Trading Canadian Equities

PureStream on Nasdaq Canada CXD

A new dark order type with innovative liquidity discovery

A dark pool trading book on the Nasdaq Canada Exchange that is an alternative source of non-displayed liquidity and price-improvement opportunities.

Now available on Nasdaq CXD - PureStream uses innovative matching and trading logic to dramatically increase the liquidity transfer for institutional broker dealers and their institutional clients, with a matching protocol that executes orders by referencing the volume, and associated price, of each reference trade printed on the consolidated Canadian marketplace as they are reported. The PureStream order type coexists within Nasdaq’s CXD dark pool and focuses on improving liquidity discovery and fill rates.

PureStream is accessible via broker algorithms and directed orders.

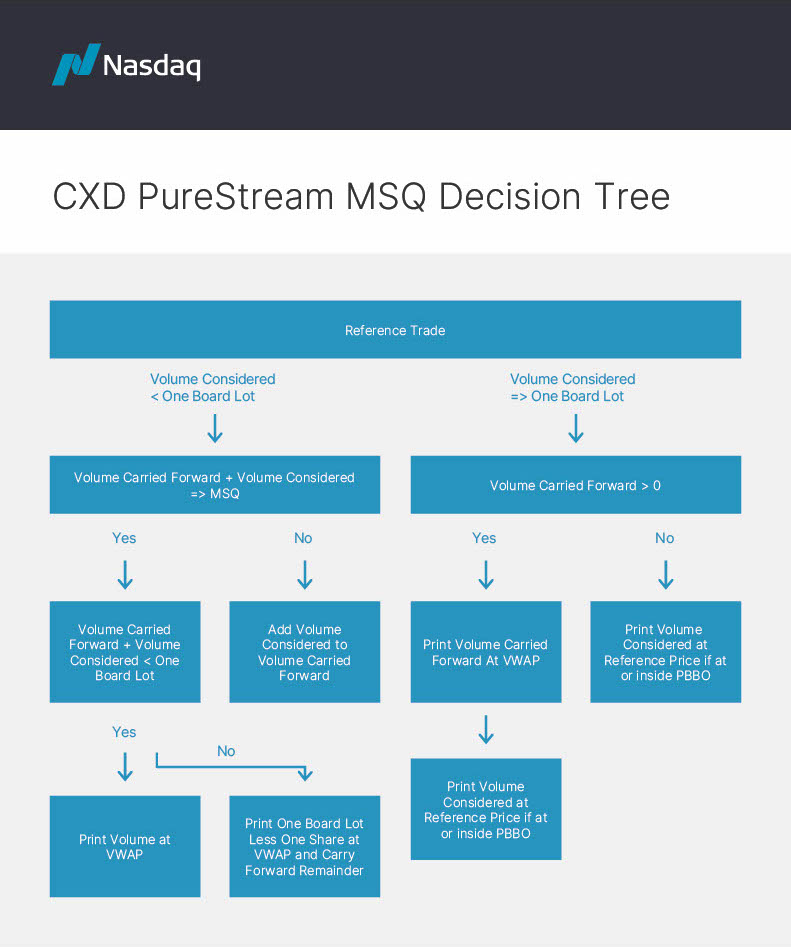

Instead of printing a PureStream trade each time a Reference Trade takes place, PureStream will now calculate the VWAP of all Reference Trades. When the aggregated volume reaches a minimum volume threshold (MSQ) a trade will be printed. The MSQ will initially be set to 70% of a Standard Trading Unit, or 70 shares for securities that trade with a board lot size of 100 shares. The introduction of an MSQ will decrease the number of small sized trades which in turn will decrease regulatory costs and the administrative burden. For more information on how the MSQ works including examples please see Nasdaq Canada’s Notice of Proposed Changes and decision tree.

Addresses the challenges asset managers face when executing block trades, while minimizing information leakage.

Has Match characteristics of a block without the price impact of an algo because you are getting a fraction or multiple of everything that trades.

Matches orders based on the percentage of the market’s future volume a trader is willing to trade and does not compete for volume.

The limit price of an order must exceed the far side of the protected BBO by the Marketability Threshold of the security to be eligible to be paired in a stream. The limit price of Liquidity Seeking orders must be equal to the mid-point of the protected BBO to match against a contra-side Liquidity Seeking order in a mid-point block trade.

The limit price of an order must exceed the far side of the protected BBO by the Marketability Threshold of the security to be eligible to be paired in a stream. The limit price of Liquidity Seeking orders must be equal to the mid-point of the protected BBO to match against a contra-side Liquidity Seeking order in a mid-point block trade.

Firm-Up Orders received by Nasdaq after the Firm-Up Request has expired will be rejected.

Firm-Up Orders received by Nasdaq after the Firm-Up Request has expired will be rejected.

Nasdaq will monitor firm-up invitations at the trader ID level on a symbol-by-symbol basis. If, after 20 firm-up invitations for a given symbol, a trader ID responds to less than 70% of requests before the timer expires then new conditional orders and cancel/replace requests of existing conditional orders by the trader ID for that symbol will be rejected for the remainder of the trading session. Similarly, firm-up responses that have modified the price such that the order is no longer eligible to be paired in a stream or immediately matched in a mid-point block will be considered to have “fallen down” and count towards the number of failed firm-up responses.

Nasdaq will monitor firm-up invitations at the trader ID level on a symbol-by-symbol basis. If, after 20 firm-up invitations for a given symbol, a trader ID responds to less than 70% of requests before the timer expires then new conditional orders and cancel/replace requests of existing conditional orders by the trader ID for that symbol will be rejected for the remainder of the trading session. Similarly, firm-up responses that have modified the price such that the order is no longer eligible to be paired in a stream or immediately matched in a mid-point block will be considered to have “fallen down” and count towards the number of failed firm-up responses.

Nasdaq will monitor for streams that are terminated before a reference trade occurs due to order cancel or order cancel/replace requests at the trader ID level on a symbol-by-symbol basis. If, after 20 established streams for a given symbol, a trader ID sends an order cancel or order cancel/replace request that causes all streams to be terminated and a Stream Off message to be sent before a reference trade occurs in more than 70% of streams then new CXD PureStream orders and cancel/replace requests of existing CXD PureStream orders by the trader ID for that symbol will be rejected for the remainder of the trading session.

Nasdaq will monitor for streams that are terminated before a reference trade occurs due to order cancel or order cancel/replace requests at the trader ID level on a symbol-by-symbol basis. If, after 20 established streams for a given symbol, a trader ID sends an order cancel or order cancel/replace request that causes all streams to be terminated and a Stream Off message to be sent before a reference trade occurs in more than 70% of streams then new CXD PureStream orders and cancel/replace requests of existing CXD PureStream orders by the trader ID for that symbol will be rejected for the remainder of the trading session.

Market |

Market Hours |

|---|---|

|

CXC and CX2 |

Monday – Friday, 8:00 a.m. – 5:00 p.m. EST |

|

CXD |

Monday – Friday, 9:30 a.m. – 4:00 p.m. EST |

For Questions About |

By Phone or Email |

|---|---|

|

Trading Canadian Equities |

Nasdaq Sales team |

|

Media Support |

Emily Pan

+1 (646) 441-5120 |