With its roots dating back to 1973 and following the merger between Sumitomo Mitsui Asset Management and Daiwa SB Investments, in 2019 Sumitomo Mitsui DS Asset Management (“SMDAM”) was established.

Under the leadership of Takashi Saruta, who was appointed as President and CEO of SMDAM in 2020, the company has been actively leading ESG initiatives in Japan, and committed to becoming a champion in Japan and in the globe.

As the first Asset Manager in Japan to subscribe to Nasdaq eVestment™ ESG Analytics, having the tools to understand the position of its ESG strategy compared with its peers, SMDAM expects that it will help them promote their strategy to prospective investors more efficiently and effectively. SMDAM is looking forward to utilizing Nasdaq eVestment™ to help them develop market-based, demand-driven solutions to better navigate the rapidly evolving impact investing ecosystem.

SMDAM also leverages other Nasdaq eVestment™ tools to stay abreast of market trends with data-driven intelligence and evaluating against its competitors on multiple dimensions.

A Successful Story in Japan

With over USD140 billion asset under management1 and 260 investment professionals which have an average industry experience of 16 years2, SMDAM’s success in investment performance has earned a lot of industry recognitions – across different asset classes, countries, and investment themes.

“We are committed to improve our client’s Quality of Life with our investment management products and services. Simultaneously, as an asset management company which constitutes a part of the investment chain, we place extra emphasis on investments that contributes to solving environmental and social issues” said Takashi Saruta, President and CEO.

Expanding Global Footprint

As an active manager, SMDAM recognizes that diversifying investments in large capital markets around the world is essential, and have strategically established a strong presence in key asset management hubs, including the U.S., Europe, and China.

As a visionary asset manager, SMDAM’s perseverance can be seen from its establishment of the research center in Shanghai back in 2005. 17 years later, SMDAM successfully built a solid research platform, which provides a wealth of knowledge that benefits SMDAM in its global investment strategy and its clients.

In 2022, SMDAM established a wholly-owned subsidiary in Shanghai, and successfully registered as a private fund manager in September 2023, enabling them to provide asset management services with on-the-ground presence in China.

With its strong investment capability in Japan, solid research foundation in China and its footprint in APAC, Europe and in the U.S., SMDAM is able to deliver outstanding investment performance to its clients regionally, and globally.

Leveraging Nasdaq eVestment™ to Accelerate Growth

SMDAM had started engaging Nasdaq eVestment™ back in December 2014, before the merger, when it implemented its database strategy.

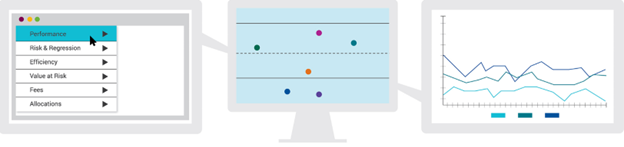

By using Nasdaq eVestment™ Omni, SMDAM developed a regimen to align with its distribution objectives, putting the company’s brand and investment strategies in front of prospective allocators and consultants. Omni also enables SMDAM to measure its market presence and

understand which data is more relevant to its potential investors – and ultimately, to win more assets.

With Nasdaq eVestment™ Market Lens, SMDAM can have a direct line of sight into the broader context of institutional investment, identifying mandate opportunities, searching for investors that have an appetite that matched the company’s strategies and identifying where competitors are gaining traction.

Looking Ahead: Going Global

SMDAM aims to further accelerate its global business expansion, offering its active investment capabilities and unparalleled knowledge, particularly in Japanese and Asian equities, to more clients in Europe and Asia ex-Japan.

Our goal is to identify attractive investment opportunities and bring them to global investors. We look forward to working continuously with Nasdaq, which supports us to efficiently build our brand franchise internationally

To that end, SMDAM is launching a global website by the end of 2024 that will bring together its international and Japan capabilities under one roof.

Sumitomo Mitsui DS Asset Management Company, Limited is also active on LinkedIn (Link added), where they actively post reports and videos on the market outlook in Japan and China, and communicate with many global investors.

Registration Number: The Director of Kanto Local Finance Bureau (KINSHO) No.399

Member of Japan Investment Advisers Association, The Investment Trusts Association, Japan and Type Financial Instruments Firms Association

© Sumitomo Mitsui DS Asset Management Company, Limited

1 Source: SMDAM website. Institutional accounts and investment trusts combined.

2 Source: SMDAM website

Note on awards:

- The R&I Fund Award is presented to provide reference information based on the past data R&I believes to be reliable (however, its accuracy and completeness are not guaranteed by R&I) and is not intended to recommend the purchase, sale or holding of particular products or guarantee their future performance. The Award is not the Credit Rating Business, but one of the Other Lines of Business (businesses excluding Credit Rating Business and also excluding the Ancillary Businesses) as set forth in Article 299, paragraph (1), item (xxviii) of the Cabinet Office Ordinance on Financial Instruments Business, etc. With respect to such business, relevant laws and regulations require measures to be implemented so that activities pertaining to such business would not unreasonably affect the Credit Rating Activities. Intellectual property rights including copyright and all other rights in this Award are the sole property of R&I, and any unauthorized copying, reproduction and so forth are prohibited.

- The LSEG Lipper Fund Awards, granted annually, highlight funds and fund companies that have excelled in delivering consistently strong risk-adjusted performance relative to their peers. The LSEG Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 36, 60 and 120 months. The fund with the highest Lipper Leader for Consistent Return (Effective Return) value in each eligible classification wins the LSEG Lipper Fund Award. For more information, see lipperfundawards.com. Although LSEG makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by LSEG Lipper.

- © [2024] Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and (4) does not constitute advice of any kind, whether investment, tax, legal or otherwise. User is solely responsible for ensuring that any use of this information complies with all laws, regulations and restrictions applicable to it. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

How to Build Brand Awareness in the Institutional Market

Every quarter, investors and consultants conduct more than 150,000 product views in Nasdaq eVestment™ looking for managers. If your strategies aren’t visible, you’re excluded from their screens by default.

-

Every quarter, investors and consultants conduct more than 150,000 product views in Nasdaq eVestment™ looking for managers. If your strategies aren’t visible, you’re excluded from their screens by default.