Reg NMS for Dummies

A lot of the microstructure debate centers around “Reg NMS.” But what is Reg NMS? And what are those rule numbers people quote?

Well, Reg stands for Regulation and NMS stands for National Market System. It was introduced in 2005 and became law in 2007.

NMS helped investors in an already automating market

Reg NMS is a set of rules that defines how trading works in the U.S. for all listed stocks.

As automated trading increased, NMS ushered in a new era of competition in trading and introduced a number of important protections for investors.

In 1994, following the introduction of the Unlisted Trading Privileges Act, or UTP, stocks were allowed to trade on any venue. That meant the primary listing exchange was no longer the only exchange on which a ticker could trade.

Reg NMS also mandated market-wide cross-connectivity, allowing for a competitive and distributed market. Then the centrality of the SIP ensured that all participants knewwhere and what price the best bid and offer for each stock was at all times.

NMS also prohibited trade-throughs and crossed markets, ensuring that customer orders were filled at the best prices available, regardless of what exchange each stock is trading on.

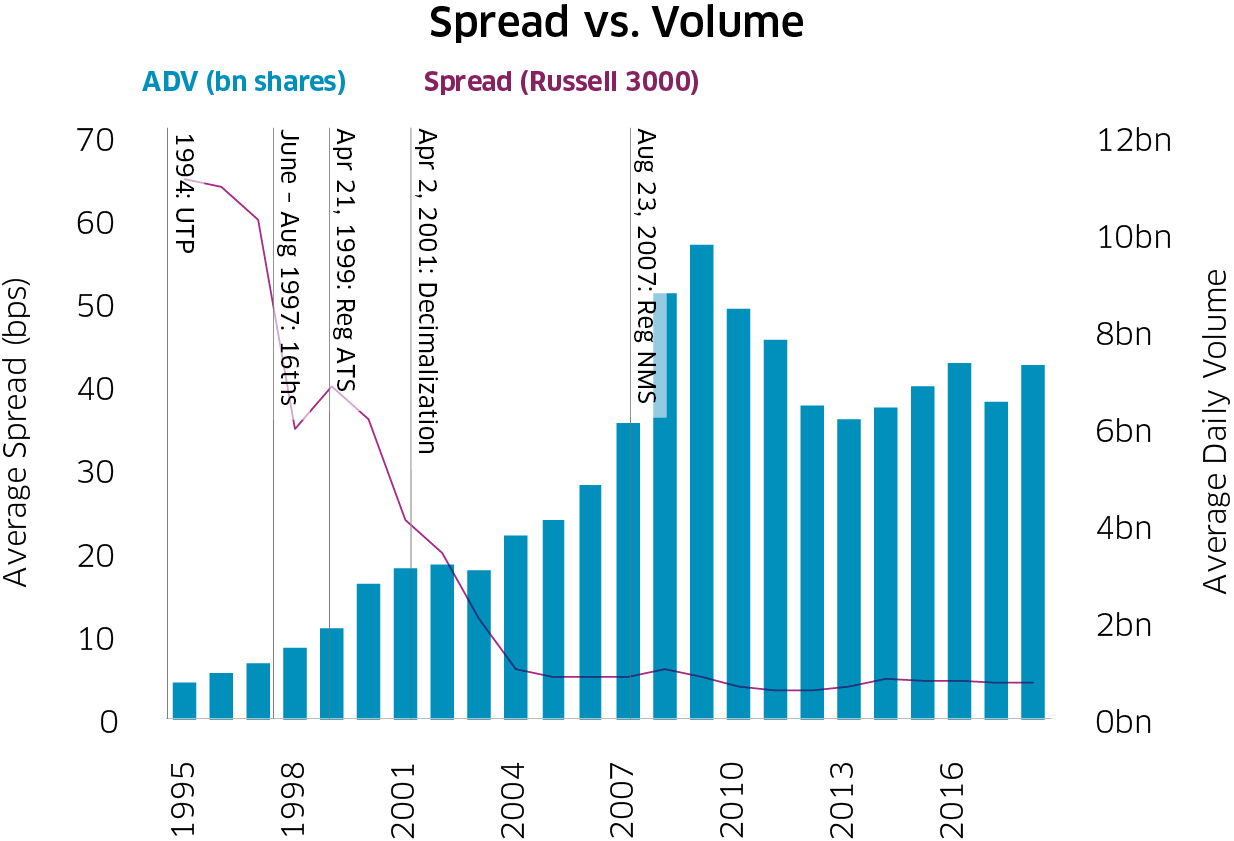

Although each of these changes facilitated the adoption of computers in trading, the reality is that computers were already automating much of trading. As Chart 1 shows, the automation and decimalization of markets led to cheaper trading. Automation also hastened the development of statistical arbitrage and quant strategies, which in turn led to more liquidity. In the space of 10 years, spreads fell 88% while liquidity increased nine fold.

Chart 1: Trading volumes accelerated and costs fell around the time of NMS

Source: Nasdaq Economic Research, Angel (2010), KCG, Rosenblatt

NMS = 14 rules to help and protect investors

There are 14 separate “rules” that makeup Reg NMS (see Table 1 below), which are grouped into six main categories with some common themes:

- Definitions: Rule 600 defines concepts and terms, which is sometimes pivotal to how the later rules work.

- Fairness in INFORMATION: Rules 601-603 are about reporting trades and quotes to the Securities Information Processors (SIPs), ensuring access to data by exchanges.

- Broker ACCOUNTABILITY: Rules 604-607 are special reporting and trading rules designed to mostly protect retail investors.

- SRO rules: Rules 608 and 609 set rules for what Self Regulating Organizations (SROs) need to do to publicly change rules, including SIP operations.

- Fairness in TRADING: Rules 610-612 cover trading rules like protected quotes, decimal ticks, access fee caps.

- CAT: Rule 613 is relatively new rule, covering the consolidated audit trail (CAT).

Modern Markets are Data Driven

Now that the market is almost totally automated, there have been many calls to modify Reg NMS. Trading is so fast that the SIP often holds up new prices in the first venue to trade, and trading is so cheap that the cost of connecting to new markets might not be worth the benefit. In our own TotalMarkets proposals, we suggested that some of the descriptive mandates of NMS designed to make the market equal to all might no longer be considered fair by all.

Computers are also more deterministic and predictable in their intentions than most human traders. Automation has also led to far more detailed and accurate data, as evidenced by FINRA’s recent disclosure of a new high of 135 billion records in a single day.

Combined with improved data analysis, transparency may now be a better way to hold the market accountable. That’s also why the SEC decided to add Rule 613, to produce a Consolidated Audit Trail, as recently as late 2012.

We’ve talked about how the industry should embrace data to prove accountability in our recent blogs as well as our new Total Markets blueprint.

Table 1: Summary of what Reg NMS rules cover

|

Rule |

Key Features |

|

Definitions: Defines the concepts used in NMS, including what is a SIP, NBBO, protected quote, automated quote, SRO, block size, NMS stock, trade through, ISO order, etc. |

|

|

Trade dissemination: All trades must be reported. Exchanges report directly to SIPs. TRF is created for brokers to report “off exchange” trades. Data costs: SRO’s may impost reasonable, uniform charges for trade dissemination. |

|

|

Quote dissemination: Exchanges must report all bids and offers, quote size and cancels. ECNs: Publish actionable quotes. |

|

|

Equal Access: Distribution of information on fair and reasonable terms – not unreasonably discriminatory. SIPs: Display NBBO and trades through a single processor. |

|

|

Held Orders: Must be immediately displayed, in full size, if marketable. Exceptions for internalized, odd lots or block sized orders. |

|

|

Execution Quality: Only “held” (covered) orders required to report (so predominantly retail orders). Compute average time to trade, effective spread paid, price improvement, percentage of orders executed outside the quote and average cents through NBBO. |

|

|

Routing: This currently applies to small orders only (under $200,000) and requires disclosure of Top 10 routing destinations by brokers, financial incentives with destinations including PFOF and profit sharing. Note1: An expanded 606 is currently in implementation (the deadline was recently extended to Oct 1, 2019). This will include fulfillment data and allow institutional customers to request a customized report on their own routes. |

|

|

Customer Statements: Must disclose annually PFOF policies with all routing partners, including when there is price improvement. |

|

|

NMS Plans: Any two SRO’s may propose changes to NMS via an NMS plan. |

|

|

SIP Registration: Including applications for changes to rules of the SIP must be submitted on “Form SIP.” |

|

|

Equal Access: Exchanges must offer all customers the same rate schedule and access to trades. Access fees: Limited to 30mils (silent on rebates). Locked and crossed markets: Exchanges should stop them from happening and have policies to unlock them if they do. |

|

|

Protected Quotes: Can’t route so you trade at prices worse than SIP NBBO. This includes off-exchange trades. Trade-through: Banned (with exceptions). |

|

|

Decimals: Orders can only be in decimals. There are no rules requiring executions to be in whole pennies. |

|

|

CAT: The Consolidated Audit Trail is designed to collect detailed data on every order, execution and amendment in the market across all participants. |

Go here to sign up for Phil's newsletter to get his latest insights on the markets and the economy.