or the app store. Still, it “took six or seven years” for Samsung and others to make truly competitive phones like the Galaxy S and the HTC One.

Looking at the evolution of market definitions of “immediate” over time reinforce how quickly we moved from (whole) seconds to (almost) nanoseconds in less than 15 years (Table 1).

Table 2: Definitions of “quickly” have changed significantly, even in market rules and regulations

Definitions of "quickly"

| Time | Rules | Details | ||

|---|---|---|---|---|

| 10 seconds | FINRA | Nov 2013: SEC sets “Timely” reporting to TRF for off-exchange transactions as 10 seconds. | ||

| 1 seconds | SEC | 2005: NMS uses 1 second in a few places. Timestamps on trade receipt and execution times, as well as the quote used for the OPR (Order Protection Rule ). | ||

| 50ms | FINRA | August 2016: FINRA reduced the clock sync tolerance to 50ms. | ||

| 1ms | SEC | June 2016: SEC definition of de minimis for the purpose of "immediate and accessible quotes". | ||

| < 100µs | SIP | 2019: Reported speed of the SIP on both CTA (Tape A/B) and UTP (Tape C). | ||

| 1µs | SIP | July 2015: SIPs move to microsecond time stamps |

Ironically, technology makes most definitions of “fast” seem pretty slow, pretty quickly.

We know race conditions will always exist—and there are always nanoseconds. The good news, however, is that we are almost at the theoretical speed of light which, in a relative sense, makes everyone is pretty close to equal – at least until quantum entanglement is invented...