Workday (NASDAQ: WDAY) saw its share price last week after the software-as-a-service (SaaS) company offered fiscal 2025 Q4 guidance failed to excite investors. The stock is now down about 6% on the year at the time of this writing. Given the strong performance of the S&P 500, the stock has clearly had a disappointing 2024.

That said, the question now is whether the stock of the financial and human capital management software company can rebound in 2025. Let's take a closer look at its most recent results to see if this is a good time to buy the dip.

Revised guidance fails to impress investors

For its fiscal 2025 Q3 ended Oct. 31, Workday turned in solid results, with revenue climbing 16% year over year to $2.16 billion and subscription revenue also increasing 16% to $1.959 billion. That was just ahead of the $1.955 billion in subscription revenue that it previously forecast, while total revenue came in just above the $2.13 billion analyst consensus, as compiled by LSEG. Adjusted earnings per share (EPS) jumped 21% to $1.89, easily topping the $1.76 consensus.

The company has been leaning into artificial intelligence (AI), saying that about 30% of its customer expansions in the quarter came from AI solutions. It called out its Recruiter Agent and Talent Optimization solutions as seeing strong momentum.

Workday's 12-month subscription revenue backlog increased by 15% to $6.98 billion, while its total subscription revenue backlog jumped 20% to $22.19 billion. These metrics can be an indication of future revenue growth.

The company continues to generate a lot of cash with operating cash flow of $406 million and free cash flow of $359 million. It ended the period with $7.16 billion in cash and marketable securities and $2.98 billion in debt. It repurchased 600,000 shares at a cost of $157 million in the quarter.

Looking ahead, the company revised its full-year outlook for subscription revenue growth to be approximately $7.703 billion, which was toward the low end of its prior $7.7 billion to $7.725 billion guidance. That would be good for growth of about 17%. It is looking for an adjusted operating margin of about 25.5%, which is a slight uptick from its previous forecast of 25.25%.

For its fiscal Q4, it guided for subscription revenue of $2.025 billion, representing growth of 15%. It projected an adjusted operating margin of 25%.

Workday said its guidance was affected by strategic contract wins that will have some delayed revenue recognition due to some deliverables coming later. It noted this occurred for strategic deals with the Defense Intelligence Agency and with its Workday Wellness platform. It said this would impact its fiscal Q4 guidance by about $8 million to $10 million.

Meanwhile, Workday said it is looking for fiscal year 2026 growth of about 14% to $8.8 billion with adjusted adjusted operating margins of around 27.5%. For Q1, it expects growth to be slower due to the leap year. Overall, this is a slight reduction from last quarter when the company said it was looking for subscription revenue growth of approximately 15%.

Image source: Getty Images.

Is it time to buy the dip?

Workday's revenue growth is starting to settle in the mid-teens growth range as the company's business becomes more mature. It is turning toward AI to help power results moving forward, and it has introduced several AI innovations that are starting to gain traction.

In addition, Workday is also looking to aggressively pursue the government space, where it sees a big opportunity to displace what it calls antiquated on-premise systems. With the Trump administration's focus on government spending and waste, Workday thinks moving these systems to the cloud can help create more efficiency and save costs versus the government having to maintain the older systems.

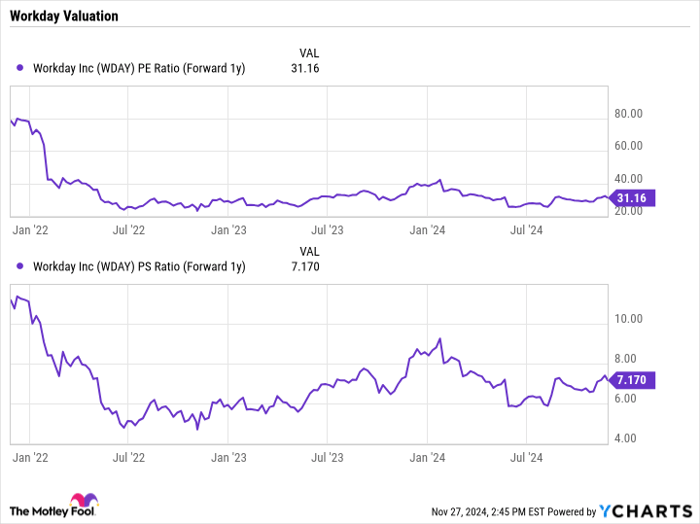

From a valuation standpoint, Workday trades at a forward price-to-sales (P/S) ratio of 7.2 and a forward price-to-earnings (P/E) ratio of just over 31 based on analysts' fiscal 2026 estimates. That seems an appropriate valuation given its growth outlook over the next couple of years.

WDAY PE Ratio (Forward 1y) data by YCharts

The key going forward for Workday stock is keeping revenue in that mid-teens range or more and continuing to expand its operating margins, which would lead to profit growth outpacing revenue growth. It's looking for its adjusted operating margin to go from 25.5% this year to 27.5% next year and then 30% in fiscal year 2027.

If it can achieve this forecast it should see strong earnings growth in the years ahead, which should help power the stock forward. Meanwhile, given its strong balance sheet and cash-flow generation, the company should also be able to buy back stock and lower its share count, boosting its EPS as well.

As such, I think Workday is a solid option for investors to consider on this price dip.

Should you invest $1,000 in Workday right now?

Before you buy stock in Workday, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Workday wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $847,211!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 25, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Workday. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.