XRP price is setting up for a remarkable rally above $1,000 according to a recently surfaced liquidity sheet analysis factoring in a daily cross-border payment volume of $1 trillion.

XRP’s utility in cross-border payments, especially as utilized in Ripple’s On-Demand Liquidity product (now Ripple Payments), has contributed to the bullish sentiments surrounding the cryptocurrency among market participants.

XRP’s Utility in Cross-Border Payments

This utility has caught the attention of multiple payment entities over the years. Last December, a JPMorgan report mentioned Ripple and XRP as entities that could help unlock the $120 billion trapped in cross-border payments. The Crypto Basic also revealed in November 2023 that Grayscale highlighted XRP as a potential alternative to SWIFT in cross-border settlements.

In addition, The American Institute of Physics, the IMF and the World Bank also spotlighted XRP’s utility in cross-border payments in different reports. Interestingly, even SEC Chair Gary Gensler previously acknowledged XRP’s advantages for use in cross-border payments over traditional fiat currencies.

With this utility recognized by the general public, investors believe XRP is massively undervalued, projecting an imminent price explosion, especially on the back of a growth in the cross-border payment sector. Citing the Bank of England, Ripple noted in its 2023 New Value Report that the cross-border payment sector could witness a $250 trillion in volume in the next three years.

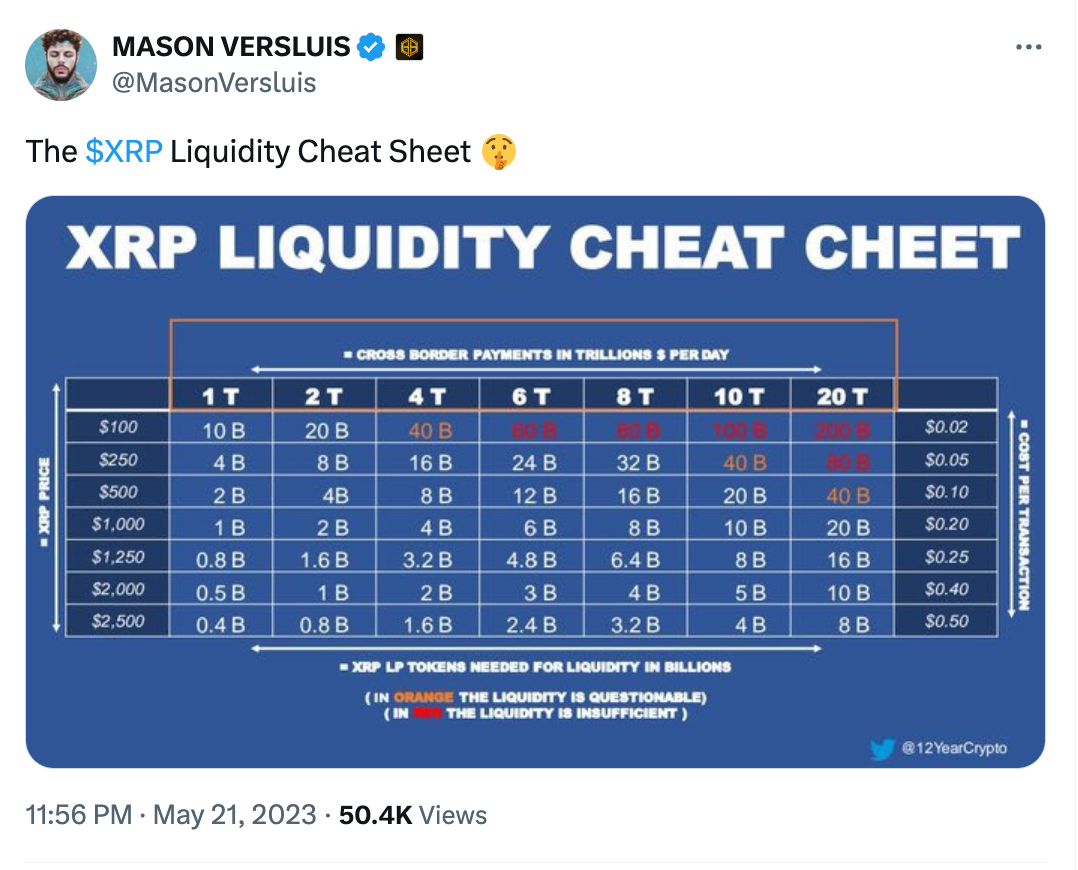

With this projection expected to materialize, pundits argue that XRP would need to soar way beyond its current price below $1 if it captures a fraction of this volume. Mason Versluis, an XRP community figure and founder of Gold Squad, presented a sheet last August of hypothetical price requirements for varying cross-border payment volumes.

An Argument for a $1,000 XRP Price

A prominent market analyst, by the Twitter (X) pseudonym Mason Versluis recently called the XRP community’s attention to a document, lending credence to the lofty price target. In the sheet, the analysis evaluates trading liquidity needed to be for XRP to cater to different daily cross-border payment volumes.

At prices ranging from $100 to $500, XRP could sufficiently handle daily payment volumes from $1 trillion, but this price becomes less feasible at volumes from $6 trillion to $20 trillion. This is because XRP’s circulating supply of 55 billion would not be sufficient for the amount of XRP tokens needed to handle these volumes.

Recall that finance pundit Shannon Thorpe previously argued that XRP would be undervalued at $500 if it locked in a portion of the projected $250 trillion cross-border payment volume.

Versluis’ sheet proposes that XRP would only sufficiently address daily payment volumes ranging from $1 trillion to $20 trillion if its price is at least $1,000. At a $1,000 price, the market would need to move 1 billion XRP tokens to account for a $1 trillion volume and 20 billion tokens for a $20 trillion volume.

For XRP to clinch a $1,000 price, it would need to skyrocket by a massive 188,543% from its current value of $0.5301. With this price potentially pushing XRP’s market cap to an unimaginable $55 trillion, some industry commentators have strongly expressed doubts.

Moreover, some have pointed out that a $1 trillion daily cross-border volume is a difficult task for XRP over the next ten years and beyond. For context, the entire global cross-border volume stood at $150 trillion in 2022, representing an average of $410 billion volume a day. A $1 trillion volume would be more than double this figure.

This article was originally posted on FX Empire

More From FXEMPIRE:

- US Dollar (DXY) Index News: Weaker Amid Fed Rate Cut Speculations

- Natural Gas News: Texas Heat Wave Spurs Sharp Turn in Prices

- Nasdaq Index, Dow Jones, S&P 500 News: Stock Futures Rally as Hopes Surge for Fed Rate Cut

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.