Nasdaq eVestment™ for Asset Owners

Nasdaq eVestment™ Analytics

Asset manager research and portfolio analytics platform, leveraging Nasdaq eVestment™'s database of 25,000+ institutional strategies.

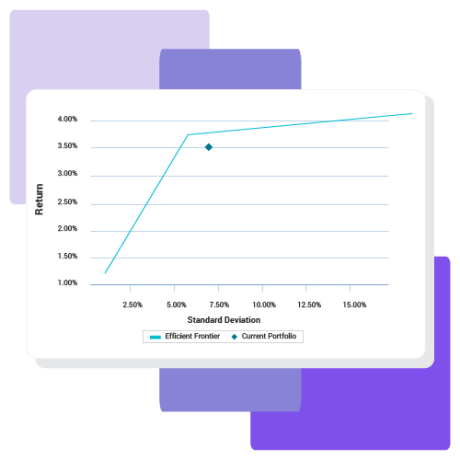

Differentiating managers is a constantly moving target. To make the best manager decisions, you need the right data and analytics tools for screening and peer comparisons. Leverage Nasdaq eVestment™ Analytics, built on the institutional market’s most comprehensive database of manager data, to find the best-fit managers for your investment objectives, every time.

The peer-group analysis we conduct in eVestment is essential to our process. It helps us form our initial list of managers of interest for a particular search.