It's always best to build a diverse portfolio of shares, since any stock business could lag the broader market. But if you're going to beat the market overall, you need to have individual stocks that outperform. Zoom Video Communications, Inc. (NASDAQ:ZM) has done well over the last year, with the stock price up 47% beating the market return of 43% (not including dividends). We'll need to follow Zoom Video Communications for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

We don't think that Zoom Video Communications' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Zoom Video Communications grew its revenue by 296% last year. That's well above most other pre-profit companies. While the share price gain of 47% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. If that's the case, now might be the time to take a close look at Zoom Video Communications. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

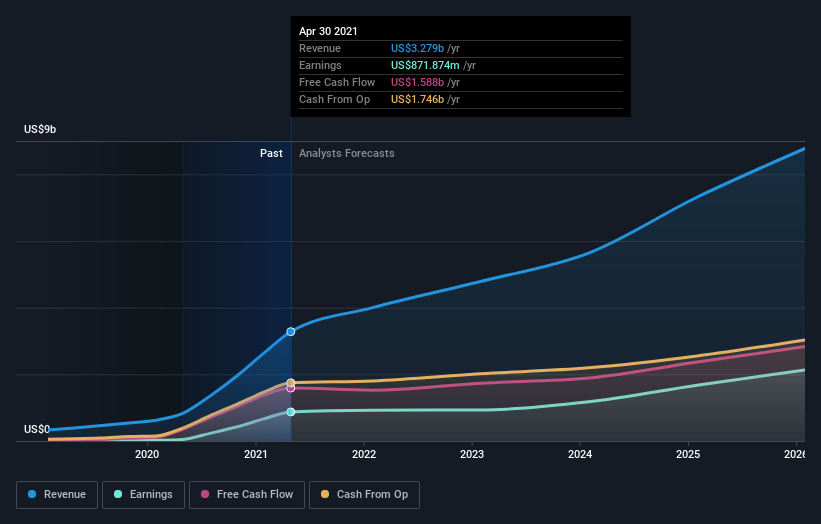

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Zoom Video Communications

A Different Perspective

In the last year the market returned about 45%, and Zoom Video Communications generated a TSR of 47% for its shareholders. A substantial portion of that gain has come in the last three months, with the stock up 20% in that time. This suggests the share price maintains some momentum, and investors are taking a more positive view of the stock. It's always interesting to track share price performance over the longer term. But to understand Zoom Video Communications better, we need to consider many other factors. Take risks, for example - Zoom Video Communications has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.