Artificial intelligence (AI) has dominated Wall Street's attention since bursting onto the scene roughly two years ago. While Nvidia was arguably the hottest AI stock of 2023, Palantir Technologies (NYSE: PLTR) seems to have taken the lead in this year's race. The stock price has exploded, appreciating over 235% over the past year and roughly 900% since January 2023.

What sparked the price jump in 2024? It likely has to do with the company's Artificial Intelligence Platform (AIP), which is a smashing success and has helped ignite profitable and accelerating revenue growth.

Now, with Palantir at a $147 billion market cap, is it time for investors to think bigger? Could Palantir become a trillion-dollar company by 2030?

Here is what you need to know.

Palantir's technology is flexible enough to capture AI's widespread impact

It doesn't seem like a stretch to call AI one of the most significant advances in modern history. According to market research firm IDC, AI could create nearly $20 trillion in cumulative economic value by 2030. That's both directly and indirectly, meaning it's counting not just AI applications themselves but the value AI can create across other industries through increased productivity and efficiency.

Why is this important? It shows how diverse AI's impact can be, and that plays directly into Palantir's hands. Palantir creates and deploys custom AI, machine learning, and data analytics software. This software can do a countless number of jobs. Palantir got its start in government work, aiding in classified missions within the military. It helped roll out the COVID-19 vaccine during the pandemic. Today, it's helping hospital systems run efficiently and detecting financial fraud, among dozens of other applications.

Any organization large enough to have many moving parts (people, processes, and data) is a potential customer.

U.S. momentum drives Palantir's growth, and there's room to run

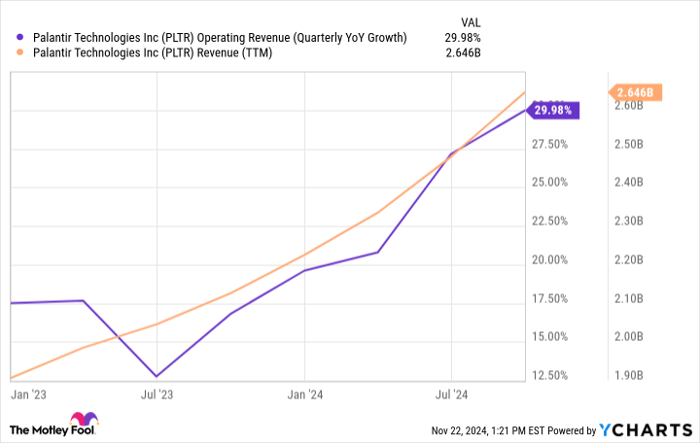

Palantir's total revenue grew 30% year over year in the third quarter, but its U.S. revenue grew 44%, driven by 40% growth in government business and 54% commercial growth. As U.S. revenue grows and makes up a more significant part of the total pie, it's accelerating the company's total top-line growth:

PLTR Operating Revenue (Quarterly YoY Growth) data by YCharts

Palantir has grown its U.S. commercial client base fivefold over the past three years and still, remarkably, has just 321 U.S. commercial customers. There are approximately 20,000 large companies (at least 500 employees) in the United States. That's a wide-open opportunity, even if Palantir ultimately works with just a fraction of them.

It's hard to predict how much more Palantir's growth will accelerate, but this growth story seems to be in its early chapters.

Can Palantir become a trillion-dollar company?

To become a $1 trillion company, Palantir must grow roughly sevenfold from its current size. Revenue growth, valuation, or both can achieve that.

First, let's project what Palantir's revenue might look like by 2030. Analysts estimate Palantir's 2024 revenue will come in at $2.8 billion. I'll extrapolate that out five years at hypothetical growth rates of 20%, 30%, and 40%. That would look like this:

| Annualized growth rate | Annual revenue ending Dec. 31, 2029 |

|---|---|

| 20% | $7.0 billion |

| 30% | $10.4 billion |

| 40% | $15.0 billion |

Table by author.

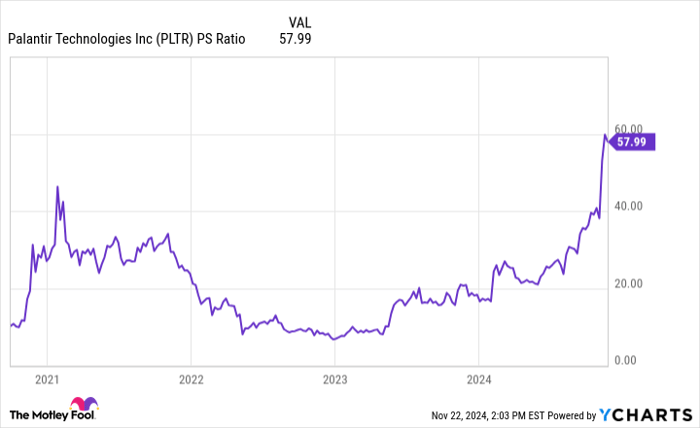

Palantir's stock must trade at some pretty high valuations to achieve a $1 trillion market cap on $7 billion to $15 billion in revenue. The stock's price-to-sales (P/S) ratio would need to be between 67 and 143 depending on whether Palantir's revenue hits the high or low end of these projections.

I'm not going to tell you it's impossible. Snowflake was one of the hottest stocks on Wall Street in late 2021 when the company's P/S ratio peaked at 183. However, that was during a stock market bubble. Snowflake is still down almost 60% from its former high, and its P/S ratio has collapsed by 90%. Such extreme valuations rarely end well.

Today, Palantir trades at a P/S ratio of 58. That's not 2021 Snowflake high, but it's even higher than its peak during that same market bubble!

PLTR PS Ratio data by YCharts

Technically speaking, Palantir can defy the odds, but I'd say it's doubtful the stock will approach a $1 trillion market cap by 2030. Palantir's a mighty impressive company, but the problem is that the stock is already baking in at least a few years' worth of growth. The math could dramatically change if the stock crashes to a much lower valuation or Palantir grows well beyond the 40% rate I projected.

But beyond those things, Palantir stock is arguably a bubble itself, which may eventually disappoint investors expecting more big things from the stock. Given all this, it's highly unlikely Palantir can hit a trillion-dollar valuation in just over five years. But the odds of it outpacing the market overall are still within reach and it's still worth a closer look.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $368,053!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,533!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $484,170!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 25, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia, Palantir Technologies, and Snowflake. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.