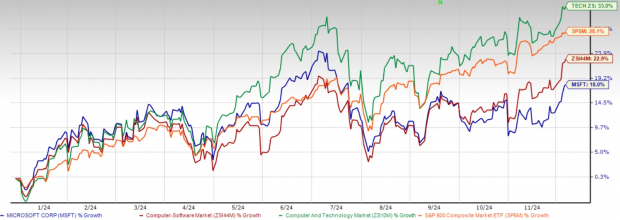

Microsoft's MSFT Azure cloud platform continues to demonstrate robust momentum, with revenues growing 33% in the latest quarter, including a significant 12-point contribution from AI services. The company's strategic positioning in the cloud infrastructure market, combined with its early mover advantage in AI integration, suggests continued strength in 2025. Azure's growth trajectory is particularly noteworthy as it took shares from competitors while doubling its OpenAI service usage over the past six months. However, investors should carefully weigh the current valuation against future growth prospects, given the stock's substantial 18% year-to-date (YTD) appreciation.

Year-to-date Performance

Image Source: Zacks Investment Research

Infrastructure Expansion and Competitive Edge

Amazon AMZN-owned Amazon Web Services, Alphabet GOOGL-owned Google Cloud and Microsoft Azure combined accounted for a whopping 67% of the global cloud services market in the second quarter of 2024, according to new data from IT market research firm Synergy.

Microsoft is aggressively expanding its cloud infrastructure, with data centers now operating in more than 60 regions globally. Recent announcements of new cloud and AI investments in Brazil, Italy, Mexico and Sweden demonstrate the company's commitment to meeting long-term demand signals. The introduction of Cobalt 100 VMs, offering up to 50% better price performance than previous generations, has attracted major enterprise customers like Databricks, Elastic and Snowflake. This technological advancement, coupled with the company's first-party accelerator Maia 100 and partnerships with AMD and NVIDIA, positions Azure strongly in the competitive cloud market.

AI Integration and Revenue Momentum

The company's AI business is approaching a significant milestone, expected to surpass $10 billion in annual revenue run rate next quarter, making it Microsoft's fastest-growing business segment historically. Notable enterprise adoption includes GE Aerospace's implementation of Azure OpenAI for 52,000 employees, resulting in more than 500,000 internal queries and 200,000 document processes in just three months. This rapid adoption suggests potential for sustained growth in 2025, particularly as more enterprises transition from testing to production environments.

Market Position and Future Outlook

Microsoft's outlook for 2025 appears promising, with management expecting Azure growth to accelerate in the second half of fiscal 2024 as capital investments create increased AI capacity. The company's strong position in enterprise AI, evidenced by nearly 70% of Fortune 500 companies using Microsoft 365 Copilot, indicates potential for sustained growth. The expansion of data and analytics services, including Azure Cosmos DB and Azure SQL DB Hyperscale, further strengthens the company's market position.

The Zacks Consensus Estimate for Microsoft’s fiscal 2025 revenues is pegged at $277.69 billion, which suggests 13.29% year-over-year growth. The consensus mark for earnings is pegged at $12.93 per share, which indicates a 9.58% year-over-year increase.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Image Source: Zacks Investment Research

Financial Considerations and Challenges

Despite the strong growth narrative, investors should consider several key factors. The company's cloud gross margin percentage decreased 2 points year over year to 71%, primarily due to AI infrastructure scaling costs. Capital expenditures, including finance leases, reached $20 billion, with approximately half allocated to long-lived assets supporting 15-year monetization horizons. The company also acknowledges capacity constraints in AI services, which could limit near-term growth potential.

Current stock prices may already reflect much of the near-term growth potential from Azure AI initiatives. Microsoft's current valuation presents a premium scenario, with its forward 12-month P/S ratio of 10.78X exceeding both the Zacks Computer - Software industry average of 7.93X and its own historical median of 10.15X. This elevated pricing reflects strong investor confidence in Microsoft's future growth, particularly in cloud computing and AI. However, it also raises questions about potential limitations and whether the company's performance can justify this premium in the long term.

MSFT’s P/S F12M Ratio Depicts Stretched Valuation

Image Source: Zacks Investment Research

Investment Recommendation

Given the current valuation levels and recent stock performance, investors might consider holding their existing positions rather than initiating new ones at current prices. While Microsoft's long-term growth prospects remain strong, supported by Azure's expanding capabilities and AI integration, the stock's significant YTD appreciation of 18% suggests limited near-term upside potential.

Several factors support a cautious approach: First, the substantial capital expenditure required for AI infrastructure expansion may pressure margins in the coming quarters. Second, while Azure's growth remains impressive, the company faces capacity constraints in AI services that could limit near-term growth potential. Third, the current valuation may already reflect much of the optimism surrounding Microsoft's AI initiatives and cloud growth.

Conclusion

Looking ahead to 2025, Microsoft's cloud strategy appears solid, with strong enterprise adoption and continued innovation in AI services. However, investors might benefit from waiting for a more attractive entry point, possibly during market pullbacks or when the company demonstrates successful execution of its AI infrastructure expansion plans. The key metrics to monitor include Azure's growth rate, AI service capacity expansion and margin trends as the company scales its infrastructure.

This balanced approach acknowledges Microsoft's strong market position and growth potential while recognizing that current valuations may already reflect much of the near-term optimism. Investors should closely monitor the company's execution in scaling AI capabilities and maintaining growth rates in its core cloud business before considering additional investment exposure. Microsoft currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we’re working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world’s nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy's Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.