While the market showed strong momentum through much of 2024, Zscaler (NASDAQ: ZS) hasn't followed suit and struggled to gain traction in 2024. The latest evidence of this came as share prices fell after the cybersecurity company released its fiscal 2025 first-quarter results. The stock price is now down about 10% on the year as of this writing.

The decline in share price comes despite the company reporting solid revenue growth and increasing its guidance. Let's dive into its results to see if this price dip is justified or instead presents a buying opportunity.

Zscaler increased guidance

For its fiscal first quarter ended Oct. 31, Zscaler's revenue jumped 26% year over year to $628 million. That easily topped management's earlier guidance for revenue of between $604 million and $606 million.

However, investors were clearly disappointed with the company's calculated billings growth, which is the amount invoiced to customers. This metric, which is a potential indicator of future revenue growth, rose just 13% year over year to $516.7 million. Deferred revenue, which is another metric that can reflect future growth, increased more robustly to $1.78 billion, up 27%. This is money the company has received for services that it has not yet delivered.

Adjusted earnings per share (EPS) climbed to $0.77 from $0.55 a year ago. That was well ahead of the adjusted EPS of between $0.62 and $0.63 the company had forecast.

Image source: Getty Images.

It produced operating cash flow of $331.3 million and free cash flow of $291.9 million. It ended the period with $2.7 billion in cash and short-term investments on its balance sheet and $1.15 billion in debt in the form of convertible notes.

Zscaler continues to do a nice job of growing within its existing customer base, with a trailing-12-month dollar-based net retention rate of 114%, similar to the 115% it saw last quarter. The company is seeing strong upsells, especially for its Zscaler Private Access (ZPA) business. This solution provides seamless zero-trust connectivity to all users and can replace older technologies such as virtual private networks (VPNs). It said it is also seeing strong uptake of emerging solutions, including Zscaler Digital Experience (ZDX), Zero Trust for Branch and Cloud, and artificial intelligence (AI) analytics.

Zscaler increased both its full-year revenue and adjusted EPS guidance. It now expects revenue of between $2.623 billion and $2.643 billion, up from a prior outlook of between $2.6 billion and $2.62 billion. Adjusted EPS guidance was boosted to a range of $2.94 to $2.99 from a previous range of $2.81 to $2.87.

Below is a chart of its increased guidance.

| Metric | Prior Guidance | New Guidance |

|---|---|---|

| Revenue | $2.6 billion and $2.62 billion. | $2.623 billion to $2.643 billion |

| Adjusted EPS | $2.81 to $2.87 | $2.94 to $2.99 |

| Calculated billings | $3.11 billion to $3.135 billion | $3.124 billion to $3.149 billion |

Data source: Zscaler.

For its fiscal Q2, Zscaler forecasted revenue of between $633 million and $635 million with adjusted EPS of between $0.68 and $0.69. That was pretty much in line with analyst expectations for $0.68 in EPS on $633 million in revenue, as compiled by FactSet.

Is it time to buy the dip?

Zscaler had previously guided for billings growth of 13% in the first half of its current fiscal year before it accelerates to 23% in the back half, and its increased billings guidance works out to 19% to 20% growth on the year. As such, it is not a metric I'd be too worried about at the moment. Meanwhile, the company said it saw a 20% increase in the quarter from unscheduled billings as well.

The company continues to do a nice job upselling to existing customers and its new emerging products appear to be gaining nice traction. Like many companies, it is leaning into new AI solutions, which it said has started to contribute to new customer wins. Data security is one big potential area of opportunity and it won a deal in the quarter to protect Microsoft Copilot data. It is also making strides in the federal government vertical and has improved its go-to-market strategy.

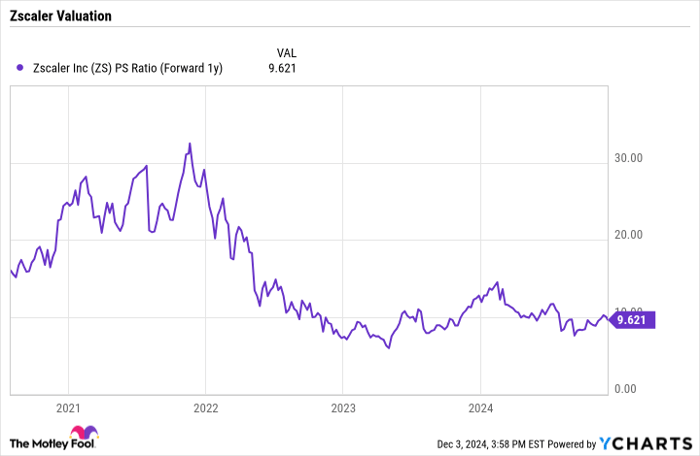

Zscaler trades at a forward price-to-sales multiple of about 9.6 based on current fiscal-year analyst estimates. Given its current revenue growth rate of more than 25%, I think that valuation looks attractive.

ZS PS Ratio (Forward 1y) data by YCharts

If Zscaler can show accelerating billings growth in the back half of its fiscal 2025 as it has forecast, I think the stock should see some solid upside from here. The company has traditionally been conservative with guidance, so I would expect it to achieve its forecast.

Cybersecurity remains a priority for organizations and Zscaler is a solid option for investors to consider buying in the space at current levels.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $376,324!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,022!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $491,327!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 2, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Zscaler. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.