Wind Energy: 2021 Performance and Industry Update

Index Info

The ISE Clean Edge Global Wind Energy Index™ (GWE™) was launched on December 16, 2005. As of January 18, GWE consisted of 48 components. Clean Edge – a leader in clean energy research and partner to Nasdaq on indexes since 2006 – determines the universe of constituents, using primary and secondary sources to select only companies that are “engaged and involved in some aspect of the wind energy industry such as the development or management of a wind farm; the production or distribution of electricity generated by wind power; or involvement in the design, manufacture or distribution of machinery or materials designed specifically for the industry.” As part of its research, Clean Edge further segments the index’s constituents into Pure Play and Diversified categories, with a more stringent set of conditions for the former including at least “50% or more of revenues and/or generating assets (energy capacity and/or production) coming from wind-related activities.”

Performance

Q4 2021 Update

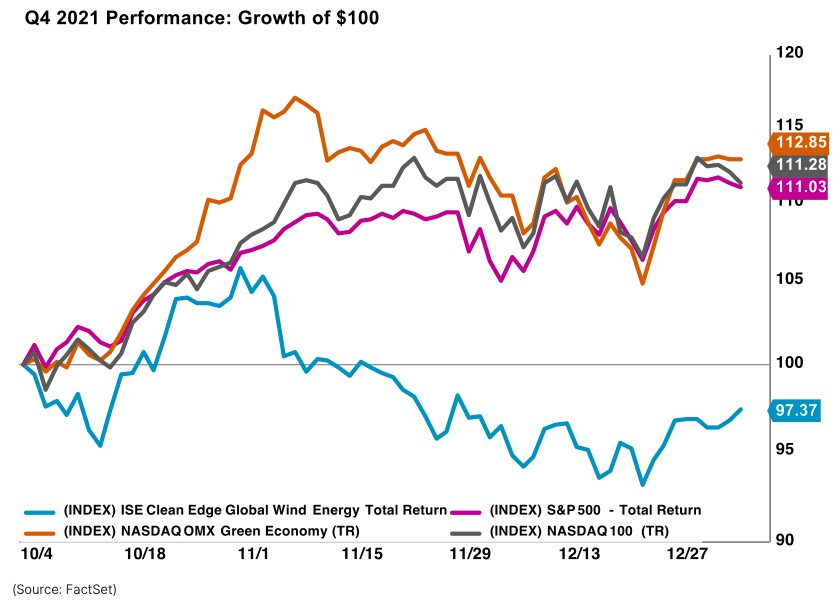

In Q4 2021, the ISE Clean Edge Global Wind Energy Index Total Return™ (GWETR™) fell -2.63%, causing it to underperform its respective equity benchmarks displayed in the chart below and listed here: Nasdaq-100® Total Return Index (XNDX®), S&P 500 Index Total Return (SPXT), and the Nasdaq OMX Green Economy Total Return™ (QGREENX™), an index comprised of 300+ companies across multiple areas of green energy and sustainability. All three of the benchmarks were in the positive, double-digit territory during the quarter. Much of the weakness across the global wind energy theme last quarter was tied to general concern over inflation, rising interest rates, supply chain disruptions, and the stalled “Build Back Better” bill in the U.S. Congress. We will discuss these developments in the section below titled, “Wind Energy Industry Update.”

While GWE underperformed in Q4 2021, there were some bright spots within the index, specifically from the Industrials and Utilities industries. GWE’s Utilities components, in general, were up an average of 7.04% (on a total return basis). Top performers in this area were Falk Renewables (MTAA: FKR) and BKW AG (XSWX: BKW), as they were up 26.34%% and 20.24%, respectively. Other strong Utilities companies were Nextera Energy Inc. (NYSE: NEE), up 19.42%, and Iberdrola SA (BMEX: IBE), up 17.64%. At the end of Q4, Utilities made up around over half of the index. Although Industrials make up just under one-tenth of the index, there were some strong names, such as Acciona SA (BMEX: ANA) and ABB Rg. (XSWX: ABBN), as they were up 15.20% and 13.84%, respectively.

Energy and Basic Materials industries, which account for just over one-third of the index, respectively, were trouble areas within the index last quarter. Companies classified as Energy experienced broad weakness. In fact, 12 out of the 13 Energy components in GWE were negative last quarter, with an average performance of -17.47% (-15.73% for all 13 companies). The worst performing companies were TPI Composites Inc. (NASDAQ: TPIC), down -55.67%, American Superconductor Corp. (NASDAQ: AMSC), down -25.38%, and Vestas Wind Systems A/S (XCSE: VWS), down -23.79%. All Basic Materials components were down as well, with an average performance of -9.47%. The worst performing group in this industry was SGL Carbon SE (SGL), down -19.89%.

2021 Update

In 2021, GWETR was down -10.30%, trailing all three benchmarks, indicating that 2021 was a weak year for the global wind energy theme, yet a strong year for the broader market as well as some areas of the “green economy.” SPXT was up 28.71% in 2021, followed by 27.51% by the XNDX and 23.41% by QGREENX. [It’s worth noting that clean energy was not all doom and gloom in 2021. In fact, the Nasdaq OMX Clean Edge Smart Grid Infrastructure Total Return Index™ (QGDX™) and ISE Clean Edge Water Total Return Index™ (HHOTR™) posted returns that beat the S&P 500 for the year (+29.34% and +33.30%, respectively, vs. the S&P 500’s return of 28.71%).]

Wind Energy Industry Update

Headwinds (Negatives):

The global wind energy theme has experienced several negative headwinds that impacted recent performance. After the strong run in 2019 – 2020, the global wind energy theme stagnated, especially as investors appeared to get concerned over overstretched valuations and lofty return expectations. But there were also non-valuation-based headwinds that were responsible for some of the weakness expected across the broader theme. See below for more detail:

- Supply Chain Disruption & Inflation: Rising material and components costs are providing headwinds for global wind energy projects and ongoing maintenance. For example, costs have risen for key wind energy components, “including steel (up 210 percent over last calendar year), aluminum (up 67 percent) and copper (up 43 percent).”1 These rising costs and disruptions are making it more difficult for wind energy companies to add new capacity or maintain existing wind farms.

- Rising Interest Rates: The US Treasury 10 Year Yield Index (TNX) rose 59 bps last year as interest rates moved off their 2020 lows. Additional uncertainty and selling pressure took place across the renewable energy space, potentially because of the rising interest rate pictures. Recall, high rates mean it is more expensive to borrow and thus more expensive to finance capital-intensive energy projects, such as wind farms.

- Build Back Better Bill Concerns: There is concern that the Build Back Better Bill will not get passed by the US senate. This bill is important to wind energy companies because the bill includes a number of key wind energy-related provisions, such as the extension of various production tax credits, direct payment provisions, and some investment tax credits, which would help offshore wind providers.2

- A Mighty Wind is Not Blowing: Throughout much of the summer of 2021 and into early winter, parts of the globe, especially Europe, experienced low wind speeds, which reduced wind power generation. The lack of steady wind has added additional fuel to the headwinds and has the potential to reduce the revenue of renewables companies.3

Tailwinds (Positives):

Although the global wind theme faced several headwinds last year, there are still several positives for the theme, providing the theme with a healthy investment outlook.

- Continued Growth in Wind Energy: Renewable energy now accounts for 25.47% of US-installed energy generating capacity, with wind energy accounting for 10.54% of the capacity.4 This is up from just 3.80% in October 2011.5 This growth is due to a number of installed wind power facilities that took place in 2019 and 2020, per U.S. Energy Information Administration (EIA) data which reported that the “United States set a record in 2020 [for energy capacity additions], totaling 14.2 GW and surpassing the previous record of 13.2 GW added in 2012.”6 There continues to be global growth as well, especially in China. According to the IEA, China “is expected to reach 1200 GW of total wind and solar capacity in 2026 – four years earlier than its current target of 2030.”7 Through year-end, the EIA reported that 2021 had another “record- high” with “17.1 GW of wind capacity [come] online in the United States.”8

- Policy Support: Governments around the world are pushing to meet the clean energy goals set at the COP26 Climate change Conference. US President Joe Biden wants the US to reach net-zero greenhouse gas emissions by 2050 while also reaching a 100 percent “clean” power sector by 2035.9 In addition, the US government continues to push for more growth through the addition of more offshore wind leasing rights, creating more opportunity for growth.10 At the state level, California and New York, in particular, are working aggressively to build their offshore wind capabilities and capacity with both policy and monetary support.11

- Innovation: Technological innovation will continue to drive new phases of growth and opportunity in global wind energy production. For example, new innovative turbines are generating more and more electricity with each turn, such as the 15-megawatt (mw) turbine that is in testing purposes (up from the other prototype in the 13-mw range as well as the commercially available 8 to 9.5 mw turbines), and programs led by the National Offshore wind research and development consortium and the Electric Power Research Institute to help foster investment in new technologies through research and development.12

Sources: Nasdaq, FactSet, Bloomberg.

1. https://www.greenbiz.com/article/why-supply-chain-disruptions-may-slow-down-clean-energy-deployments

2. https://www.windpowermonthly.com/article/1733772/us-wind-pins-hopes-build-back-better-bill-approval

3. https://www.simplyswitch.com/low-wind-speeds-and-stratospheric-gas-prices-hit-good-energys-profits/

6. https://nawindpower.com/record-year-in-2020-for-wind-turbine-installation-in-the-u-s

8. https://www.eia.gov/todayinenergy/detail.php?id=50818

10. https://blog.ucsusa.org/john-rogers/more-and-more-5-offshore-wind-stories-im-watching/

11. https://www.eia.gov/todayinenergy/detail.php?id=50818, https://www.governor.ny.gov/news/governor-hochul-announces-nation-leading-500-million-investment-offshore-wind

12. https://blog.ucsusa.org/john-rogers/more-and-more-5-offshore-wind-stories-im-watching/

Global Index Watch (GIW)

Nasdaq’s Web-based Index Delivery Service

In This Story

TPIC AMSCOther Topics

Indexes Research and Insights Renewable EnergyContact Us for More Information

Global Indexes