CrowdStrike Holdings, Inc. CRWD has had a rollercoaster year, with its stock swinging between extremes. After hitting a 52-week high on July 9, the stock plummeted to a 52-week low by Aug. 5, largely due to the fallout from a global IT outage on July 19 that affected millions of Microsoft Corporation MSFT Windows devices.

However, CrowdStrike has staged an impressive recovery, with shares surging 59% since Aug. 5. Year to date (YTD), the stock has risen 38.5%, outperforming the Zacks Computer and Technology sector and the S&P 500 index, which have jumped 33% and 28.1%, respectively.

YTD Price Return Performance

Image Source: Zacks Investment Research

The big question is whether CrowdStrike’s momentum is sustainable. Here’s why holding the stock for now might be the best strategy.

CrowdStrike’s Strong Recovery in Financial Performance

Despite setbacks earlier in the year, CrowdStrike’s third-quarter fiscal 2025 results demonstrate its resilience. Revenues surged 29% year over year to $1.01 billion, surpassing the Zacks Consensus Estimate by 2.8%. Non-GAAP earnings per share came in at 93 cents, up 13.4% from the prior year, and beat the consensus mark by 14.8%.

CrowdStrike’s annual recurring revenues (ARR) reached $4.02 billion, reflecting 27% year-over-year growth. This robust ARR underscores the sustained demand for CrowdStrike’s cybersecurity solutions, even in the face of extended sales cycles caused by the July IT outage.

CrowdStrike’s Innovation and Strategic Enhancements

CrowdStrike’s ability to innovate and adapt has been central to its recovery. Following the July IT incident, the company introduced advanced automated recovery techniques and enhancements to its Falcon platform. These updates bolstered visibility, quality assurance and overall platform security, reinforcing trust among its customers.

The Falcon platform, with its expansive range of more than 28 modules — including endpoint protection, identity security and next-gen SIEM — continues to drive diversification and growth. Cloud security, identity protection and LogScale SIEM businesses collectively exceeded $1 billion in ARR in the second quarter, growing at an impressive 85% year over year.

CrowdStrike’s proactive response to challenges and focus on innovation position it as a reliable cybersecurity partner for enterprises navigating an increasingly complex threat landscape.

CrowdStrike’s Market Leadership and Customer Retention

CrowdStrike’s reputation as a market leader remains intact, even in a competitive cybersecurity landscape. The company secured significant deals in the third quarter, including multiple eight-figure contracts, highlighting its strong sales pipeline.

Its “Falcon Flex” subscription model has been instrumental in driving customer retention. By enabling flexible adoption of security modules, Falcon Flex simplifies procurement processes and fosters long-term customer relationships, ensuring steady revenue growth.

Challenges to Watch for CrowdStrike

Despite its strengths, CrowdStrike faces near-term challenges. The aftermath of the July outage has extended sales cycles and shifted some deals into future quarters. While the company projects these issues will stabilize over the next year, they may weigh on net new ARR growth in the short term.

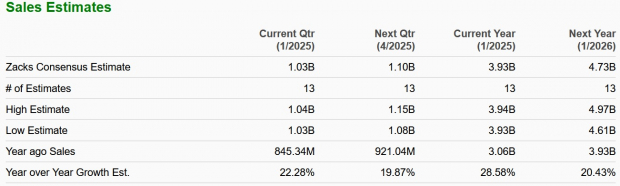

CrowdStrike’s growth rate has moderated compared to its pre-2023 highs. The Zacks Consensus Estimate projects revenue growth in the 20% range for fiscal 2025 and 2026, which implies a significant slowdown from the 50%-plus rates seen in previous fiscals.

Image Source: Zacks Investment Research

Legal risks related to the July incident and intensifying competition from peers like Palo Alto Networks, Inc. PANW and Fortinet, Inc. FTNT add another layer of uncertainty.

Valuation Concerns for CRWD Stock

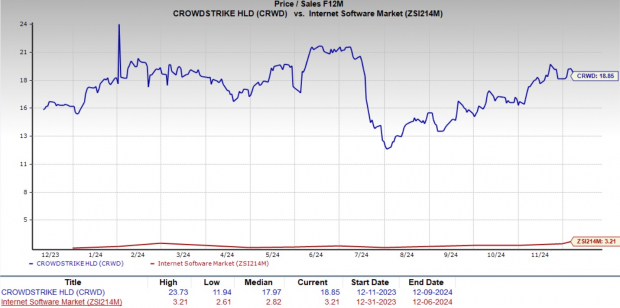

Valuation remains a critical factor for CrowdStrike. The stock trades at a lofty forward 12-month price-to-earnings (P/E) of 82.78X, significantly higher than the Zacks Internet – Software industry average of 37.91X. Similarly, its forward 12-month price-to-sales (P/S) ratio of 18.85 dwarfs the industry average of 3.21.

Image Source: Zacks Investment Research

Competitors like Palo Alto Networks and Fortinet offer more attractive valuations, with forward P/S ratios of 13.23 and 11.34, respectively. Talking about the forward 12-month P/E ratio, PANW trades at 58.49 multiple, while FTNT has 41.47. While CrowdStrike’s premium valuation reflects its leadership and growth potential, it also leaves the stock vulnerable to corrections if expectations aren’t met.

Conclusion: Hold CrowdStrike Stock for Now

CrowdStrike’s YTD performance highlights its resilience and strong market position. Its innovative strategies, robust customer relationships and diversified portfolio underscore its potential as a long-term player in the cybersecurity industry.

However, near-term challenges, including extended sales cycles, elevated valuations and slowing growth rates, suggest caution. For now, holding the stock appears to be the most prudent strategy, allowing investors to benefit from CrowdStrike’s long-term potential while navigating short-term uncertainties.

As the cybersecurity landscape continues to evolve, CrowdStrike’s leadership and adaptability make it a stock worth watching closely. CRWD carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2025

Want to be tipped off early to our 10 top picks for the entirety of 2025?

History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2025. Don’t miss your chance to get in on these stocks when they’re released on January 2.

Be First to New Top 10 Stocks >>Microsoft Corporation (MSFT) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.