As the economy expands and contracts, so do the financial performances of companies across the 11 stock sectors. When the outlook is positive, economically sensitive companies perform better and investors are prompted to buy their shares. If the outlook turns sour, investors may sell out of those companies and swap into investments that can better weather economic downturns. This practice is known as sector rotation.

Sector rotation is evidenced in basic form by comparing the long and short-term performance of value and growth companies. Growth stocks, which are more sensitive to interest rates and other economic factors, have taken advantage of favorable conditions over the last decade, and have drastically outperformed “value” companies.

Download Visual | Modify in YCharts

Since the COVID-19 pandemic, however, spiking treasury rates, inflation, and confirmation from the Fed of rate hikes to-come have caused investors to rotate out of growth stocks. Value stocks, typically established companies with steadier business models, have become favored instead. Though large amounts of money have been flowing out of equities in general since the start of 2022, growth stocks have been more acutely affected. As illustrated by the iShares Russell 1000 Value (IWD) and Growth (IWF) ETFs, value stocks’ performance has been on-par with growth, and trading volume has been relatively greater since the market bottom on March 23, 2020.

Download Visual | Modify in YCharts

For more on the relationship between value and growth stocks, check out our Value vs Growth: Current Trends, Top Stocks & ETFs article here.

Cycles that Trigger Sector Rotations

The economy goes through cycles, and sector rotations occur at each stage. The most common cycles that investors follow are:

• Changes in the Market Cycle

• Changes in the Economic Cycle

• Overbought vs Oversold Cycles

The Market Cycle

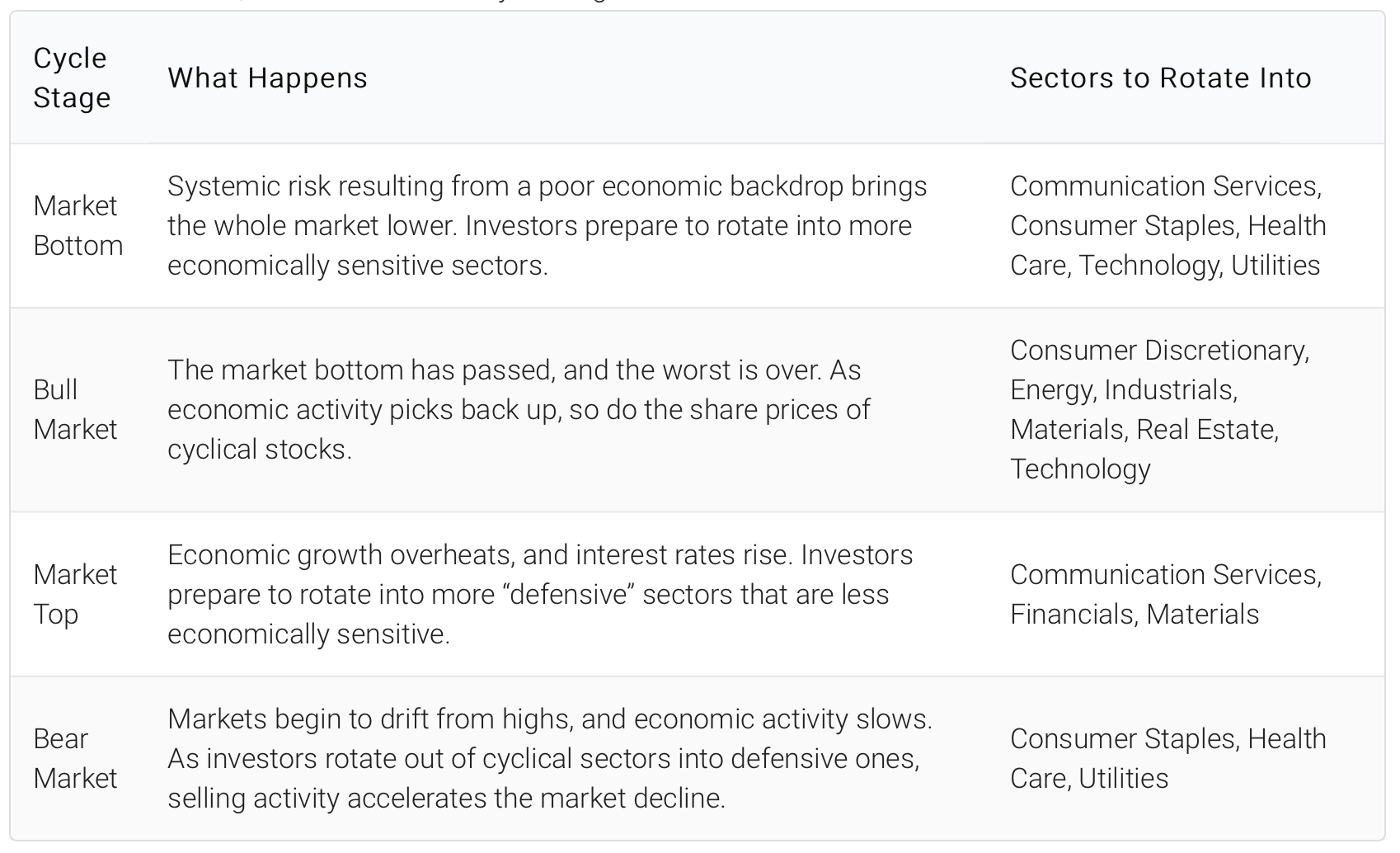

The market cycle typically moves ahead of the economic cycle since investors make decisions in anticipation of the future. As such, the current market cycle stage can indicate which sectors will soon become market leaders:

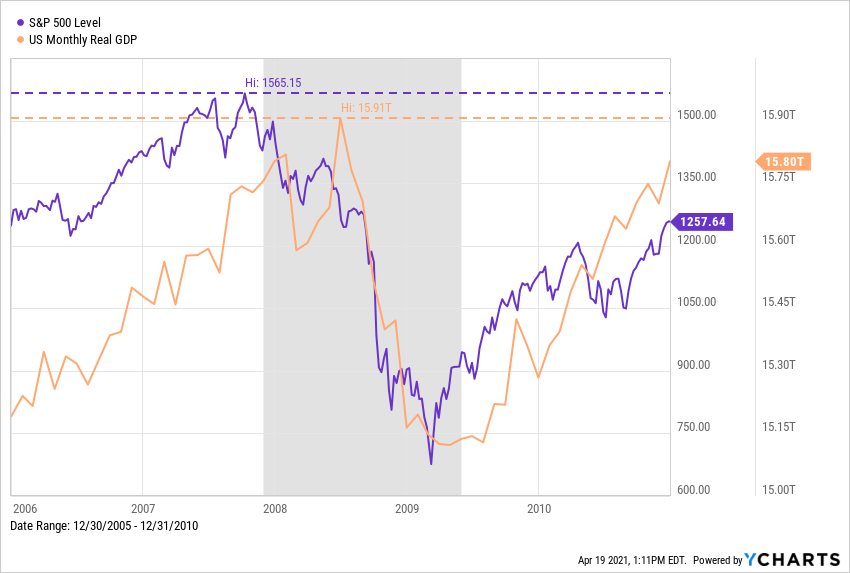

This dynamic, in which the market cycle leads the economic cycle, came to fruition during both the 2008 and 2020 recessions. In 2008, the S&P 500 peaked months ahead of US Monthly Real GDP’s top. Stocks sold off in anticipation of a worsening economy.

Download Visual | Modify in YCharts

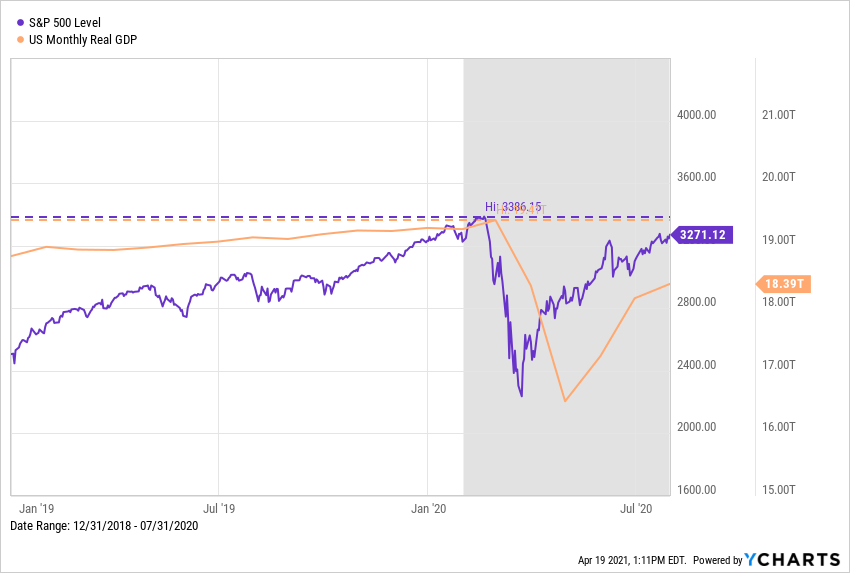

When the COVID-19 pandemic struck in early 2020, the stock market was ahead of the 8-ball once again. Such is the nature of both stock prices that discount future cash flows, and investors who always want to be one step ahead.

Download Visual | Modify in YCharts

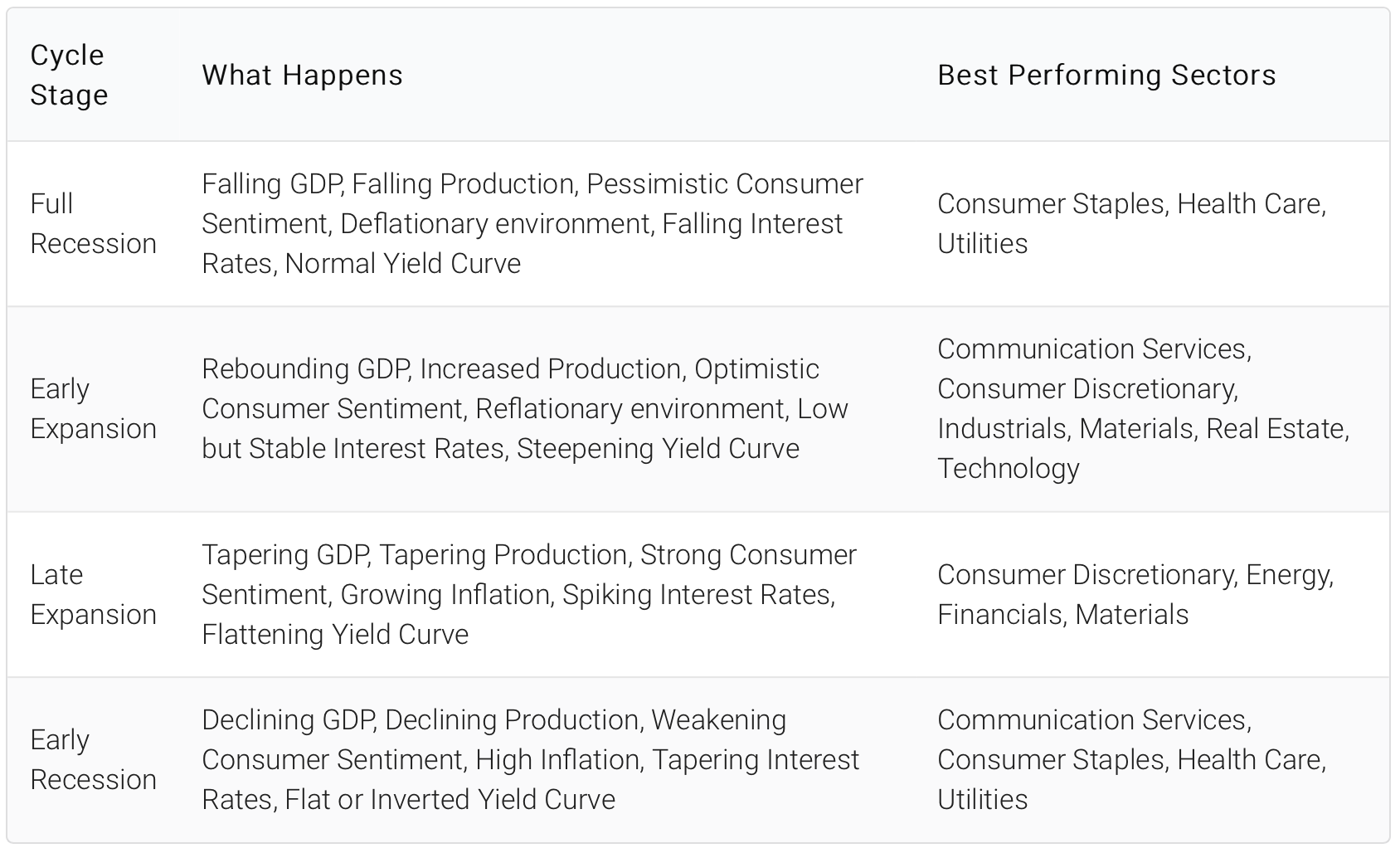

The Economic Cycle

Layered underneath the market cycle is the economic cycle. Because economic data is released more infrequently, and investors price in their estimates beforehand, the economic cycle lags behind market movements. That said, it can provide solid confirmation of prevailing market trends. Sectors tend to perform differently based on the current economic cycle stage:

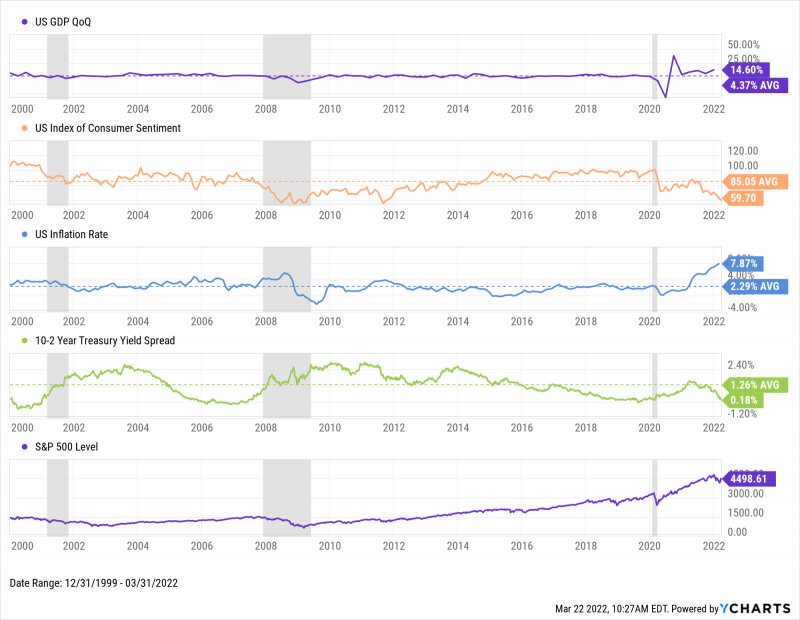

Here’s how a few of those relevant economic indicators have been trending compared to market performance, including US GDP, Consumer Sentiment, Inflation Rate, and the 10-2 Year Treasury Yield Spread:

Download Visual | Modify in YCharts

Overbought and Oversold Cycles

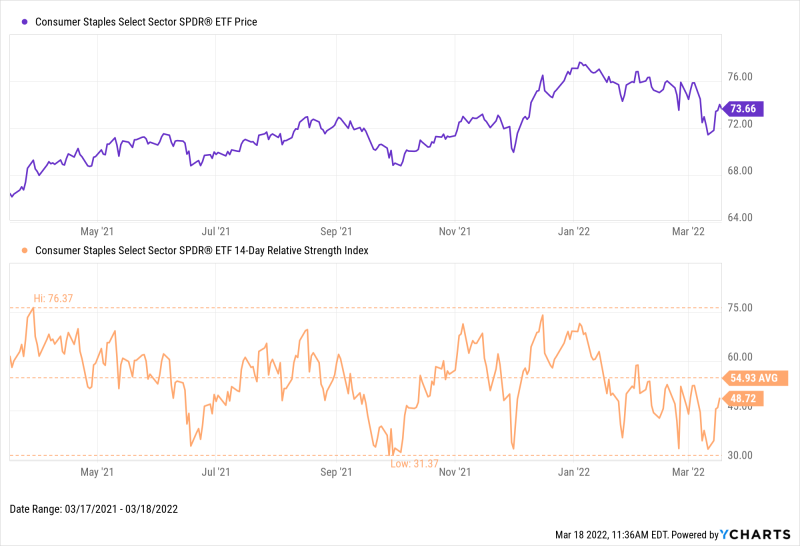

Lastly, oversold and overbought indicators can be used to hone in on investment decisions with added precision. In both October and December 2021, the value-focused Consumer Staples Select Sector SPDR ETF (XLP) triggered a common oversold signal when its relative strength index (RSI) plummeted. An RSI reading of 30 or lower indicates a security is oversold, and a value above 70 indicates it’s overbought. The ETF surged 9.4% in the two weeks following December 1st, when XLP’s relative strength dipped to near-oversold territory.

Download Visual | Modify in YCharts

Furthermore, the Consumer Staples sector’s low RSI readings coupled with bounces off its 200-day simple moving average provided additional signals that the sector was oversold. The drop in XLP’s price to its 200-day SMA was akin to reaching a level of support. Investors promptly rotated back into XLP both times after bouncing off of the 200-day SMA, and XLP most recently flashed signs of that same pattern in March 2022, when it tested the 200-day SMA again. Incorporating technical indicators into sector rotation analysis is known by many as the “marriage of technicals and fundamentals.”

Download Visual | Modify in YCharts

Sector Rotation in Practice

One argument for using a sector rotation strategy is that share prices of companies within each sector tend to move in the same direction. This is a natural effect of sector classification, whereby companies with similar business models are grouped together. At a minimum, investors can gain baseline exposure to a given sector’s sensitivities using individual stocks. Or, broader exposure can be secured using sector ETFs.

An example is the relationship of crude oil prices with major airliners American Airlines (AAL), Delta Airlines (DAL), Southwest Airlines (LUV), and United Airlines (UAL), as well as United Parcel Service (UPS) and FedEx (FDX). Despite operating in different industries, these industrials sector companies all benefit from lower oil prices, causing share prices to move higher when fuel costs decline.

Investors use a top-down approach and look to macroeconomic indicators to assess the current economic cycle stage. Once favorable sectors are identified, rotations are made out of unfavorable ones and into those that are poised to grow.

Other Factors to Consider

Sector rotation involves active management, which requires frequent monitoring of market and economic events in order to capture opportunities. As explained earlier, the economic cycle takes longer to catch up to the market cycle—and markets could also fail to digest economic news efficiently. Mistiming the market cycle could cause alpha or returns to be left on the table.

Remember: rotating out of a given sector involves selling shares, and each profitable sale triggers a knock on the door from Uncle Sam to collect capital gains tax. Tax events can diminish overall returns, which is why the level of active portfolio management should be considered in order to avoid unnecessary capital gains tax.

Also keep in mind that industries aren’t as homogenous as broader sectors, and a deviation can throw off a rotation strategy. Using the previous example, low oil prices are a major tailwind for major airlines, but other industrials like railroads might suffer as crude oil shipments decline. It might be thought that a rising tide lifts all boats, but there could be outlying industries that fail to swim, reinforcing the need for thorough investment research such as a full top-down approach.

Finally, past performance isn’t always indicative of future results. Even if a chart historically shows declines after a security’s peak and growth following a trough, economic and market events could alter those trajectories.

Using YCharts to Plan Your Sector Rotation Strategy

Visualize the Economic and Market Cycles

Want to determine the current cycle stages? Fundamental Charts can illustrate market performance along with over 400,000 economic indicators, including interest rates, unemployment, and US GDP, as illustrated in the charts above.

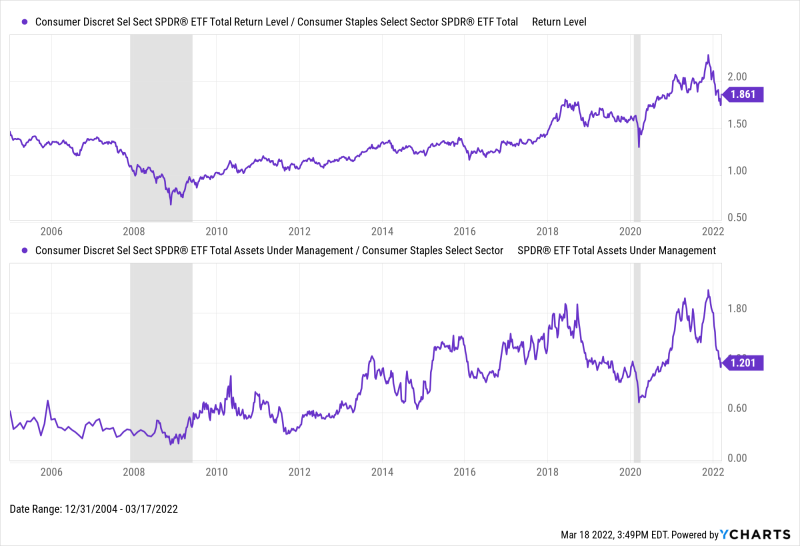

Plotting ratios, spreads, and correlations along with US recession backdrops can also uncover how different securities fare throughout the economic cycle and its stages.

Download Visual | Modify in YCharts

Screen for Investment Ideas

Once you have a sense of current market conditions, it’s time to find investments that are poised to outperform. The YCharts Stock Screener finds securities across all sectors and industries based on your own criteria.

Screening templates are also available to get you started. Find momentum stocks or stocks trading near lows, as well as ones with attractive relative metrics against the market, their respective industry, and respective sector.

Similarly, the Fund Screener enables you to search over 77,000 mutual funds and ETFs. This includes sector-tracking funds and even ETFs that leverage sector rotation strategies, such as:

• Anfield US Equity Sector Rotation ETF (AESR)

• ATAC US Rotation ETF (RORO)

• First Trust Lunt US Factor Rotation ETF (FCTR)

• Main Sector Rotation ETF (SECT)

• SPDR SSGA Fixed Income Sector Rotation ETF (FISR)

• SPDR SSGA US Sector Rotation ETF (XLSR)

Model Portfolios

Tie your analysis together with Model Portfolios to validate your sector rotation strategy against any benchmark. Here you can evaluate how much alpha your rotation strategies drive, and showcase your research with client-ready PDF reports.

Download a Sample Model Portfolio Report

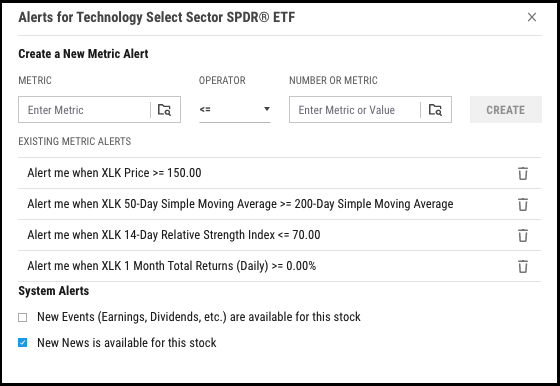

Alerts

YCharts will let you know when a possible sector rotation is near with custom alerts. Get automatic alerts—and a head start on your sector rotation game plan—when an equity or economic indicator reaches certain levels, including price, moving averages, RSI, and much more.

Learn More About Sector Rotation

• Sector Rotation Definition (Investopedia)

• Sector Rotation and the Stock Market Cycle (Barry Ritholtz)

• What Is Sector Rotation? (The Motley Fool)

• New on YCharts: Heat Maps for Stocks, Indices & Sector

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.