PGT Innovations, Inc. PGTI is poised to benefit from positive momentum of housing, and repair and remodeling activities amid the pandemic. Also, the company’s strategy of expanding footprint through acquisitions and enhanced cost management bodes well.

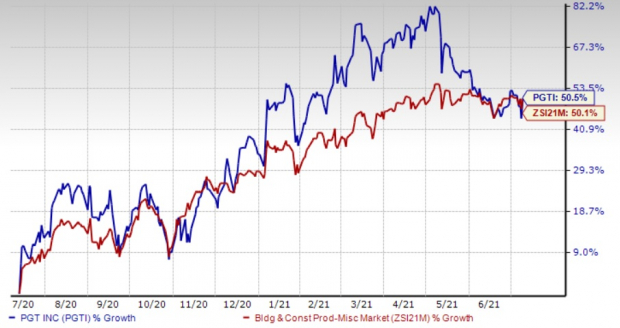

Over the past year, shares of PGT Innovations have gained 50.5%, almost in line with the Zacks Building Products - Miscellaneous industry’s 50.1% rally.

Analysts are optimistic about PGT Innovations’ near-term prospects, as is evident from the recent estimate revision trend. Earnings estimates have risen in the past few weeks, suggesting bullish sentiments surrounding the stock. The Zacks Consensus Estimate for 2021 earnings has increased 11.1% and the same for 2022 has risen 13.7% over the past 60 days. This bullish trend justifies the Zacks Rank #1 (Strong Buy) stock’s retention in investors’ portfolio. You can see the complete list of today’s Zacks #1 Rank stocks here.

Image Source: Zacks Investment Research

What Makes the Stock a Solid Pick?

Eco Window Acquisition: PGT Innovations follows a systematic inorganic strategy for expansions and diversifications. It has wrapped up various bolt-on acquisitions that contributed significantly to growth, with the recent one being Eco Window Systems. In February 2021, PGT Innovations acquired a 75% ownership stake in Eco Window Systems and its related companies. With this acquisition, PGT Innovations further enhanced its strategy of expanding and diversifying product lines with strong brands.

Eco is a leading manufacturer and installer of aluminum, impact-resistant windows and doors serving the South Florida region. Hence, this acquisition will not only help PGT innovations to diversify and expand product lines in the high-growth commercial market, but also result in vertically integrated manufacturing capabilities, which strengthen PGT Innovations’ supply chain for glass and enable faster production.

Superior ROE: Return on equity (ROE) supports growth potential. The company’s ROE of 12.1% compares favorably with the industry’s average of 10.5%, implying that it is efficient in using shareholders’ funds.

Solid Growth Rate: PGT Innovations has solid prospects, as is evident from the Zacks Consensus Estimate for earnings of $1.30 per share for the current year, indicating 34% year-over-year growth. Meanwhile, the company’s sales are expected to increase 26.4% for the current year.

Positive Momentum of Repair/Remodel (R&R) Activity: Robust U.S. housing market fundamentals and R&R activities have been benefiting PGT Innovations and companies like Masco MAS, Armstrong World Industries, Inc. AWI, and Beacon Roofing Supply, Inc. BECN. Housing markets have been showing resilience of late, given Fed’s dovish stance, low borrowing costs and lack of available supply. With the opening of the economy and increasing trend of consumers to invest more in homes amid the pandemic, demand for housing and building material products has been improving. Apart from remarkable recovery in single-family housing construction, repair/remodel activity also has been robust, supported by do-it-yourself and professional activity.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Masco Corporation (MAS): Free Stock Analysis Report

Beacon Roofing Supply, Inc. (BECN): Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI): Free Stock Analysis Report

PGT, Inc. (PGTI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.