Vistra Corp.’s VST ongoing transformation generation portfolio, expansion of the customer base, strong liquidity, share repurchase and dividend make it a solid choice for investment in the utility space.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment pick at the moment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Growth Projections and Surprise History

The Zacks Consensus Estimate for 2022 and 2023 earnings indicates year-over-year growth of 138.6% and 178.4%, respectively.

The Zacks Consensus Estimate for 2022 and 2023 earnings per share has moved up 1% and 3% in the past 30 days.

Vistra reported an average positive surprise of 127.1% in the last four reported quarters.

Return on Equity & Dividend Yield

Return on Equity (ROE) indicates how efficiently Vistra is utilizing shareholders’ funds to generate returns. At present, Vistra’s ROE is 27.24%, higher than the industry average of 10.38%.

Currently, it has a dividend yield of 3.44% compared with the Zacks S&P 500 composite’s 1.84%.

Emission Reduction & Investments

Vistra has been making systematic capital expenditures to boost its portfolio and announced plans to invest $1,814 million in 2022 to further strengthen its operation.

Vistra is targeting net-zero emissions by 2050 and is advancing its transformation via planned retirements of coal plants and investments in solar and batteries. The company, through the transformation of its generation assets, is expected to retire 8,000 MW of fossil-fueled power plants by 2027.

Liquidity & Share Repurchase Program

As of Aug 2, 2022, Vistra completed nearly $1.6 billion in share repurchases under its existing $2 billion share repurchase program. It has purchased $70.5 million shares since Nov 2, 2021, representing around 14.6% of the shares outstanding at that time. Taking into account the incremental $1.25 billion in authorization, at present, $1.65 billion remains available for execution under the program, which the company expects to execute by 2023-end. The ongoing repurchase of shares outstanding will definitely boost shareholders’ value.

As of Jun 30, 2022, Vistra had total available liquidity of nearly $3,439 million, including cash and cash equivalents of $1,871 million and $368 million of availability under its corporate revolving credit facility, which is enough to meet near-term obligations.

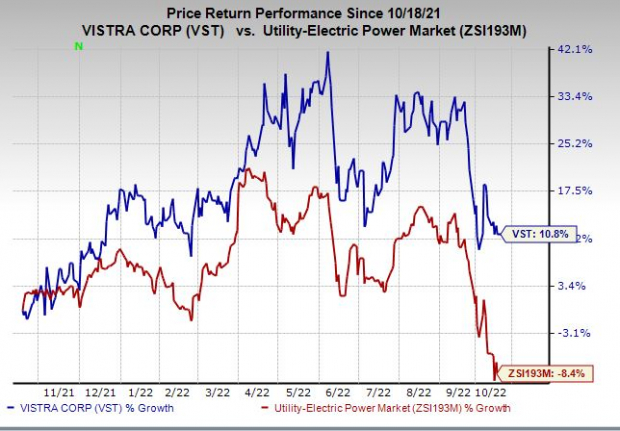

Price Performance

Over the past 12 months, Vistra’s shares have returned 10.8% against the industry’s 8.4% decline.

Image Source: Zacks Investment Research

Other Stocks to Consider

Other top-ranked stocks in the same sector include NextEra Energy NEE, Eversource Energy ES and DTE Energy DTE, each holding a Zacks Rank #2.

NextEra, Eversource Energy and DTE delivered an average earnings surprise of 5.5%, 1%, and 1.03%, respectively, in the last four quarters.

The Zacks Consensus Estimate for NextEra, Eversource Energy and DTE earnings per share in 2022 is up 13.3%, 6.5% and 0.7% respectively.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

DTE Energy Company (DTE): Free Stock Analysis Report

Eversource Energy (ES): Free Stock Analysis Report

Vistra Corp. (VST): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.