Kronos Worldwide, Inc.’s KRO stock looks promising at the moment. It is benefiting from higher demand and selling prices of titanium dioxide (TiO2).

We are positive on the company’s prospects and believe that the time is right for you to add the stock to portfolio as it looks promising and is poised to carry the momentum ahead.

Kronos Worldwide has a Zacks Rank #2 (Buy) and a VGM Score of A. Our research shows that stocks with a VGM Score of A or B, combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities for investors.

Let’s take a look into the factors that make Kronos Worldwide an attractive choice for investors right now.

An Outperformer

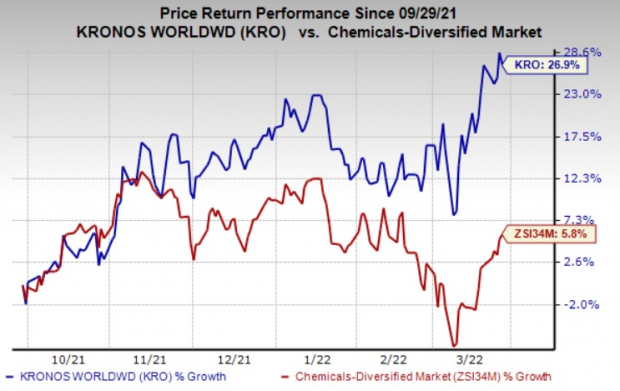

Shares of Kronos Worldwide have popped 26.9% over the past six months against the 5.8% rise of its industry. It has also outperformed the S&P 500’s roughly 2.3% rise over the same period.

Image Source: Zacks Investment Research

Estimates Going Up

Earnings estimate revisions have the greatest impact on stock prices. Over the past two months, the Zacks Consensus Estimate for Kronos Worldwide for 2022 has increased around 2.4%. The consensus estimate for 2023 has also been revised 0.7% upward over the same time frame.

Healthy Growth Prospects

The Zacks Consensus Estimate for earnings for 2022 for Kronos Worldwide is currently pegged at $1.28, reflecting an expected year-over-year growth of 30.6%. Earnings are also expected to register a 6.3% growth in 2023.

Upbeat Prospects

Kronos Worldwide is poised to benefit from higher demand for TiO2. The company sees demand to grow 2-3% annually over the long term. Higher demand in European and North American markets are likely to drive its TiO2 sales volumes. New product development, a solid customer base and effective marketing strategies are also working in the company’s favor.

The company is also gaining from an uptick in selling prices. Its average TiO2 selling prices rose 17% on a year-over-year basis in the fourth quarter of 2021. The company is expected to continue to benefit from higher TiO2 selling prices in the first quarter of 2022 on strong consumer demand.

Kronos Worldwide, on its fourth-quarter call, said that it expects global demand for consumer products to remain strong throughout 2022. TiO2 selling prices are projected to increase this year as a result of higher costs and strong demand. Kronos Worldwide also expects its sales and income from operations for 2022 to be higher on a year-over-year basis.

Kronos Worldwide Inc Price and Consensus

Kronos Worldwide Inc price-consensus-chart | Kronos Worldwide Inc Quote

Stocks to Consider

Other top-ranked stocks worth considering in the basic materials space include The Mosaic Company MOS, AdvanSix Inc. ASIX and Commercial Metals Company CMC.

Mosaic, sporting a Zacks Rank #1, has a projected earnings growth rate of 125% for the current year. The Zacks Consensus Estimate for MOS's current-year earnings has been revised 29.2% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Mosaic beat the Zacks Consensus Estimate for earnings in three of the last four quarters, while missed once. It has a trailing four-quarter earnings surprise of roughly 3.7%, on average. MOS has rallied around 96% in a year.

AdvanSix, carrying a Zacks Rank #1, has an expected earnings growth rate of 64.9% for the current year. ASIX's consensus estimate for current-year earnings has been revised 53% upward in the past 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 46.9%. ASIX has rallied around 36% in a year.

Commercial Metals, carrying a Zacks Rank #1, has a projected earnings growth rate of 114.7% for the current fiscal year. The Zacks Consensus Estimate for CMC's current fiscal year earnings has been revised 35.1% upward over the past 60 days.

Commercial Metals beat the Zacks Consensus Estimate for earnings in three of the last four quarters while missed once. It has a trailing four-quarter earnings surprise of roughly 13.7%, on average. CMC has gained around 40% in a year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Mosaic Company (MOS): Free Stock Analysis Report

Commercial Metals Company (CMC): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

AdvanSix (ASIX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.