A national pilot project by Commonwealth with support from the Nasdaq Foundation aimed at shifting perceptions of investor identity.

This report and actionable toolkit highlight the findings of a year-long pilot program focused on how to develop an investor identity amongst Black and Latinx communities, attracting new investors to capital markets and unlocking the wealth-building opportunities they provide.

Commonwealth's earlier investing research identified investor identity as one of the four primary barriers to participation in capital markets by women living on Low to Medium Income (LMI).

Elements of Investor Identity

Development of an investor identity can allow new investors to fully take advantage of the wealth-building opportunities afforded by retail investing by overcoming initial feelings of doubt, discomfort or not belonging.

-

Belonging

The feeling of alignment between self-perception and environment

-

Connection

Interacting with others in a way that makes the sense of being part of a community concrete

-

Learning

The growing ability to make sense of investing

-

Agency

Feeling a sense of control over outcomes, including calculated risks

-

Confidence

Trust in one’s own ability to make good investing decisions

Connection

Interacting with others in a way that makes one feel like part of a community

The inability to connect with others about their investing journey is heavily influenced by not knowing people who invest.

When we start something new, and are most vulnerable to criticism, having a safe place to share an experience can determine whether we continue that experience or not.

Sense of belonging and overall ratings of their experience investing increased significantly for participants who talked more frequently with others about investing.

19% of participants had been encouraged to invest by their parents or family members.

70% of participants had two or fewer people they felt they could discuss investing with.

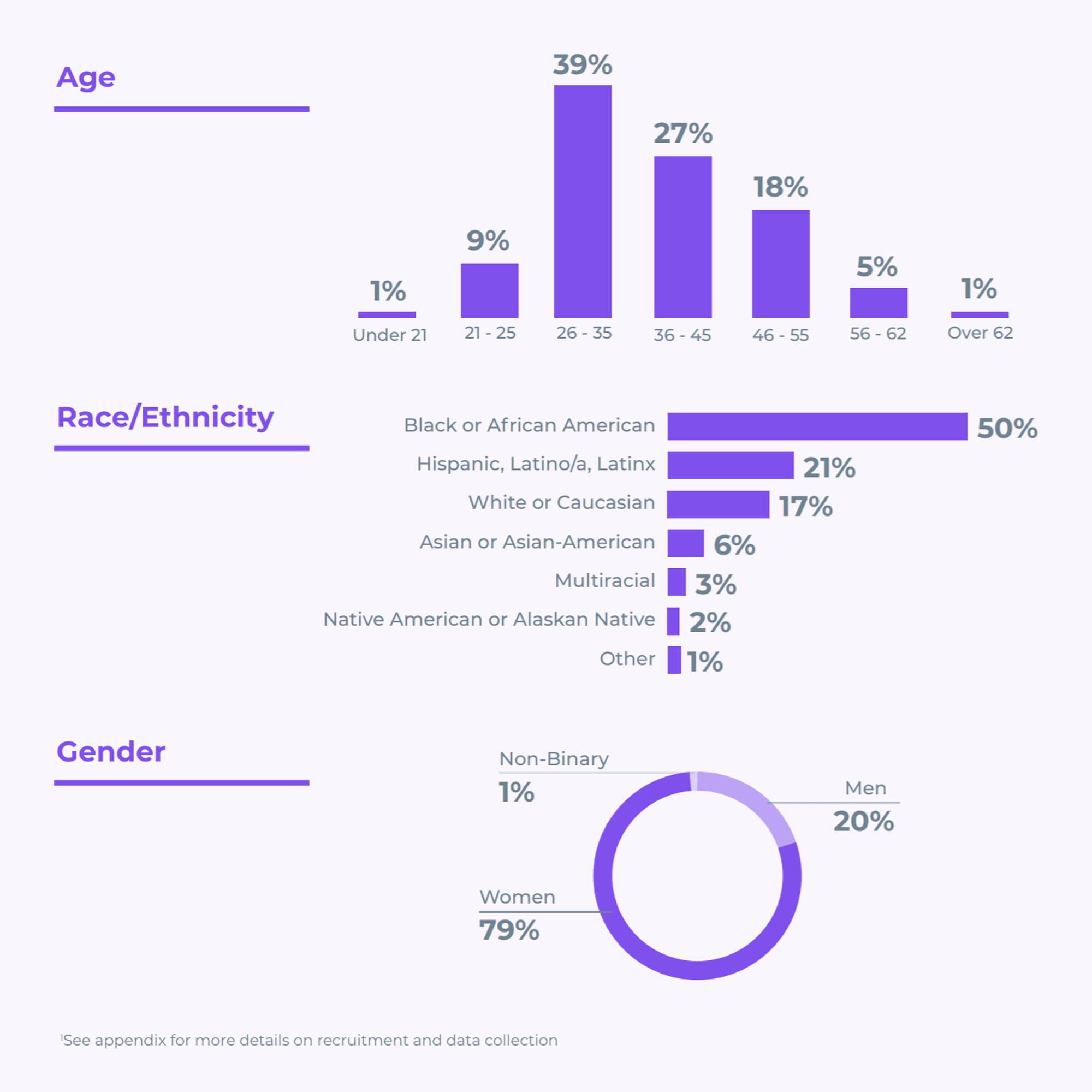

Participant Overview

863

participants

primarily Black and Latinx women with household incomes ranging from $30,000 to $80,000

$150

in seed funding

provided to each participant to invest

1 YR+

investing via Ellevest, Public or Stash

as one of our field test investing platform partners

Participant Demographics

We gathered data on participants’ investing experience through surveys, interviews, and user data provided by their respective platforms.1

The Future Faces of Investing

Research Participant Spotlights

“I'm still in that process of learning, but it's good learning because I'm taking my time and I know, in the next couple of months, I know when I put more money in there, I know where I'm going.”

-

“I'm still in that process of learning, but it's good learning because I'm taking my time and I know, in the next couple of months, I know when I put more money in there, I know where I'm going.”

“Some of these people are first time learners like myself and I like that. That encourages me to read [other peoples’ comments] every day. Normally I’ll go into my app and read the comments, from different people. That right there, it just keeps me going.”

-

“Some of these people are first time learners like myself and I like that. That encourages me to read [other peoples’ comments] every day. Normally I’ll go into my app and read the comments, from different people. That right there, it just keeps me going.”

“The more information you have, the less scary it is. Now my comfort level is well beyond what I thought it would ever be.”

-

“The more information you have, the less scary it is. Now my comfort level is well beyond what I thought it would ever be.”

71% | of participants felt investing was easier after they started |