Nasdaq Survey Report

2024 Global Governance Pulse

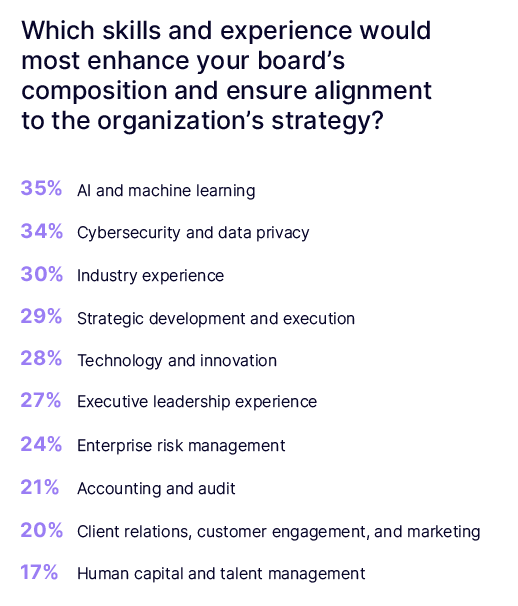

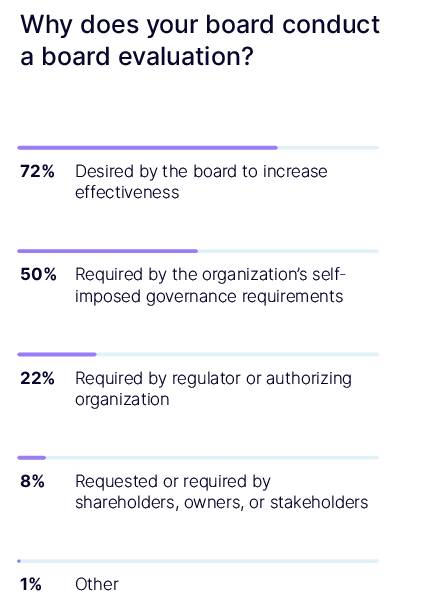

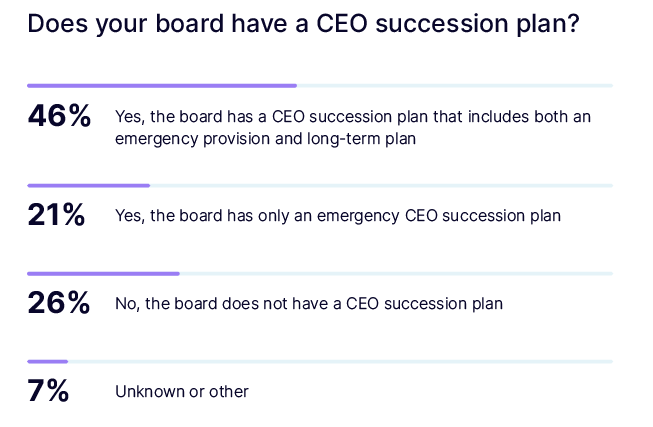

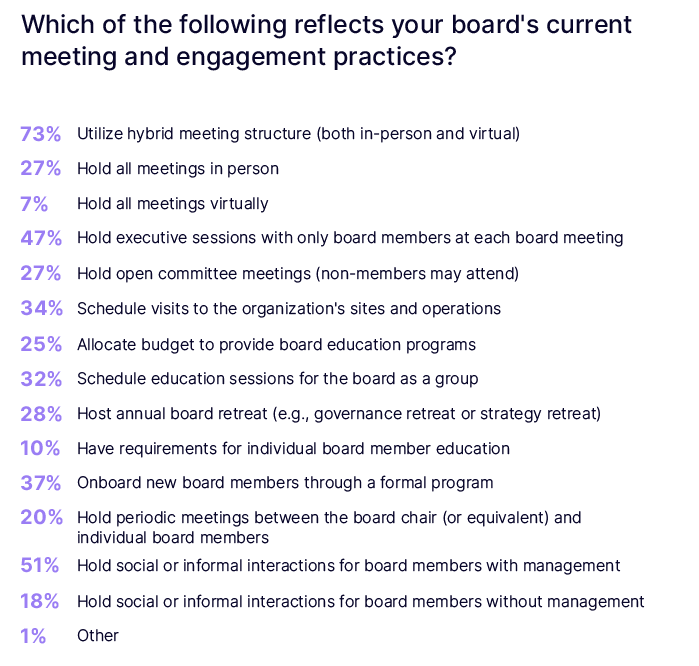

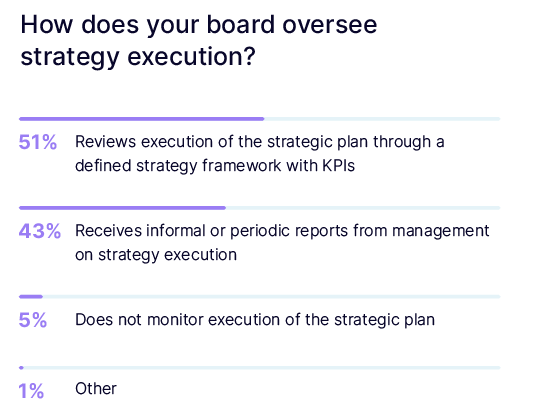

Review the results from a survey that gathered data from over 870 board members, executives, and governance professionals across organizations and industries globally. The diverse respondents offer a comprehensive view of corporate governance trends and practices and anticipated 2025 board priorities.