Elevance Health Inc. ELV is currently aided by a well-performing Government business, thanks to increasing premiums and numerous contract wins. The pursuit of buyouts and a solid financial position are other tailwinds for the stock.

Zacks Rank & Price Rally

Elevance Health carries a Zacks Rank #3 (Hold) currently.

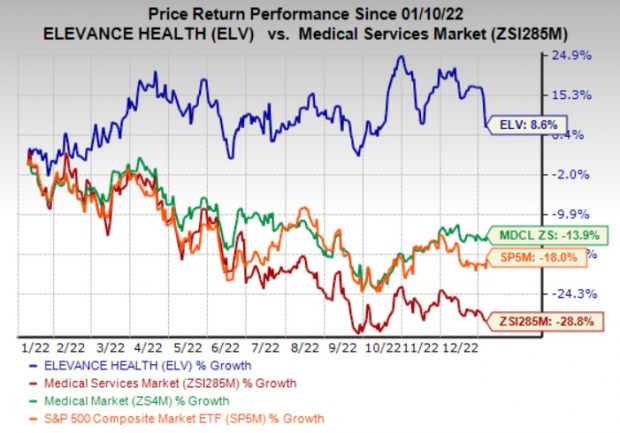

The stock has gained 8.6% in a year against the industry’s 28.8% decline. The Zacks Medical sector and the S&P 500 composite have declined 13.9% and 18%, respectively, in the said time frame.

Image Source: Zacks Investment Research

Favorable Style Score

ELV carries an impressive VGM Score of A. Here V stands for Value, G for Growth and M for Momentum, and the score is a weighted combination of all three factors.

Robust Prospects

The Zacks Consensus Estimate for Elevance Health’s 2023 earnings is pegged at $32.63 per share, indicating an 12.4% increase from the year-ago estimate. The same for revenues stands at $164.1 billion, implying 5.2% growth from the prior-year estimate.

Impressive Earnings Surprise History

ELV boasts an impressive surprise record. Its earnings outpaced estimates in each of the trailing four quarters, the average being 4.11%.

Solid Return on Equity

Elevance Health’s efficiency in utilizing shareholders’ funds can be substantiated by its trailing 12-month return on equity of 19.6% as of Sep 30, 2022, which remains higher than the industry’s average of 15.7%.

Business Tailwinds

Revenues of Elevance Health continue to benefit on the back of growing premiums within its Government business. Through this business, ELV distributes cost-effective Medicare and Medicaid plans and keeps upgrading these plans with lucrative features. This, in turn, has fetched several contract wins resulting in an extensive customer base for ELV.

An aging U.S. population is likely to sustain solid demand for the Medicare plans of Elevance Health. Its Medicare Advantage business is likely to register solid earnings growth this year, attributable to membership growth and improved operating margins. Strong pharmacy product revenue from ELV’s IngenioRx business also contributes to its top-line growth.

A series of acquisitions made over the years have expanded the business portfolio, diversified revenue streams and solidified the geographical footprint of Elevance Health.

A strong financial standing remains an additional tailwind for ELV. Not only does the healthcare provider boast a growing cash balance, but that also remains more than sufficient to cover its short-term debt obligations. Thereby, it can continue to service debt obligations and bring down the mounting interest expenses.

Elevance Health has robust cash-generating abilities in place through which it can undertake uninterrupted business investments and prudently deploy capital through share buybacks and dividend payments. ELV had a leftover capacity to repurchase shares worth around $2.4 billion remaining as of Sep 30, 2022. Its dividend yield of 1.1% remains higher than the industry’s 0.8% average.

Stocks to Consider

Some better-ranked stocks in the Medical space are Novo Nordisk A/S NVO, STAAR Surgical Company STAA and Intuitive Surgical, Inc. ISRG. While Nova Nordisk sports a Zacks Rank #1 (Strong Buy), STAAR Surgical and Intuitive Surgical carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Novo Nordisk’s earnings surpassed the Zacks Consensus Estimate in three of the last four quarters and missed the mark once, the average beat being 3.09%. The Zacks Consensus Estimate for NVO’s 2023 earnings suggests an improvement of 24%, while the same for revenues indicates growth of 14.2% from the respective year-ago estimates.

The Zacks Consensus Estimate for NVO’s 2023 earnings has moved 2.2% north in the past seven days. Shares of Novo Nordisk have gained 36.2% in a year.

STAAR Surgical’s earnings surpassed estimates in each of the last four quarters, the average being 61.05%. The Zacks Consensus Estimate for STAA’s 2023 earnings indicates a 16.9% rise, while the same for revenues suggests an improvement of 24.5% from the respective prior-year estimates.

The consensus mark for STAA’s 2023 earnings has moved 5.1% north in the past 60 days. Shares of STAAR Surgical have declined 24.1% in a year.

Intuitive Surgical’s earnings outpaced estimates in three of the trailing four quarters and missed the mark once, the average being 3.41%. The Zacks Consensus Estimate for ISRG’s 2023 earnings indicates a 13.7% rise, while the same for revenues suggests an improvement of 11.7% from the respective prior-year estimates.

The consensus mark for ISRG’s 2023 earnings has moved up 0.4% in the past 60 days. Shares of Intuitive Surgical have lost 17% in a year.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Novo Nordisk AS (NVO) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

STAAR Surgical Company (STAA) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.