By Victor Zhang, CEO of AlphaWallet. Victor is a tech entrepreneur whose goal is to build solutions to increase global mass adoption of blockchain and crypto technology. He has eight years experience in managing multinational teams and businesses all across Asia, including Australia, Singapore, China, Hong Kong, Korea, Japan, and India. He successfully managed Ticketbis(360Experience)’s APAC team, which led to their eventual acquisition from eBay for $165 million in 2016. Victor has created five business start-ups in Australia, China, HK and Singapore that focus on import/export/wholesale/sports/travel/ticketing/internet business. Victor received a Master’s Degree in Information and Communication Technology from the University of Wollongong in NSW.

The adoption of cryptocurrency continues to accelerate despite persistent market uncertainty. Since touching record highs in 2017, the market has seen both significant gains and losses, generating a continuous stream of competing forecasts. And while future price movements are anyone’s guess, one fact is inevitable - those using cryptocurrency need a wallet to hold it.

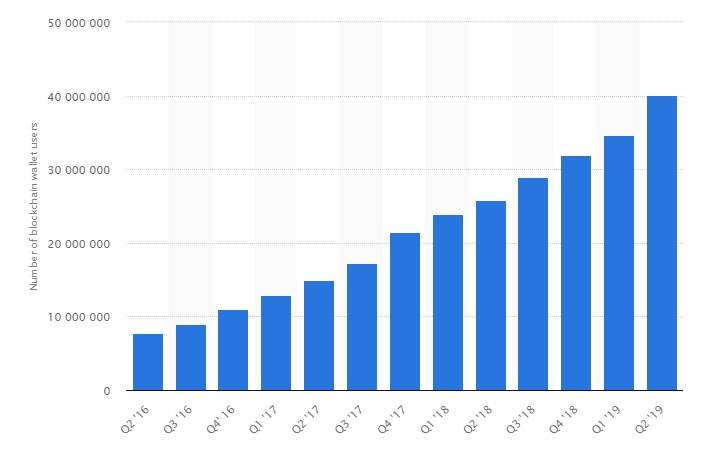

Whether or not you hold your own private keys or rely on smart contract functionality, a crypto wallet is integral to partaking in the realm of digital currency. Reflecting this reality, the Cambridge Center for Alternative Finance found the number of crypto wallet users nearly doubled in 2018. Today, data suggests the number of blockchain wallet users is more than 40 million.

Source: Bitcoin.com

And as the cryptocurrency ecosystem matures, this wallet usership is set to increase. However, market maturation comes with an evolving regulatory landscape - and the impacts are spreading around the globe. As central banks and their government overseers grapple with the emergence of digital currency, a new set of conditions will alter the trajectory of crypto wallet use.

Exploring Central Bank Digital Currency (CBDC)

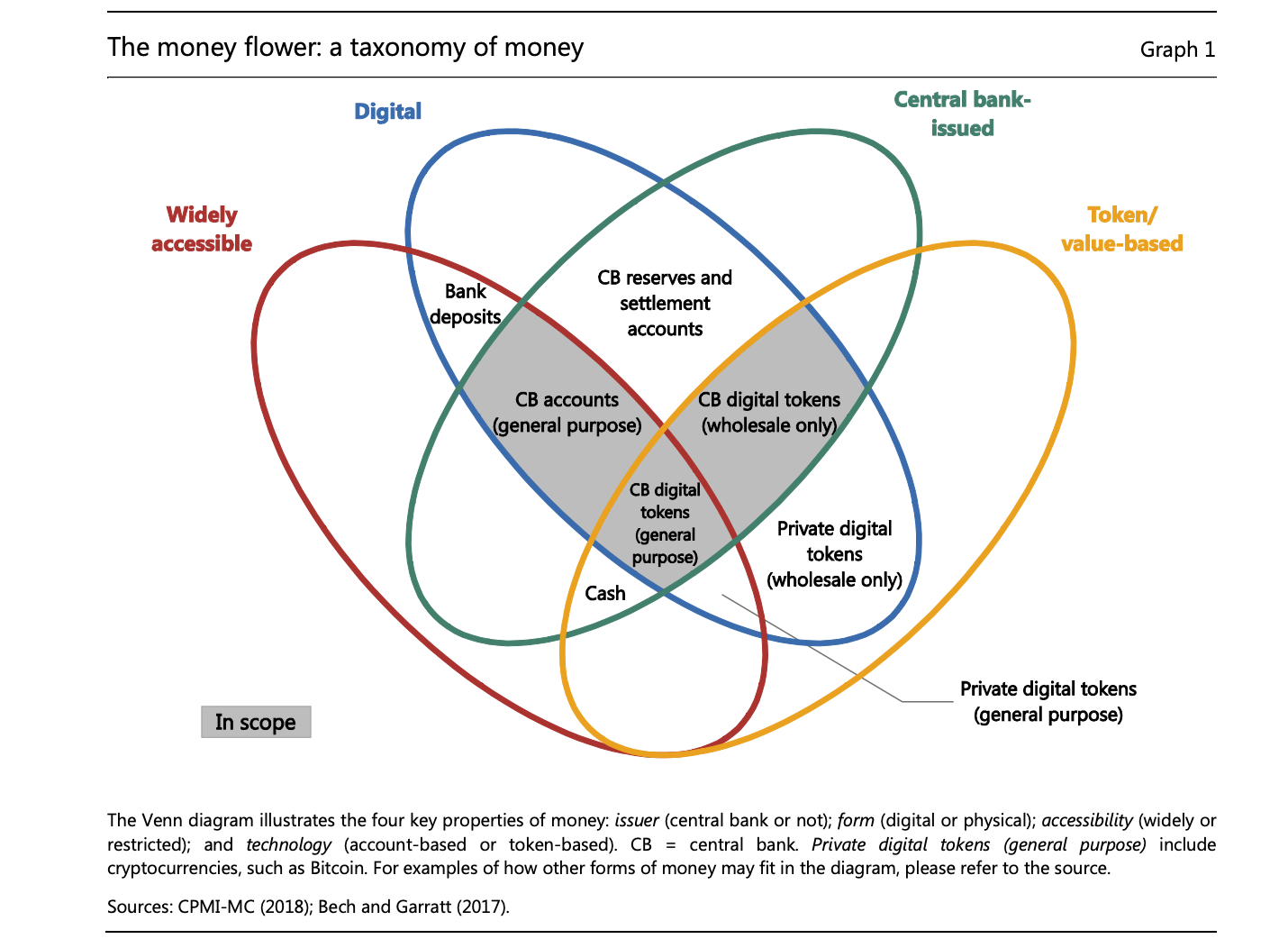

Most notably, central banks around the world have begun to assess the viability of Central Bank Digital Currency (CBDC). Already comfortable with their role as sole financial overseer, it’s no surprise that these long-standing institutions are employing this approach to crypto implementation. But what exactly is a CBDC?

In short, it’s a virtual currency issued and controlled by a federal regulator. As such, CBDC’s are not decentralized like the majority of cryptocurrencies. Instead, they represent fiat (paper) currency in a digital form. As such, central banks issuing a CBDC act as the currency regulator and their client’s account holder simultaneously.

Source: Proceeding with Caution – A Survey on Central Bank Digital Currency

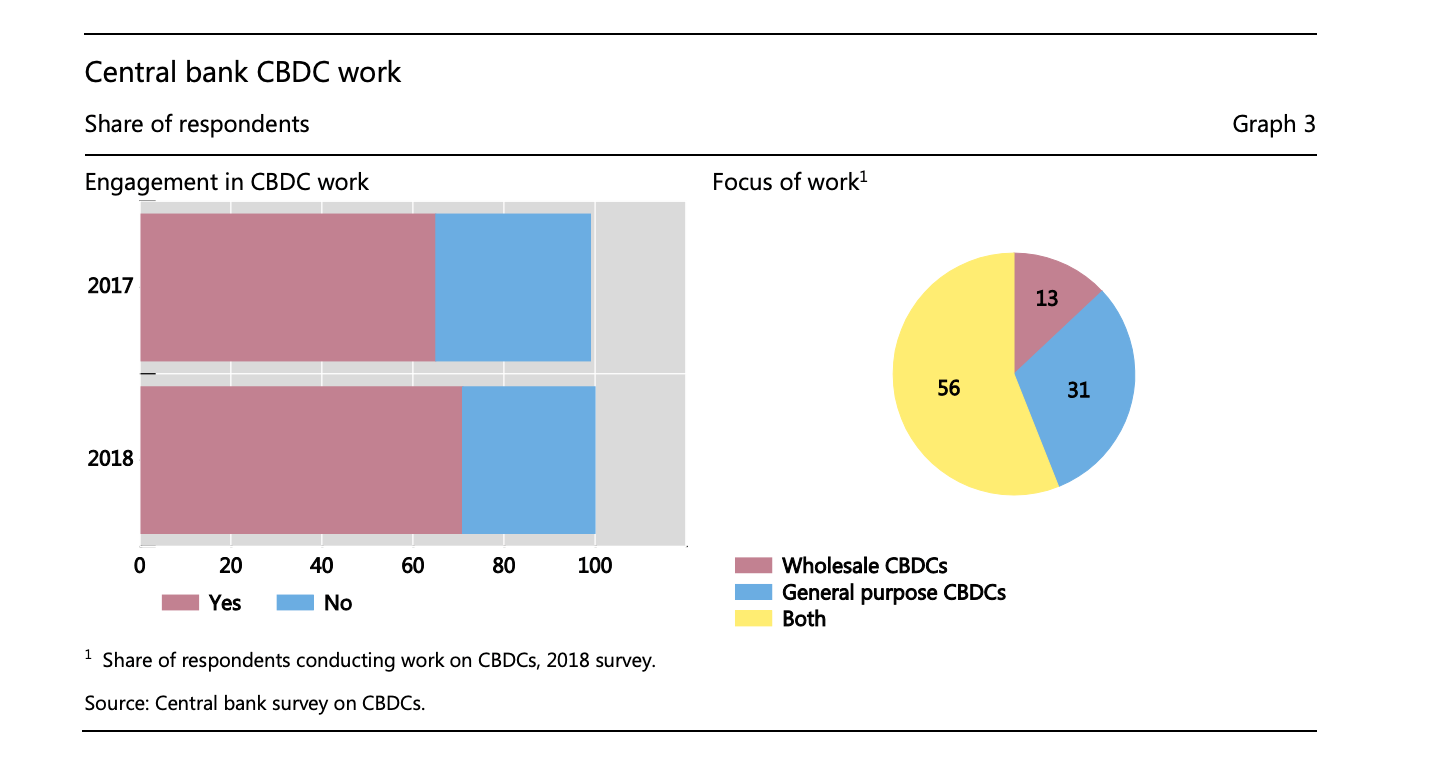

According to a recent survey from the Bank for International Settlements, 70% of respondents are currently (or will soon be) engaged in CBDC projects, representing a marginal increase since 2017. However, despite the apparent exploration of this crypto issuance model, many central banks remain on the offensive when it comes to CBDCs. In the same survey, over 85% of central banks responded that they are either somewhat unlikely or very unlikely to issue any CBDC in the near term.

Source: Proceeding with Caution – A Survey on Central Bank Digital Currency

But why is this the case? In many instances, governments can’t yet see the value of digitizing their national currency. For others, the regulatory and fiscal implications of introducing a CBDC are vast and complex - not every country is ready to face these challenges.

In the face of this reluctance, there are also significant implications for citizens. For governments, CBDC’s allow broader financial oversight and control. Because a CBDC can be implemented in the absence of blockchain technology, effectively acting as centralized digital cash, the encroachment on personal freedom is hard to ignore.

Stablecoin Momentum

Many believe that stablecoins, most notably Facebook’s Libra, forced central banks to recognize the rise of cryptocurrency and growing calls for instant, cheap digital payment solutions. Further validating this opinion Christin Lagard, president of the European Central Bank, expressed her support for the bank’s involvement in the development of a CBDC for this specific application.

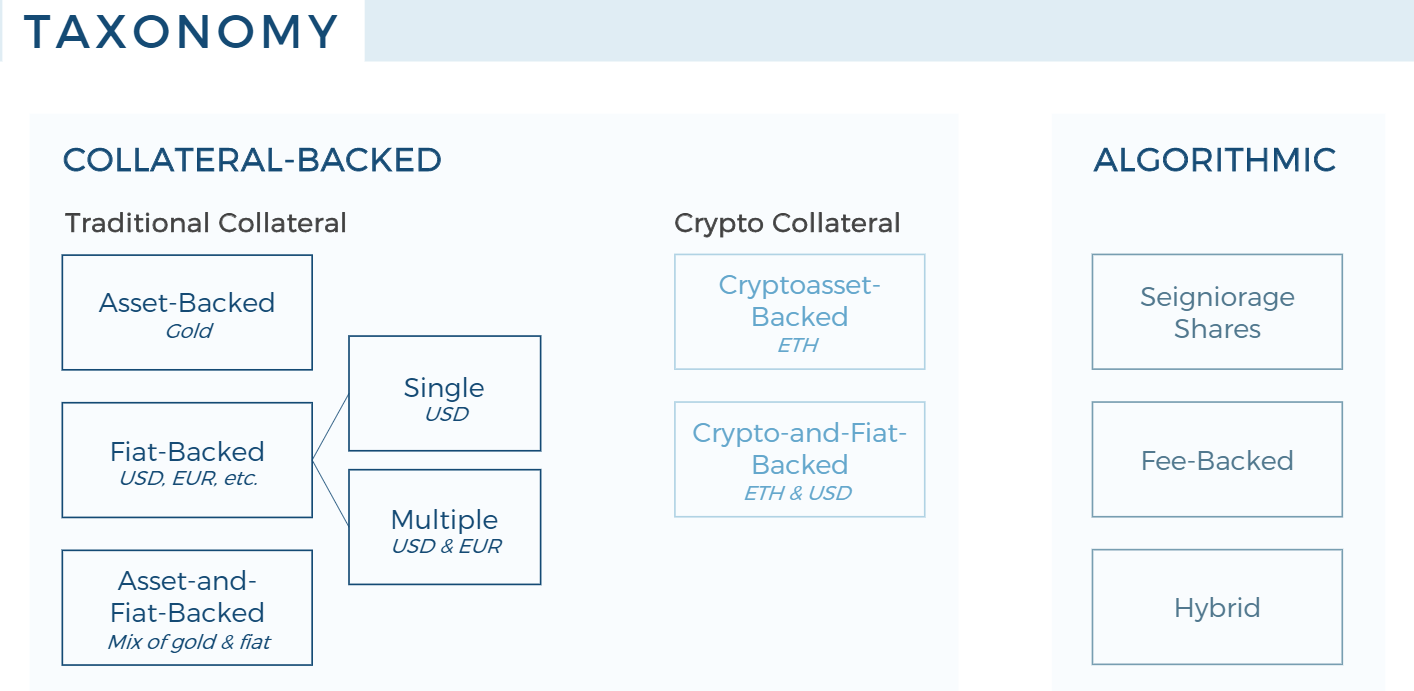

So, what’s so enticing about stablecoins? In short, they represent a safer way to invest in the digital asset class, given their real asset backing. In aiming to eliminate the volatility of cryptocurrencies, stablecoin projects have become a significant portion of the crypto ecosystem. According to a report from Blockchain, stablecoins account for 2.7% of the total crypto-asset market, up from 1.5% in September 2018. The report further estimates the total value of stablecoins now exceeds $3 billion, more than doubling from $1.4 billion in 2018.

Source: The State of Stablecoins

Emerging Crypto Wallet Trends

As the stablecoin ecosystem continues its dramatic expansion and governments further explore the potential of CBDCs, several crypto wallet trends have begun to emerge. And while the impact of each is uncertain today, each will have an undeniable influence moving forward.

The Future is Non-Custodial

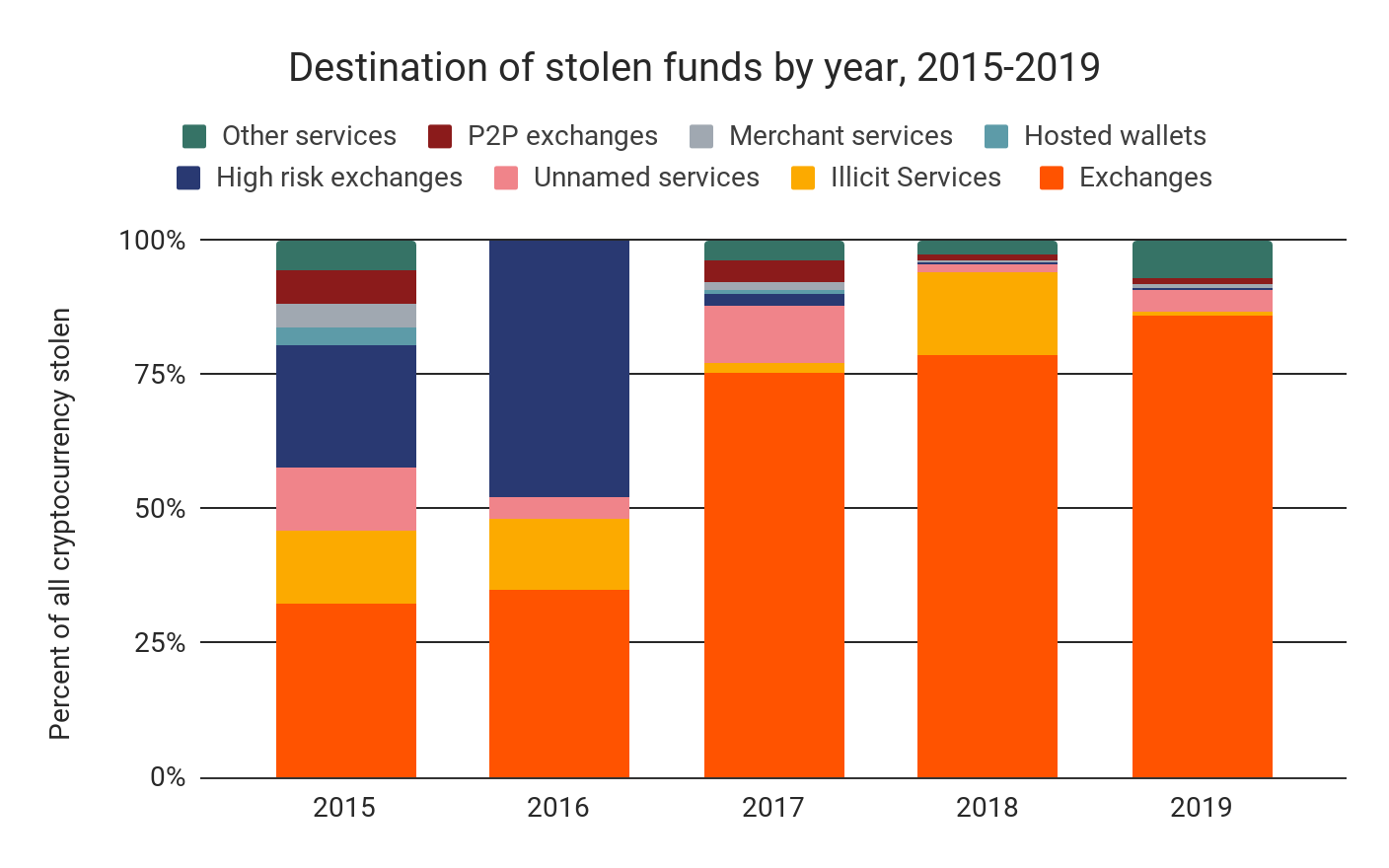

Cryptocurrency exchanges have a long, well-documented history of security breaches. Because exchange platforms assume custody of cryptocurrency deposits, user private keys are made vulnerable - an arrangement often exploited by nefarious market players. In 2018 alone, a record total of $865 million was lost across six exchanges following hacks - more than double the amount lost in 2017.

According to the Chainalysis 2020 Crypto Crime Report, 2019 saw more cryptocurrency hacks than any other year. However, of the 11 that occurred, none were comparable to the value of past heists. Despite total losses dropping significantly to $283 million in 2019, these losses remain understandably startling to both investors and lawmakers.

As non-custodial storage solutions, crypto wallets and decentralized exchanges (DEX) bolster security. In short, users can choose to keep their private keys to themselves, retaining complete control over their crypto. And because the vast majority of stolen funds originate from exchanges, crypto users are certain to leverage the added security of these platforms moving forward.

Source: Chainalysis 2020 Crypto Crime Report

Global Remittance Networks

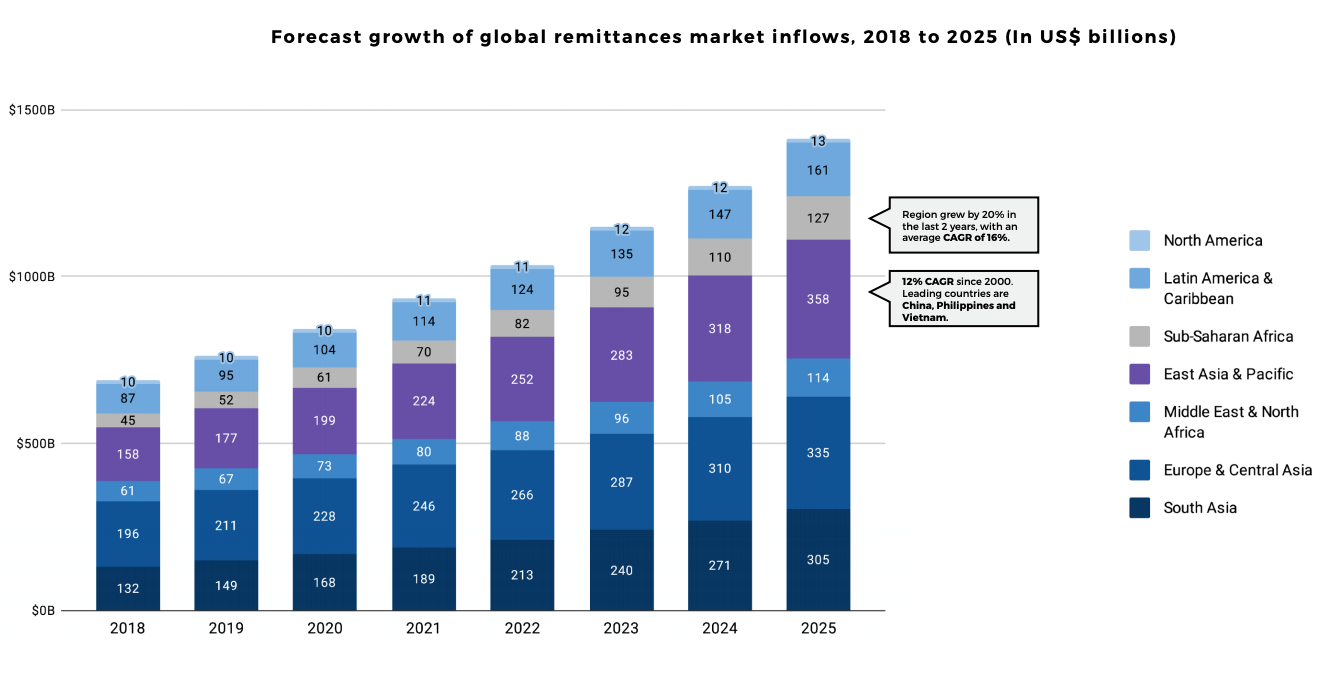

According to figures from Blockdata, the global remittance market will generate $1.035 trillion by 2022, and $1.413 trillion by 2025. As mentioned, central banks face increasingly competitive blockchain-based remittance platforms. In the face of mounting pressure, it’s perceivable that reluctant governments will need to reassess CBDCs and their place within an existing financial system.

Source: Blockdata - Remittance Market & Blockchain Technology

With a growing number of governments moving to support the growth of both stablecoins and CBDCs, crypto wallet usership is sure to accelerate. As regulations become more stringent, crypto wallets will come to serve as a crucial component of digital infrastructure.

The Reality of KYC and AML

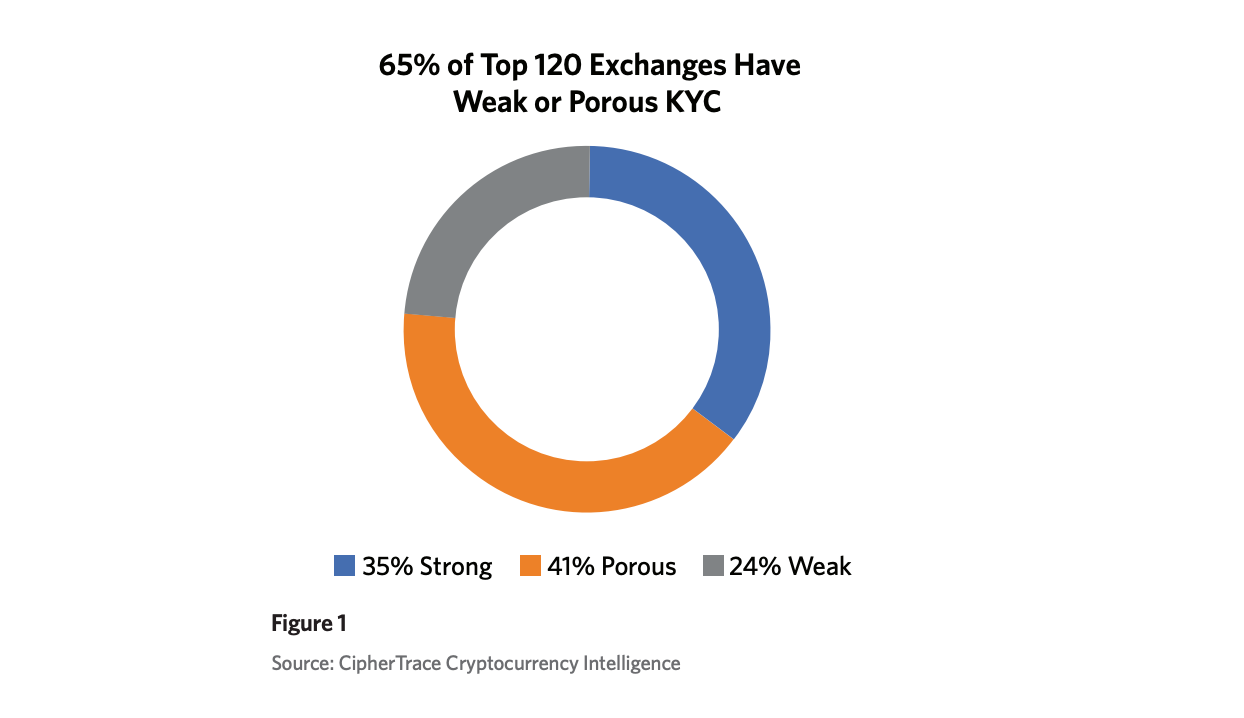

According to the latest Cryptocurrency Anti-Money Laundering Report from CipherTrace, 65% of the 120 most popular exchanges have weak or porous KYC practices. The results of this large-scale study are said to constitute the first-ever comprehensive data on KYC practices at cryptocurrency exchanges around the globe.

Source: Cryptocurrency Anti-Money Laundering Report, 2019 Q3

As one of the most prominent movements in the crypto ecosystem, robust KYC and AML practices represent a shift in industry sentiment. By conducting geographical-based verification, companies hope to validate real user identities, introducing another layer of security.

However, while novel in concept, enforcing these requirements will prove difficult using existing means. Because non-custodial wallets function similarly to software without a server, an internet-based app is not required, limiting potential oversight. Instead, KYC and AML oversight can be built into the digital assets themselves.

Recall that digital assets are smart asserts, and many already utilize this functionality to automate processes. Under this dynamic, if a trader fails to provide a KYC attestation, a smart contract would decline the transaction. In short, trying to regulate a non-custodial wallet is like asking a plastic bag manufacturer to ensure their product can’t be used for nefarious activities.

An Evolving Ecosystem

As governments around the globe grapple with their response to the rise of cryptocurrency, it’s apparent that non-custodial crypto wallets and DEX’s will play an increasingly crucial role in the ecosystem. These external platforms will introduce greater security, user autonomy, and industry legitimacy. Just as regulators concern themselves with the implications of digital currency introduction, current users must remain vigilant in protecting their privacy and crypto-assets online.

Without sustained effort, cryptocurrency wallet development will bring us to a future where wallets outperform the well-entrenched financial infrastructure we’ve come to know. Perhaps this day will come sooner than we think.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.