To say that it has been an exceptional year for Palantir Technologies (NASDAQ: PLTR) would be a gross understatement. Heading into this trading week, the stock rallied by more than 320% since the start of the year.

The company has been added to the S&P 500 and now, with its move to the Nasdaq Stock Exchange complete, it's likely just a matter of time before it is added to an even more exclusive club -- the Nasdaq-100 index.

Palantir's business has been booming as artificial intelligence (AI) elevated the company's offerings, leading to a surge in demand, and multiple quarters of impressive results. But is this tech stock still a no-brainer buy heading into 2025?

Could Palantir's growth rate accelerate in 2025?

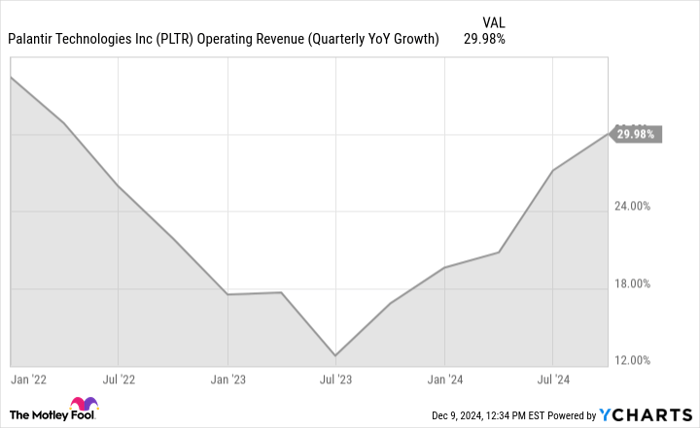

Investors have been bullish on Palantir's numbers this year as the data analytics company has been delivering much-improved results. In the third quarter, revenue rose by 30% year over year, to $726 million. That was the continuation of a promising trend for the business, with CEO Alex Karp referring to the AI-fueled demand as "unrelenting" and further claiming that it "won't slow down."

PLTR Operating Revenue (Quarterly YoY Growth) data by YCharts.

Now, with a Republican administration set to take over in Washington next year, it is possible the U.S. government will increase spending on defense and border security, so investors may be expecting even greater demand for Palantir's services in 2025. The company generates the majority of its revenue from government customers, as it offers services that aid with intelligence analysis and counterterrorism efforts.

But while Palantir's government revenue may increase, the commercial side of the business may face some headwinds.

Why it might not be smooth sailing for Palantir's business next year

Many businesses have been investing heavily in AI this year to get in on the hype and launch new AI-powered products and services. But amid that rush, some companies have taken on projects that may not prove to be all that worthwhile or profitable.

In a July report, research company Gartner predicted that by the end of next year, "[a]t least 30% of generative AI (GenAI) projects will be abandoned after proof of concept ... due to poor data quality, inadequate risk controls, escalating costs or unclear business value."

While Palantir's CEO may believe demand for the company's services isn't going to slow down, periods of excessive spending followed by sharp shifts away from it aren't unheard of in tech. Investors only need to think back a couple of years to when companies were investing heavily in the metaverse or expecting that pandemic-fueled levels of demand for various services would be the new norm. Instead, as economic conditions slowed, companies scaled back expenditures, and layoffs followed.

Assuming that demand simply won't slow can be a dangerous assumption for CEOs to make, and for investors to believe. AI could transform industries, but it's not about to take everyone's job tomorrow, either. And as companies adjust their understanding of what generative AI can and cannot do right now, there could be a significant adjustment in AI-related spending.

Palantir's valuation makes it vulnerable to a correction

Given how rapidly Palantir's stock price has soared, one big risk it faces is investors will sell their positions to lock in their gains. Currently, the stock trades at close to 400 times its trailing earnings. And while that ratio drops to 160 based on next year's expected earnings (according to analysts' consensus estimates), those are massive premiums to be paying for the business. A 30% growth rate is solid, but it's arguably not nearly enough to warrant such a lofty valuation.

Palantir's rally might continue, but with such massive gains already behind it in 2024, it appears unlikely that the stock will soar a whole lot higher next year -- and the possibility that it could suffer a steep decline is growing.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $359,936!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,730!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $492,745!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 9, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool recommends Gartner and Nasdaq. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.