The stock price of social media platform operator Snap (NYSE: SNAP) has staged a dramatic comeback in recent years. While the company struggled to manage competition with Facebook's Instagram in the period just after Snap's initial public offering in 2017, it soon figured out how to better drive revenue and daily active user (DAU) growth. That got the stock price growth trajectory back on track and it's up about 237% in the past year.

Competing social media stock Pinterest (NYSE: PINS) had less-than-exciting stock performance following its IPO in April 2019, at least until the coronavirus pandemic was declared in March 2020. In the year that followed, Pinterest's stock price jumped over 600% before falling off somewhat in the broader tech stock sell-off that began in February 2021.

Image source: Getty Images.

As we look to the performance of these two stocks over the next decade, some demographic statistics point to a more promising future for Pinterest, leaving investors wondering whether Snap can sustain its current price growth advantage. Which stock will be worth more by 2030?

Snap's advantages over Pinterest

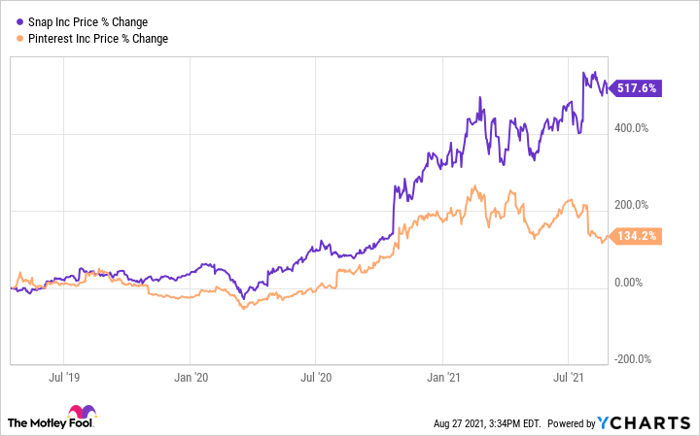

Admittedly, the current stock price statistics appear to favor Snap over Pinterest. Over the last year, Snap's stock price is up about 243% while Pinterest's stock price is up about 67%. If you measure the stock performance for each from the point when Pinterest IPO'd in 2019, the difference is even more dramatic with Snap's price up nearly 518% compared to Pinterest's 134% gain. To be fair, it should be noted that Snap's stock price at the time of Pinterest's IPO was well below its own IPO price from two years earlier.

SNAP data by YCharts

Given the stock performance difference, it makes sense that Snap's $116 billion market cap is roughly three times larger than Pinterest's $37 billion cap.

Snap's current market cap strength may partially be a result of Snap consistently outperforming Pinterest when it comes to average revenue per user (ARPU). Using their most recent earnings reports, Snap brought in ARPU of $3.35 versus only $1.32 for Pinterest.

Snap has also improved revenue growth coming out of the pandemic. In the first six months of the year, revenue was up 91% over the same time frame in 2020, compared with the 29% growth rate when comparing the first half of 2020 with the same period in 2019. Moreover, Snap's DAUs increased 23% year over year, compared with a 9% increase in monthly active users (MAUs) for Pinterest over the same period.

However, investors should also remember that increased e-commerce activity during the pandemic pulled some of Pinterest's potential growth forward. Thus, Snap's 2020 numbers came off of a lower base than those of Pinterest. The picture looks slightly different when comparing against pre-pandemic figures. Over the previous two years, Snap's DAU count grew 44%, slightly lagging Pinterest's 51% MAU growth over the same period.

How Pinterest could overtake Snap

Snap's advantage falls further apart upon closer examination of other numbers. With regards to market cap, the massive growth in Snap stock price in the past year has elevated its price-to-sales (P/S) ratio to 33. This makes its valuation significantly more expensive than Pinterest, which trades at 16 times sales. So Pinterest's stock is a relative bargain on a valuation basis.

Moreover, Pinterest seems to hold a slight growth advantage as it shapes the future of commerce. It brought in $1.1 billion in revenue for the first six months of 2021, which was a 102% year-over-year jump that exceeded Snap's revenue growth rate over the same period. Additionally, Pinterest has turned profitable, earning nearly $48 million during the first six months of the year. For now, Snap is only profitable on earnings before interest, taxes, depreciation, and amortization (EBITDA) basis, and its guidance did not point to overall profitability anytime soon.

When you look at the demographics of each app's users, the figures point to struggles in Snap's future. According to Omnicore, Snap's DAUs are strongest among users under age 25 and fall off significantly for older users. Among internet users between the ages of 36 and 45, only 18% have used Snapchat. That figure drops even further for those over age 45.

In contrast, Pinterest holds its appeal with older (and richer) demographics. Pinterest grew its following among millennials (ages 25 to 40) by 35% in 2020. Also, by the end of 2020, 45% of U.S. households earning more than $100,000 per year had a Pinterest user, according to the company.

Additionally, Pinterest reported an ARPU of $5.08 in the U.S. compared with just $0.36 internationally. This differential implies massive potential growth for international ARPU, increasing the likelihood that Pinterest closes the aforementioned gap with Snap on average revenue per user.

Snap and Pinterest in 2030

A lot could change for both Snap and Pinterest by 2030. Some new social media app could come along and make both of them also-rans in this particular business segment. But if both keep their business plans going, the data suggest that the present belongs to Snap while the advantage appears more likely to eventually turn in Pinterest's favor.

Pinterest's advantage in higher-income demographics offers a bigger opportunity for revenue growth and that could lead to better stock price increases over the next 8.5 years. Moreover, if Snap cannot improve its popularity among those over 35, its size advantage may completely disappear over the next nine years as the population (and millennials specifically) ages up.

10 stocks we like better than Pinterest

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Pinterest wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of August 9, 2021

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to its CEO, Mark Zuckerberg, is a member of The Motley Fool's board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Facebook and Pinterest. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.