News & Insights

Equity options today are hailed as one of the most successful financial products to be introduced in modern times. Learn more here

What are Options?

Options are contracts through which a seller gives a buyer the right, but not the obligation, to buy or sell a specified number of shares at a predetermined price within a set time period.

Options are derivatives, which means their value is derived from the value of an underlying investment, which most frequently is equity shares in a publicly listed company.

Other underlying investments on which options can be based include stock indexes, Exchange Traded Funds (ETFs), government securities, foreign currencies or commodities.

The market price for options will rise or decline based on the related securities’ performance.

Understanding Options

Options are financial instruments that can be used effectively under almost every market condition and for almost every investment goal.

Among a few of the many ways, options can help you:

- Protect your investments against a decline in market prices

- Increase your income on current or new investments

- Buy an equity at a lower price

- Benefit from an equity price’s rise or fall without owning the equity or selling it outright

Benefits of Trading Options

Orderly, Efficient and Liquid Markets

Standardized option contracts allow for orderly, efficient and liquid option markets.

Flexibility

Because of their unique risk/reward structure, options can be used in many combinations with other option contracts and/or other financial instruments to seek profits or protection.

Leverage

An equity option allows investors to fix the price for a specific period of time at which an investor can purchase or sell 100 shares of an equity for a premium (price), which is only a percentage of what one would pay to own the equity outright.

This allows option investors to leverage their investment power while increasing their potential reward from an equity’s price movements.

Limited Risk for Buyer

Unlike other investments where the risks may have no boundaries, options trading offers a defined risk to buyers. An option buyer absolutely cannot lose more than the price of the option, the premium. An uncovered option seller, on the other hand, may face unlimited risk.

Options Contracts

In most cases, stock options contracts are for 100 shares of the underlying stock. You can have one contract or many, but fractional contracts are not traded.

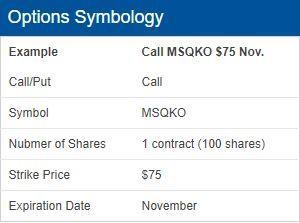

An option contract is defined by the following elements:

- Type (Put or Call)

- Underlying security

- Unit of trade (number of shares)

- Strike price and expiration date.

All option contracts that are of the same type and style and cover the same underlying security are referred to as a class of options. All options of the same class that also have the same unit of trade at the same strike price and expiration date are referred to as an option series.

Puts & Calls

Option contracts fall into two categories - Calls and Puts. A Call represents the right of the holder to buy stock. A Put represents the right of the holder to sell stock.

The Expiration Process

At any given time, an option can be bought or sold with multiple expiration dates. The expiration date is the last day an option exists, and is the deadline by which brokerage firms must submit exercise notices.

The seller of a Call option is obligated to sell the underlying security if the Call buyer exercises his or her option to buy on or before the option expiration date.

The seller of a Put option is obligated to buy the underlying security if the Put buyer exercises his or her option to sell on or before the option expiration date.

Exercising the Option...

… means buying or selling the underlying shares that are associated with their options. Options investors don’t have to do this - they can simply opt to resell their options.

Pricing Options: The Strike Price

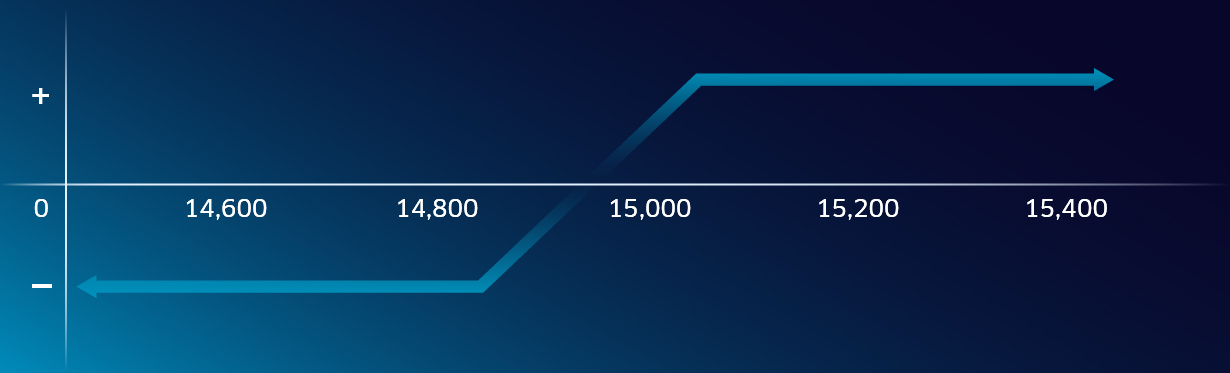

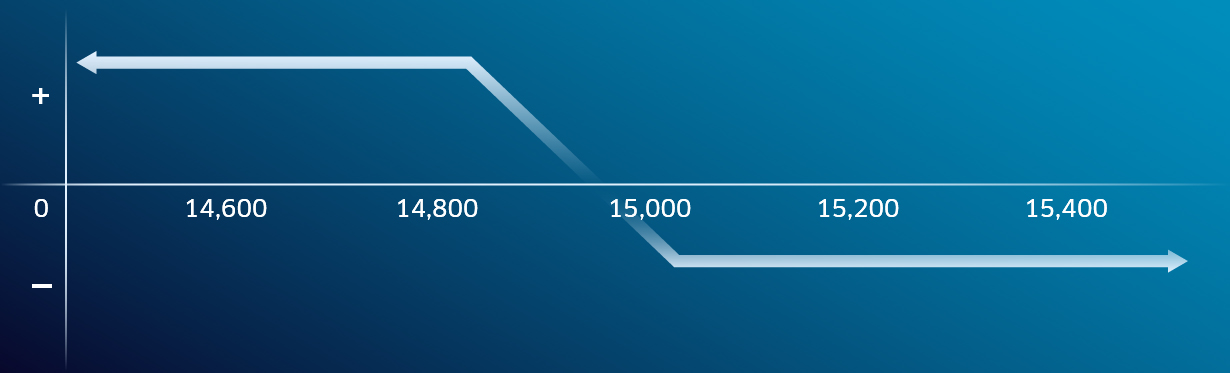

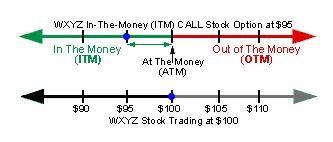

The strike price is the price at which the underlying asset is bought or sold if the option is exercised. The relationship between the strike price and the actual price of a stock determines whether the option is in-the-money, at-the-money or out-of-the-money.

- In-the-money: An in-the-money Call option strike price is below the actual stock price. An in-the-money Put option strike price is above the actual stock price.

- At the money: For both Put and Call options, the strike and the actual stock prices are the same.

- Out-of-the-money: An out-of-the-money Call option strike price is above the actual stock price. An out-of-the-money Put option strike price is below the actual stock price.

Pricing Options: The Premium

The premium is the price a buyer pays the seller for an option, on a per-share basis. The premium is paid up front at purchase and is not refundable - even if the option is not exercised.

The amount of the premium (price) is determined by this equation:

Price of Option = Intrinsic value + Time value + Volatility value

- Intrinsic value- the underlying stock price in relation to the strike price

- Time value - the length of time until the option expires

- Volatility value - how much the price fluctuates

Other factors that influence option premiums (prices) include:

- The quality of the underlying equity

- The dividend rate of the underlying equity

- Prevailing market conditions

- Supply and demand for options involving the underlying equity

- Prevailing interest rates

- Taxes and commissions

How to Buy Options

1. Hold until maturity...

...then trade: This means that you hold onto your options contracts until the end of the contract period, prior to expiration, and then exercise the option at the strike price. You would want to do this when your option is in-the-money.

2. Trade before the expiration date

You exercise your option at some point before the expiration date. When your option is volatile and in-the-money temporarily, you may want to exercise it before it expires to make a profit

3. Let the option expire

You don’t trade the option and the contract expires. If you do nothing and your option is out-of-the-money at expiration, you will have no profit and the option will expire worthless. Your loss is limited to the premium you paid for the option and commissions.

How to Sell Options

Selling stock options does come with the obligation to sell the underlying equity to a buyer if that buyer decides to exercise the option and you are "assigned" the exercise obligation.

When you sell (or "write") a Call - you are selling a buyer the right to purchase stock from you at a specified strike price for a specified period of time, regardless of how high the market price of the stock may climb.

Below are two popular call writing strategies:

1. Covered Calls

In a covered call, you are selling the right to buy an equity that you own. If a buyer decides to exercise their option to buy the underlying equity, you are obligated to sell to them at the strike price. Sometimes an investor may buy an equity and simultaneously sell a call on the equity. This is referred to as a "buy-write."

2. Uncovered Calls

In an uncovered call, you are selling the right to buy an equity from you which you don’t actually own at the time. Uncovered call writing carries substantial risk if the equity’s price increases sharply.

Options Resources

Options aren’t right for every investor and are just right for others.

Options can be risky but can also provide substantial opportunities to profit for those who properly use this very flexible and powerful financial instrument.

To learn more about options, click here to access The Nasdaq Options Trading Guide.

TradeTalks Newsletter

Weekly dose of trading news, trends and education. Delivered Wednesdays.

Nasdaq-100® Index Options Strategies

Elevate your options trading by understanding this suite of strategies