Relative Strength Technical Analysis & Trading Strategy

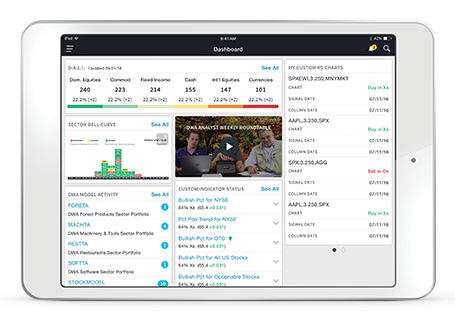

Using a Relative Strength Technical Analysis & Trading Strategy, Nasdaq Dorsey Wright (NDW) was an early adopter of smart beta strategies through its focus on alternative weightings to augment performance via proprietary tactical asset allocation models. Since its first ETF-linked index was launched in 2007, NDW has expanded its index business into new markets and turned its portfolio and tactical asset allocation models into innovative global solutions for investment professionals.

The Dorsey Wright Technical Leaders Index family selects the highest relative strength companies from within their respective investment universes. In addition, the Focus Five Indexes select the five ETFs from the First Trust Portfolios product line with powerful relative strength characteristics.

Interested in Nasdaq Dorsey Wright Research?

Sign-up today for a free 30-day trial

Dorsey Wright Research Trial

Highlighted Indexes

Key Benefits

Support

For additional support, please contact us via email at IndexServices@nasdaq.com or view our index performance data:

%20Earnings%20Report%20Date%20%7C%20Nasdaq&_biz_n=15&rnd=741663&cdn_o=a&_biz_z=1743397153782)

%20Revenue%20EPS%20%7C%20Nasdaq&_biz_n=16&rnd=85324&cdn_o=a&_biz_z=1743397153783)

%20Latest%20Prices%2C%20Charts%20%26%20News%20%7C%20Nasdaq&_biz_n=17&rnd=11078&cdn_o=a&_biz_z=1743397153783)