Nasdaq's Options Trade Outline Suite

Options activity data is an important part of testing trading models and creating sophisticated analytical strategies for options trading, as well as determining overall investment sentiment. Nasdaq’s Options Trade Outline products provide electronic trade data with aggregated summaries on trade quantity and volume.

Nasdaq's Options Trade Outline products include aggregate trade quantity and trade volume for each customer origin type of trade for every option series traded on the respective market in which an electronic trade occurred during the trading day. Activity is further broken down by opening buy, closing buy, opening sell or closing sell.

Aggregate Trade Quantity and Trade Volume for Each Customer Origin Type of the Trade

Benefits & Features

Benefits of Options Trade Outline

-

Detailed Information

Trade Outline includes aggregate trade quantity and trade volume for each customer origin type of trade for every option series traded on the respective market in which an electronic trade occurred during the trading day. Activity is further broken down by opening buy, closing buy, opening sell or closing sell.

-

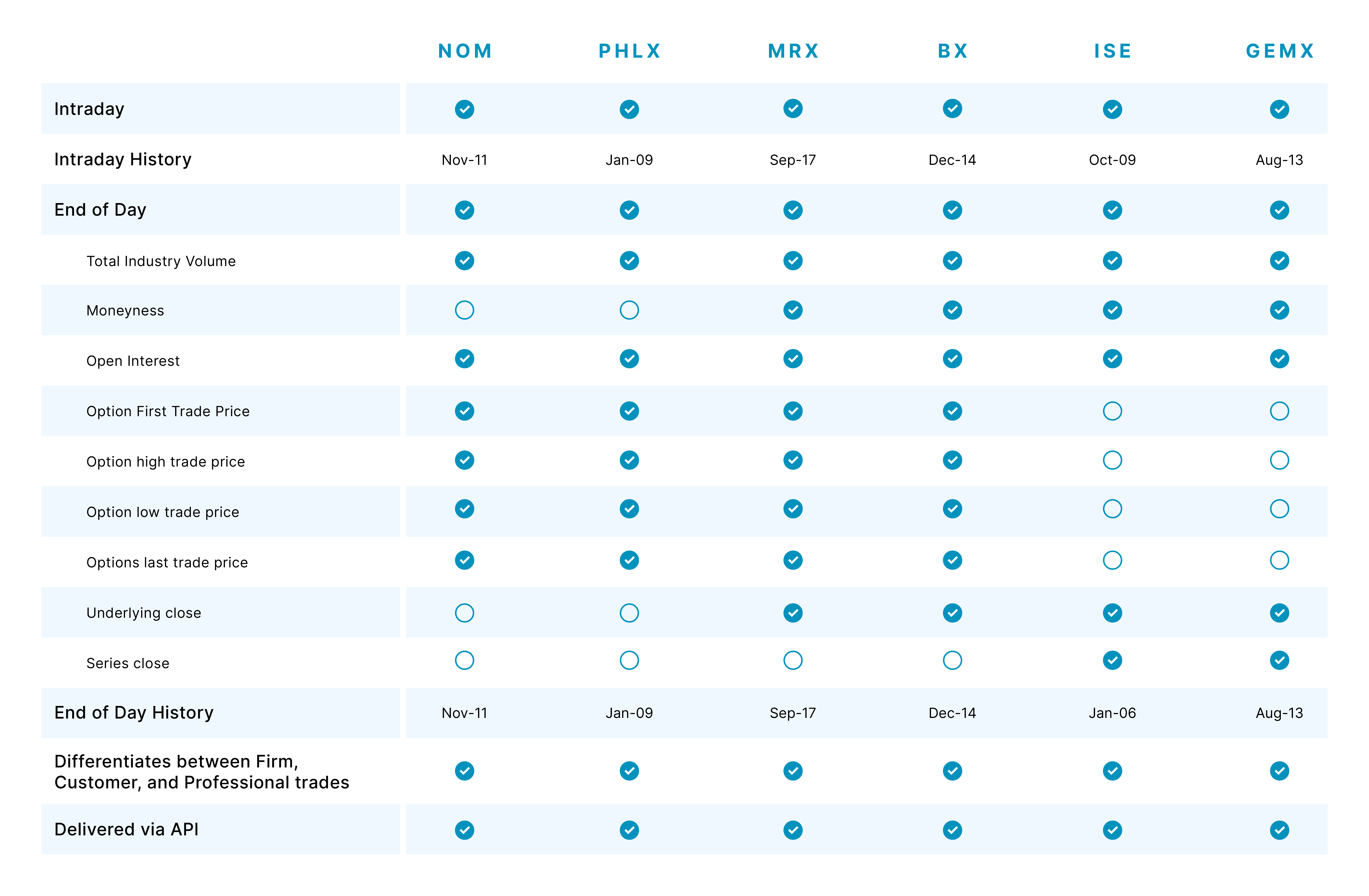

Covering All 6 of Nasdaq’s Options Exchanges

Gain a comprehensive view of all 6 of Nasdaq’s Options Exchanges, including PHLX, GMEX, ISE, NOM, MRX, and BX. These feeds can be taken individually or altogether.

Use Cases

-

Optimize Trading Strategies

Leverage option trade quantity and volume data to create new and add to existing trading models and analytical strategies.

-

Gain Comprehensive Insights

Allows firms to use various measures from the value-added data fields to gain a more holistic view of the options market, allowing the firm to make better-informed trading decisions.

-

Build Customized Sentiment Analysis

Provides valuable trade data that investors can use to understand and analyze market participant sentiment.

Compare the Data by Exchange Venue

Access Sample Data on Nasdaq Data Link

Interested in making API calls and testing out the Options Trade Outline data? More detailed product information can be found on Nasdaq Data Link:

Support

Visit Nasdaq Data Link for dataset documentation, sample data, and API details or contact datasales@nasdaq.com