Gain a Deeper Understanding of Nasdaq's Crypto Indices

Latest Performance: Nasdaq Crypto™ Index (NCI™)

Discover the latest quarterly investment performance of the Nasdaq Crypto Index (NCI) and gain valuable insights into its performance over the past quarter. Dive deep into the details of the index's portfolio changes and uncover the market drivers behind its recent performance.

Cryptocurrency: Value in the Digital Age

The digital age has prompted significant economic changes in the ways that people interact and do business in society. While our current financial infrastructure has made advancements in response to this evolution, the architecture of legacy financial systems still depends heavily on third-party intermediation as opposed to digitally trustless interactions. Accordingly, these kinds of systems are not optimally designed to facilitate transactions in a digital world.

The emergence of Distributed Ledger Technology (DLT), which utilizes cryptography and decentralized computing resources to maintain a secure record of account and transaction history, has driven the invention of trusted, digitally efficient record keeping networks.

These networks are notable because they utilize digitally native units of account, known as “cryptocurrencies” or “digital assets,” to enable seamless virtual transactions. Such developments are promising because they fundamentally impact the ease with which value can be recorded, transferred, and stored in a trusted way, without the need for intermediaries.

Measuring Digital Assets

Since the initial development of this cryptocurrency technology, there has been an explosion in the number of networks and accompanying assets, which offer a wide array of potential applications. The growth of these networks has fueled a narrative around the value and utility of digital assets, leading to major investor interest in this complex and relatively fragmented emerging asset class.

Due to the challenges and complexities associated with investing in cryptocurrency, in particular around the difficulty in identifying a representative portfolio of accessible and investable assets, Nasdaq has created a methodology-driven industry benchmark.

The Nasdaq Crypto Index (NCI) is specifically designed to be dynamic by nature, broadly representative of the market, and readily trackable by investors.

An Innovative Cryptocurrency Benchmark

While digital assets represent a unique opportunity for investors, the nuances and complexity of this asset class present challenges for creating an industry benchmark that both captures the market as it matures and remains replicable for investors. Accordingly, the Nasdaq Crypto Index (NCI) was designed to provide a benchmark that simplifies access to this asset class by adhering to the following principles:

- Adaptable: Designed to adjust the Index composition over time to ensure that it remains a flexible representation of the asset class as it evolves.

- Representative: Captures diverse market share by selecting a basket of constituent assets on the basis of relative market significance, not according to a predetermined number of assets.

- Investible: Utilizes straightforward, automated rules and exhaustive selection criteria, including exchange and custody standards that allow the Index to be easily replicated.

These principles are reinforced by the use of “Core Exchanges” and “Core Custodians” for determining asset eligibility. Core Exchanges serve to filter eligible assets based on trading availability on vetted sources. Core Custodians help to ensure that investment-grade asset custody is supported for Index constituents. The use of vetted Core Exchanges and Core Custodians to determine eligible cryptocurrency assets helps ensure that any product tracking the Nasdaq Crypto Index (NCI) is supported by investment-grade infrastructure.

Both Core Exchanges and Core Custodians are selected annually by the Nasdaq Crypto Index Oversight Committee.

The NCI uses the following Core Exchanges and Core Custodians (as of 9/30/2024):

Core Exchanges and Core Custodians

Core Exchanges | Core Custodians |

|---|---|

BitStamp | BitGo |

Coinbase | Coinbase |

Gemini | Fidelity |

itBit | Gemini |

Kraken | |

LMAX Digital |

The implementation of Zodia's consideration as part of the index eligibility criteria will go effective on December 2, 2024. The implementation of Komainu's consideration as part of the index eligibility criteria will go into effect on December 2, 2024.

-

Core Exchanges

Core Custodians

BitStamp

BitGo

Coinbase

Coinbase

Gemini

Fidelity

itBit

Gemini

Kraken

LMAX Digital

The implementation of Zodia's consideration as part of the index eligibility criteria will go effective on December 2, 2024. The implementation of Komainu's consideration as part of the index eligibility criteria will go into effect on December 2, 2024.

Crypto Index Overview

- Tracks the performance of a diverse basket of USD-traded digital assets.

- Applies rigorous liquidity, exchange, and custody standards to asset eligibility.

- Assets must be traded on at least two vetted Core Exchanges and supported by at least one Core Custodian.

- Rebalanced and reconstituted on a quarterly basis.

- Free float market cap weighted.

The Nasdaq Crypto Index (NCI) was specifically designed with these challenges in mind. The Index is designed to be dynamic in nature, broadly representative of the market, and readily trackable by investors.

(Source: NCI Index Data, 9/30/24, end of day)

| Component | Weight (%) |

|---|---|

| Bitcoin (XBT) | 73.21 |

| Ethereum (ETH) | 16.53 |

| Solana (SOL) | 5.32 |

| Ripple (XRP) | 2.18 |

| Cardano (ADA) | 1.04 |

| Chainlink (LINK) | 0.44 |

| Avalanche (AVAX) | 0.44 |

| Litecoin (LTC) | 0.35 |

| Polygon (MATIC) | 0.26 |

| Uniswap (UNI) | 0.22 |

For an exhaustive list and description of the NCI asset eligibility criteria and weighting, please review the NCI methodology.

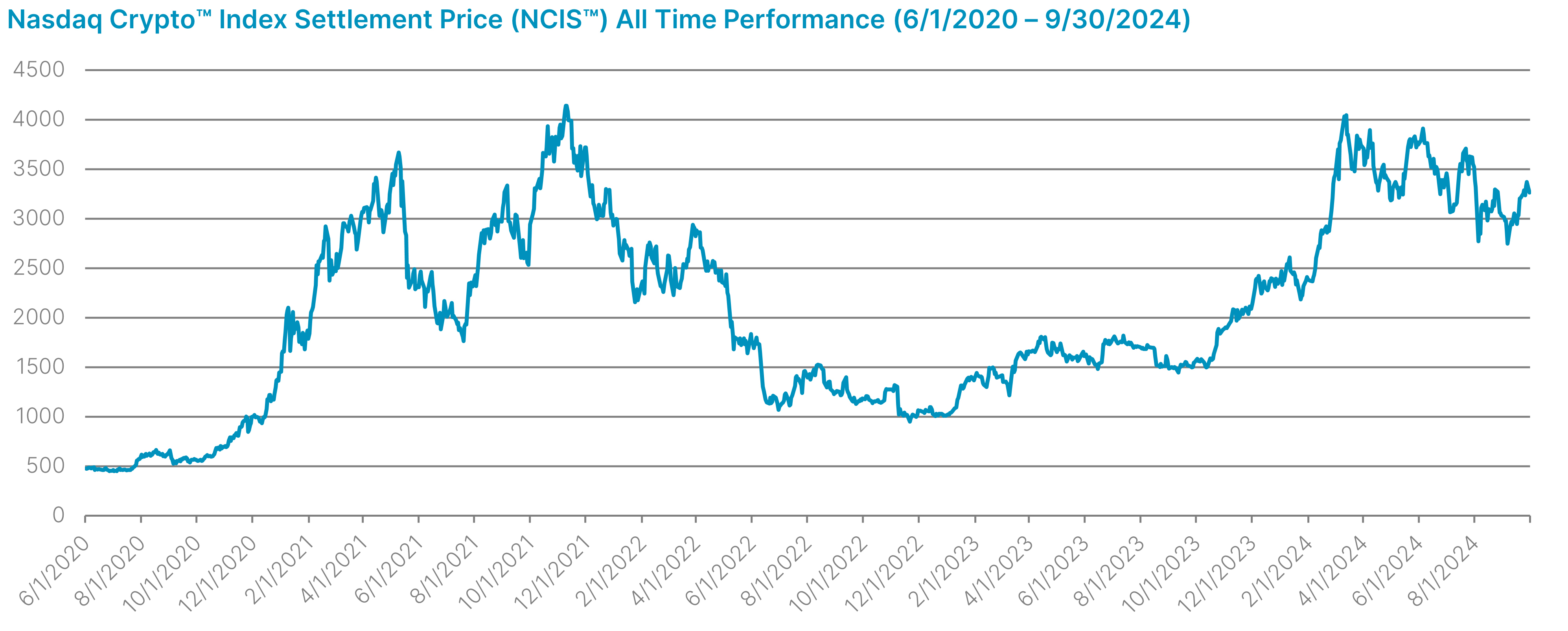

Performance Since Inception

Data included is from indexes.nasdaqomx.com/Index/History/NCIS from 6/1/2020 to 9/30/2024 and includes backtested performance for NCIS prior to 2/2/2021.

†Nasdaq provides either actual historical index values or back-tested histories for certain indexes. All back-tested index values for periods prior to the launch date of an index are merely indicative, and they are provided “AS IS” for informational and educational purposes only. Nasdaq makes no guarantee as to the accuracy, timeliness, completeness, or fitness for any particular purpose of or for any index values, either historical or back-tested. Nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Past performance is not indicative of future results.

Insights on Crypto

Governance

This asset class is new and continues to evolve quickly. Given these dynamic conditions, the Index is governed by the Nasdaq Crypto Index Oversight Committee (CIOC), which is responsible for the implementation, administration, and general oversight of the Index, including the selection of Core Exchanges and Core Custodians, adjustments to account for regulatory changes, and periodic methodology reviews.

Invest for the Future

The Index methodology was developed in part with Hashdex, a global asset manager, in preparation for their filing for an ETF to make digital assets more accessible to investors. In February 2021, Hashdex launched the Hashdex Nasdaq Crypto ETF (HDEX), which tracks the Nasdaq Crypto Index (NCI) on the Bermuda Stock Exchange (BSX). The Hashdex Nasdaq Crypto ETF is the world’s first cryptoasset-based ETF and is available on the BSX to accredited non-U.S. investors at this time.

In April 2021, Hashdex launched another version of its flagship fund, The Hashdex Nasdaq Crypto ETF (HASH11), on Brazil’s B3 exchange.

In May 2022, Hashdex launched the Hashdex Nasdaq Crypto Index Europe exchange-traded product ("ETP") on the SIX Swiss Exchange under the ticker SIX: HASH SW. Tracking the Nasdaq Crypto Index Europe™ (NCIE™), the ETP represents the firm's first European product and gives investors access to the latest and most well capitalized blockchain technologies. Nasdaq launched the Index the same day as the ETP.

In September 2022, Hashdex launched the Hashdex Nasdaq Crypto Index Europe ETP on the Euronext Paris and Euronext Amsterdam exchanges under the ticker symbols HASH FP and HASH NA, respectively, and on Deutsche Börse Xetra exchange under the ticker symbol HDX1 GY.

To learn more about Hashdex Nasdaq Crypto ETFs, visit www.hashdex.com/en.

Related Indexes

In addition to the broad-based exposure that the above, NCI-driven, structures provide, Hashdex launched two additional ETFs in Brazil tracking Nasdaq Indexes. The first, named the Hashdex Nasdaq Bitcoin Reference Price ETF (BITH11), tracks Bitcoin prices via the Nasdaq Bitcoin Reference Price Settlement Index (NQBTCS); the second, named the Hashdex Nasdaq Ether Reference Price ETF (ETHE11), tracks Ether prices via the Nasdaq Ether Reference Price Settlement Index (NQETHS).

The Hashdex Nasdaq Bitcoin Reference Price ETF has been structured to be carbon-neutral – the investment manager will purchase carbon credits and invest in carbon-neutralizing projects to offset its carbon footprint.

Both indexes benefit from the robust control procedures outlined in the respective index methodologies that include Nasdaq’s dedicated Crypto Index Oversight Committee, as well as strict evaluation criteria for Core Exchanges and Custodians.

Contact Us to Connect Today

Sign up now to receive the latest insights and updates on NCI

Resource Center

-

- Nasdaq Crypto Index (NCI) Fact Sheet

- Crypto Quarterly Market Update Nasdaq CryptoTM Index (NCITM) Review: March 2023

- Diversification in down markets: Is now the ideal time to consider a crypto index?

- Hashdex Nasdaq Crypto Index Europe ETP Now Tradable in Frankfurt, Paris and Amsterdam

- Hashdex Leads the Pack in Raising Crypto-Focused Assets

- Polkadot Joins the Nasdaq Crypto Index

- Understanding the landscape: How does the Nasdaq Crypto Index Europe stack up to its peers?

- Nasdaq Crypto Index Joins the Metaverse

- Bitcoin: A Definitive Guide for Investors

- Nasdaq Crypto Index (NCI) Methodology

- Hashdex Launches First Crypto ETF

- Victory Capital Launches Crypto Index Fund for U.S. Accredited Investors

- CF Benchmarks appointed Calculation Agent for Nasdaq Crypto Index (NCI)

- Quarterly Crypto Market Update: Q4 2021

- Crypto Quarterly Market Update: Q4 2023

- Crypto Quarterly Market Report: Q3 2023

- Crypto Quarterly Market Report: Q2 2023

- Crypto Quarterly Market Report: Q1 2024

-

-

Research Report

Nasdaq Crypto Index (NCI) Advisor Research Report

-

Index Calculation

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any digital asset or any representation about the financial condition of a digital asset. Statements regarding Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate assets before investing. ADVICE FROM A FINANCIAL PROFESSIONAL IS STRONGLY ADVISED.

© 2024. Nasdaq, Inc. All Rights Reserved