2020: A Year of Market Volatility – Introducing the Nasdaq-100® Volatility Index: VOLQ®

Daniel Carrigan, Nasdaq AVP, Strategic Planning

Jeffrey Smith, Nasdaq AVP, Economic Research

The public equity markets so far in 2020 can be described in one word: volatile. The year began with an emerging pandemic which altered how we live, work, and invest. Now, we face upcoming Presidential and Congressional elections, which many voters may reflect “the impact of this election will be felt for years to come.” Of course, these types of statements are open-ended and it can be difficult to judge outcome over time. However, when it comes to markets, the potential future magnitude of price movement —up or down — of a financial instrument like a stock index or a stock is actually easy to measure via exchange-traded options prices (future implied volatility). Further, we can also easily measure a different type of volatility by observing recent price movements (realized volatility). For example, although the Nasdaq-100® Index (Ticker Symbol: NDX) defines today’s modern industrials with category-defining companies on the forefront of innovation—Apple, Microsoft, Alphabet, Intel, Facebook, Amgen, Starbucks, and Tesla—NDX has been subject to large moves in both implied and realized volatility.

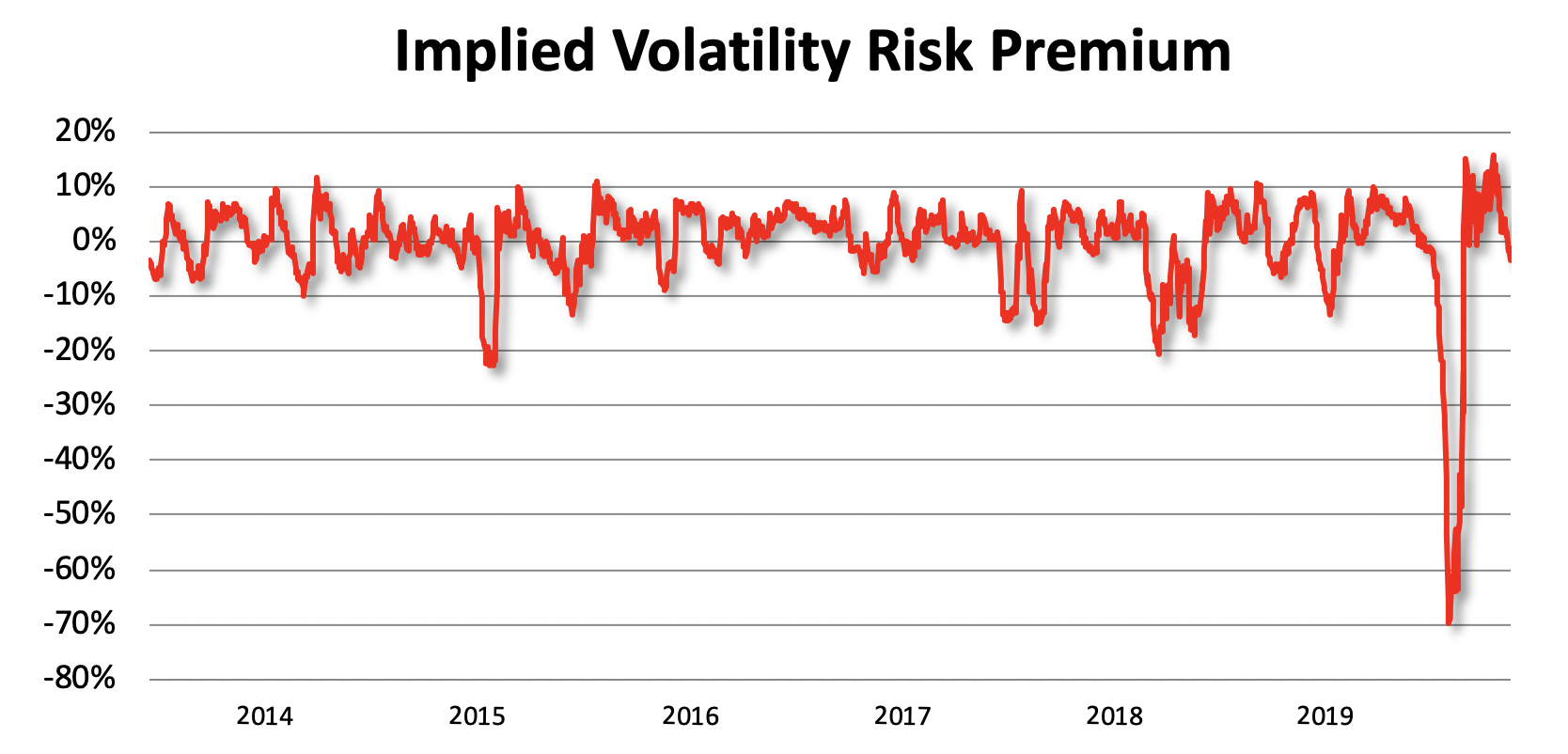

NDX began 2020 with an initial 11.5% rally to the February 19 high at 9736.57. From there, the uncertainty of the pandemic resulted in a 30.4% selloff to the intra-day low of 6771.91 on March 23. At this level, value buyers focused on today’s modern day industrials, emerged on a buying spree fueling a 66.4% gain as of market close on August 6 with the index closing at an all-time of 11,267.08. With these large index price swings, what if hindsight and present trading data for NDX large-cap growth stocks could be of use now, maybe by helping us better understand what to expect in the future? For example, how could an investor determine whether markets are normal or are excessively volatile? One way we might use hindsight to inform our view of the present and the future is to examine the history of the numerical difference between realized volatility, the actual magnitude of historical price changes of an asset, and the volatility that had been implied by option prices which covered that same period of time? This difference is known as the “Implied Volatility Risk Premium,” which reflects the historical risk premium NDX option sellers generally receive. Observation of Nasdaq-100 volatility may help investors understand what to expect in the future.

Introducing the Nasdaq-100 Volatility Index: VOLQ®

Index options are a type of financial product that give the holder the right to buy or sell the price level of the underlying index at a pre-determined price (strike price), within a specific time interval (time to expiration). The price of an option is calculated as a function of the current index price, strike price, risk-free interest rate, time to expiration, and volatility; these collective values are used as inputs to various options pricing models. Since index options prices are publicly available in the open market, they can be used to solve for the future volatility implied by those option prices.

Forward-looking, expected volatility is a central driver of index option prices — the higher the expected volatility, the higher the index option price, all else being equal. Using this approach, Nasdaq has constructed a volatility index that tracks the market’s assessment of future volatility based on observation of index option prices.

The Nasdaq-100 Volatility Index (Ticker Symbol: VOLQ) measures 30-day implied volatility as expressed by the prices of certain listed options on the Nasdaq-100 index. It does so by using those listed option prices to calculate the prices of synthetic precisely at-the money (ATM) options. The ultimate Index component options used in the computation include eight NDX options from each of four expirations for a total of thirty-two component options. Volatility traders can now leverage an implied volatility index that focuses on the options that practitioners, hedgers, and traders use most—ATM options. VOLQ is expressed as an annualized percentage and is positively correlated to NDX options prices (both calls and puts). The resulting value broadcasts the expected NDX index trading range (magnitude) over the next 30 calendar days.

Volatility Markets in 2020

When the amount of actual price volatility experienced during a period of time (backward-looking realized volatility) is greater than the volatility that had been expected or implied by option prices, an investor could say the market is experiencing excessive volatility. Option prices (implied volatility) will then generally rise to reflect the new reality. The historical implied volatility risk premium, the hindsight we have mentioned, will then provide guidance regarding how much realized volatility an investor might expect in the near-term.

Volatility Risk Premium (VOLQ Prediction minus NDX Realized Volatility)

Note: This graph is realized volatility minus VOLQ over the next 21 trading days. As such, they cover the same period of time with the small difference that VOLQ measures implied volatility over the next 30 calendar days and the realized volatility is measured over the next 21 trading days. For example, and just to be clear, on 1/2/2020, VOLQ was 13.87, which predicted annualized volatility of 13.87% for the period 1/3/2020 to 2/2/2020. Over the next 21 trading days (1/3/2020 to 2/3/2020) the realized annualized volatility was 14.92%.

To first-time observers and even seasoned volatility-strategy practitioners, viewing the implied volatility risk premium chart with negative values might not be intuitive. Accordingly, we inverted the chart to examine 2020 volatility up close and to make a point. Portfolio volatility strategies like index put selling are an accepted means of portfolio diversification. However, tail risk (sharp market movements up and down) may lead to sudden losses. When judging risk of executing a short options volatility strategy, high realized backward-looking volatility compared to forward-looking volatility is a akin to a hurricane warning to take cover and evaluate safety conditions. In other words, an investor may take caution when actual price volatility is significantly higher than implied volatility.

Volatility Risk Premium (NDX Realized Volatility minus VOLQ Prediction)

Summary

In the midst of the intense market sell-off (mid-February into late March), investors seeking exposure to long or short volatility strategies saw accelerating market risk. With the Nasdaq-100 Volatility Index: VOLQ, market participants have a 30-day measure of expectations for volatility of large-cap growth stocks. This implied volatility tool can be used to estimate index trading ranges for the next 30 calendar days. Investors can use this historical information (hindsight) to execute trading strategies, particularly those which use options, with greater confidence.

For more information on VOLQ, visit our site Nasdaq.com/VOLQ.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2020. Nasdaq, Inc. All Rights Reserved.

Sign up now to get the latest on VOLQ

Global Indexes