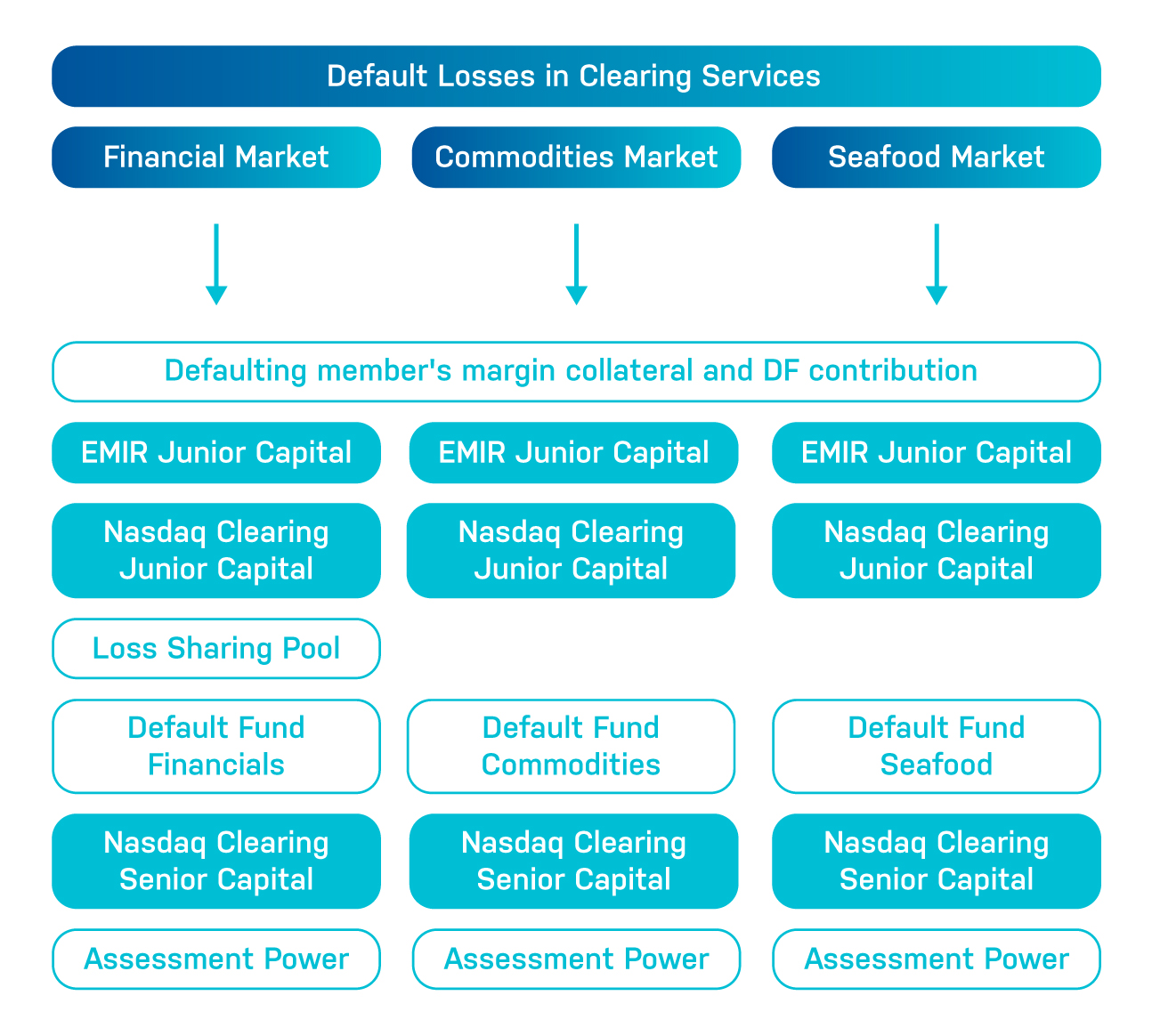

A clearing house must ensure that it has adequate resources to absorb the losses that result from the default of one or more clearing members. The resources are contributed by the CCP itself as well as by its clearing members. The total resources available to the CCP for this protection is commonly referred to as the waterfall and shows the order in which the CCP can use these resources. The Nasdaq Clearing waterfall is illustrated in the diagram.

In order to avoid having to use any of the resources in the waterfall, the first layer of protection for the clearing house is its membership requirements, margining methodology, collateral requirements and pro-active risk management.

Other Regulatory Capital

In addition to capital held to withstand counterparty defaults, Nasdaq Clearing also holds capital to ensure that it is adequately protected from operational, legal, business and investment risks or non-default losses. In addition to the funds described above, Nasdaq Clearing holds sufficient operational capital to ensure an orderly winding down or restructuring of its operations.

Refer to the Resource Center below for more details about the default fund and other financial resources of Nasdaq Clearing.

Hypothetical Capital

Regulation requires qualifying central counterparties (QCCPs), such as Nasdaq Clearing, to submit specific data points to assist clearing members in determining their default fund exposures towards Nasdaq Clearing. The Standardised approach method for counterparty credit risk (SA-CCR) method is used to calculate the hypothetical capital of the CCP and the resulting c-factors, that are calculated individually for each default fund. They are published in the Excel spreadsheet which can be retrieved in the link below (EMIR article 50c notification, under the Resource Center). The c-factors are to be applied to the value of the default fund contribution in order to calculate the hypothetical capital of the clearing member. The spreadsheet is updated each month with end-of-month data.