Why Trade Sizes and Stock Prices Matter

In the U.S., most stocks trade with the same trading rules—the same one-cent tick, the same 100-share round lot, the same price improvement calculation versus NBBO.

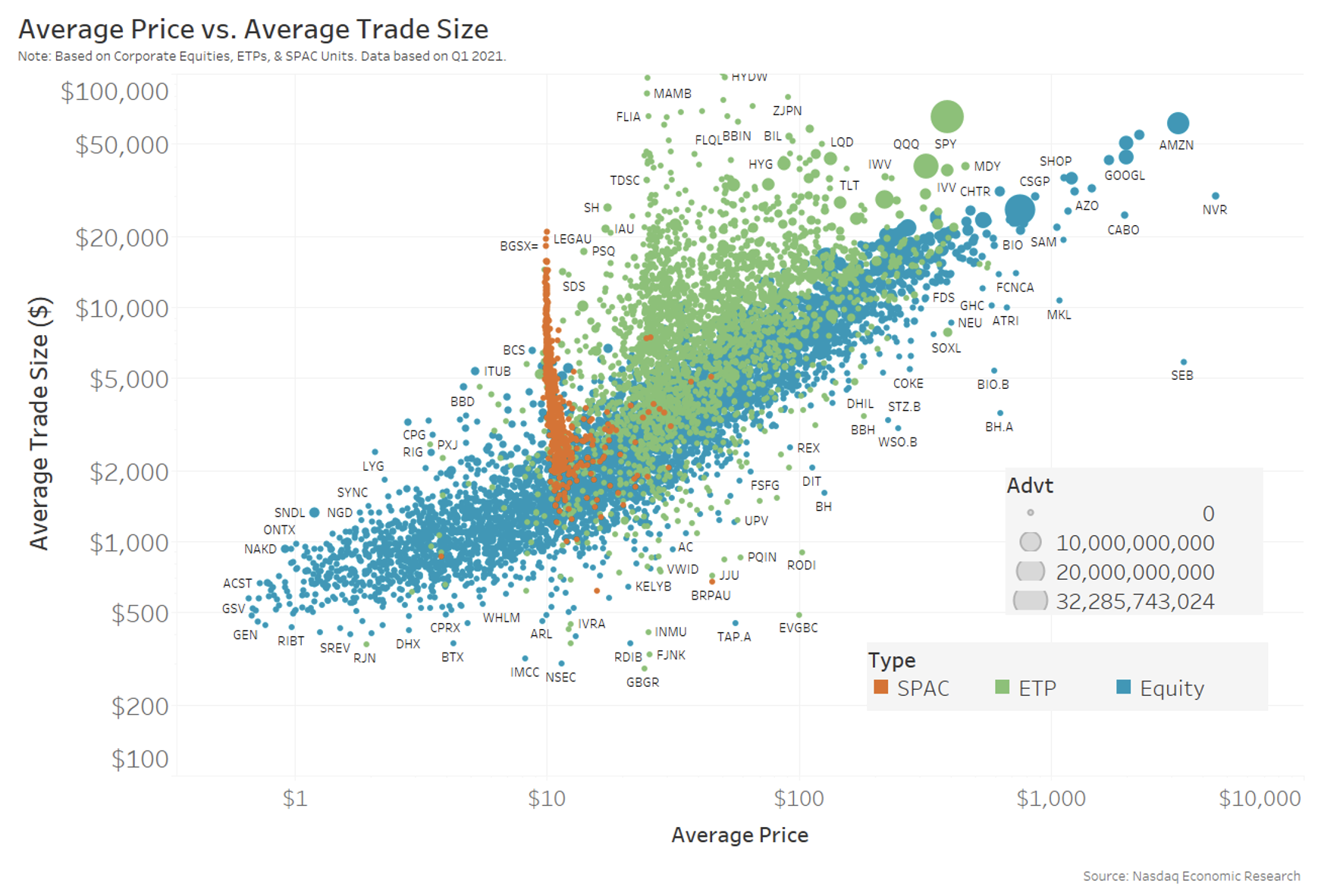

But as today’s charts show, stock prices and trade sizes vary significantly across corporates, exchange-traded products (ETPs) and special purpose acquisition companies (SPACs).

These differences are important to recognize, as they have implications for applying “one-size-fits-all” rules to a not-so-uniform marketplace.

Stock prices and trade sizes vary greatly (for corporates)

We know from previous studies that stock prices can vary greatly across tickers, with very high and very low stock prices often resulting in stocks trading sub-optimally.

Data shows the dispersion of prices is much bigger for corporates than ETFs or SPACs (Chart 1). In fact:

- SPACs are almost all priced near $10 (orange dots). Recall that SPAC units generally list at around $10 and represent cash in trust until major announcements cause prices to move.

- ETFs are also mostly concentrated in the $25 to $50 range (green dots). We’ve shown that to be a “sweet spot” for trading, where one tick represents around two to five basis points (bps). As we wrote before, that spread is cheap enough to cross, wide enough to encourage spread capture and competitive NBBO. Very few ETFs are priced below $25 or above $150. Clearly, ETF providers have made a conscious effort to ensure their products are easy and cheap to trade.

- Corporate equities, in contrast, have the broadest range of stock prices (blue dots). Notably, only 26% of corporate equities trade between $10 and $25, where liquidity would mostly lead to one- to two-cent spreads. There are still around 43 tickers with extremely high prices of more than $500.

The data also shows that most liquid stocks (largest circles) have the largest average trade size (higher dots).

The diagonal shape for corporates (blue dots) also shows that stock price drives average trade size, probably thanks to the way round lot rules affect trading.

Chart 1: Stock prices and average trade sizes are different for different stocks

Stock prices vary across corporates market cap too

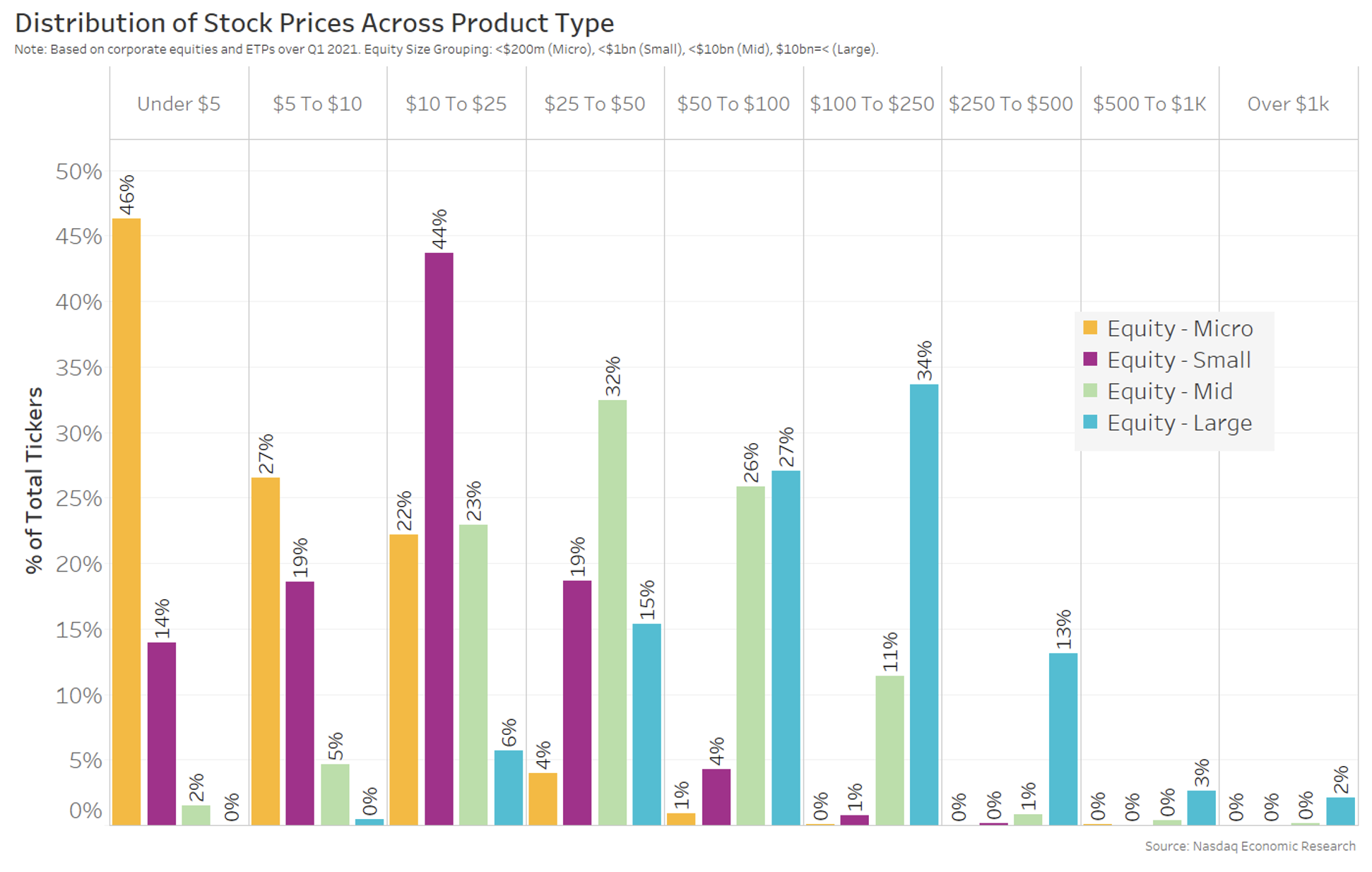

Given the range of corporate stock prices and trade sizes, it’s worth looking at them in more detail.

Grouping corporates by market cap, we see that high-priced stocks are mostly large-cap companies (light blue bars skew right) which we define here as over $10 billion in market capitalization. Most companies fall into our $100-$250 grouping, which results in a very small tick (in basis-points) and increase odd lot trading and quoting.

In contrast, the lowest-priced names are typically the smallest market caps (yellow bars skew left) which we define as market cap under $200 million. And almost half of all those tickers are priced below $5, giving them a relatively wide tick.

We see the trend continue for market caps in between, too. The most common stock price for small cap (purple) is between $10-$25, while mid-cap stocks (green) most common price is in the $25-$50 group.

Chart 2: Stock prices by market cap: small stocks have small prices (and vice versa)

The fact that smaller stocks have smaller prices means you need to trade more shares to invest the same value. That explains the difference in market shares we saw recently (although our market cap groupings here are different).

Trade sizes differ across products

We recently discussed that the average trade size for most stocks is around $10,000. We also found that the average trade size for retail is less than $8,000. But we see in Chart 1 that trade sizes are quite different from corporate stock prices.

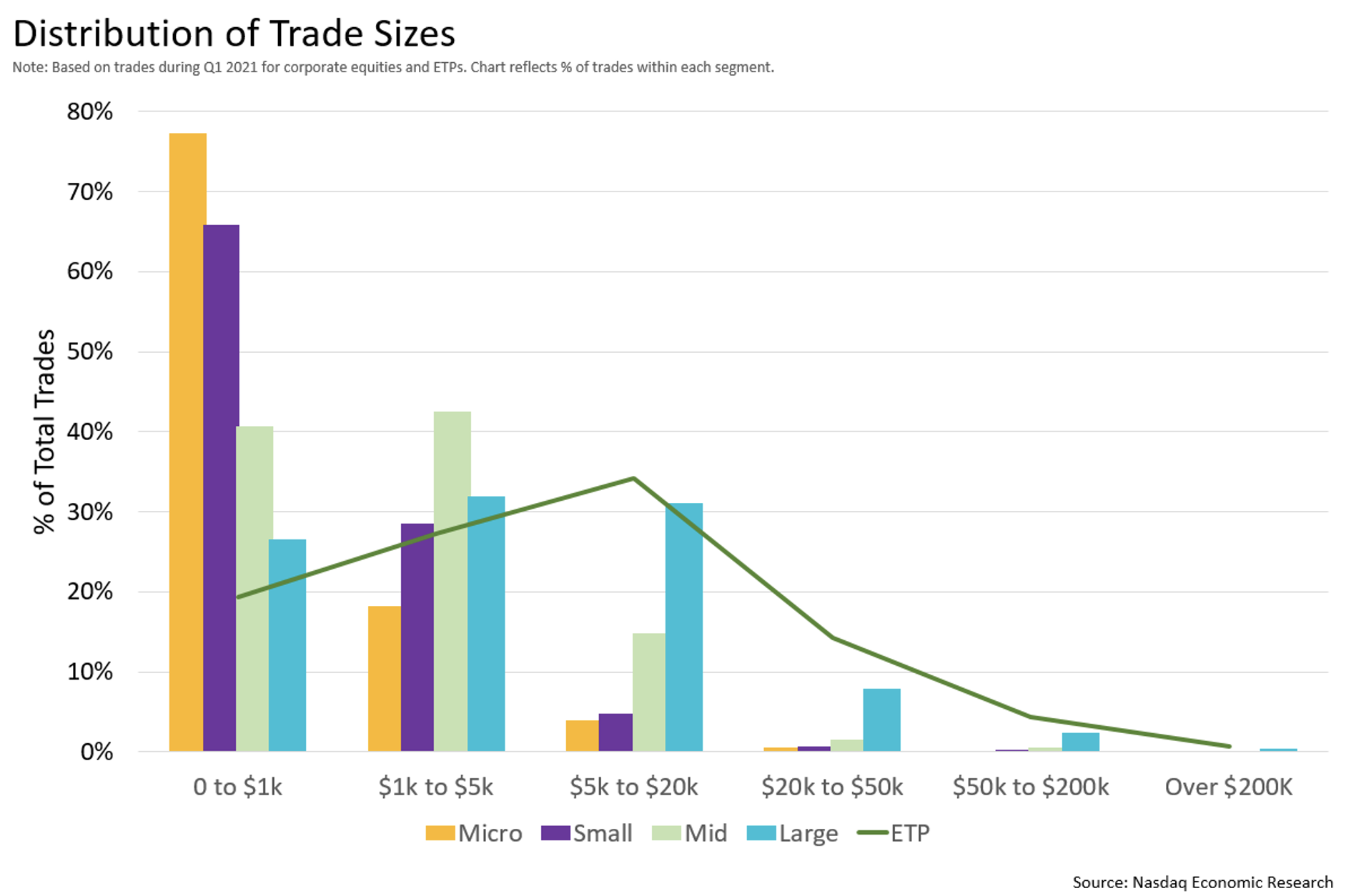

The chart below shows that:

- Nearly 75% of corporate equities trades were for less than $5,000, with more than 75% of microcap trades being less than $1000.

- Only around 0.18% of trades were for ‘block trade’ size ($200,000), although being large trades, they account for more shares and value than that.

- ETPs generally have larger trade sizes and are more than three times as likely to trade in block size.

In the context of a recent note looking at depth of book, we saw that just 7% of trades were for more than $20,000 (compared to 19% for ETPs only).

Chart 3: Trade sizes by market cap and security type

We also looked at the average trade size on a per-symbol basis and saw that over 75% of corporate equities have trade sizes less than $5,000, with an average aggregate trade size of roughly $7,000. In contrast, ETPs in aggregate had an average trade size of $18,000.

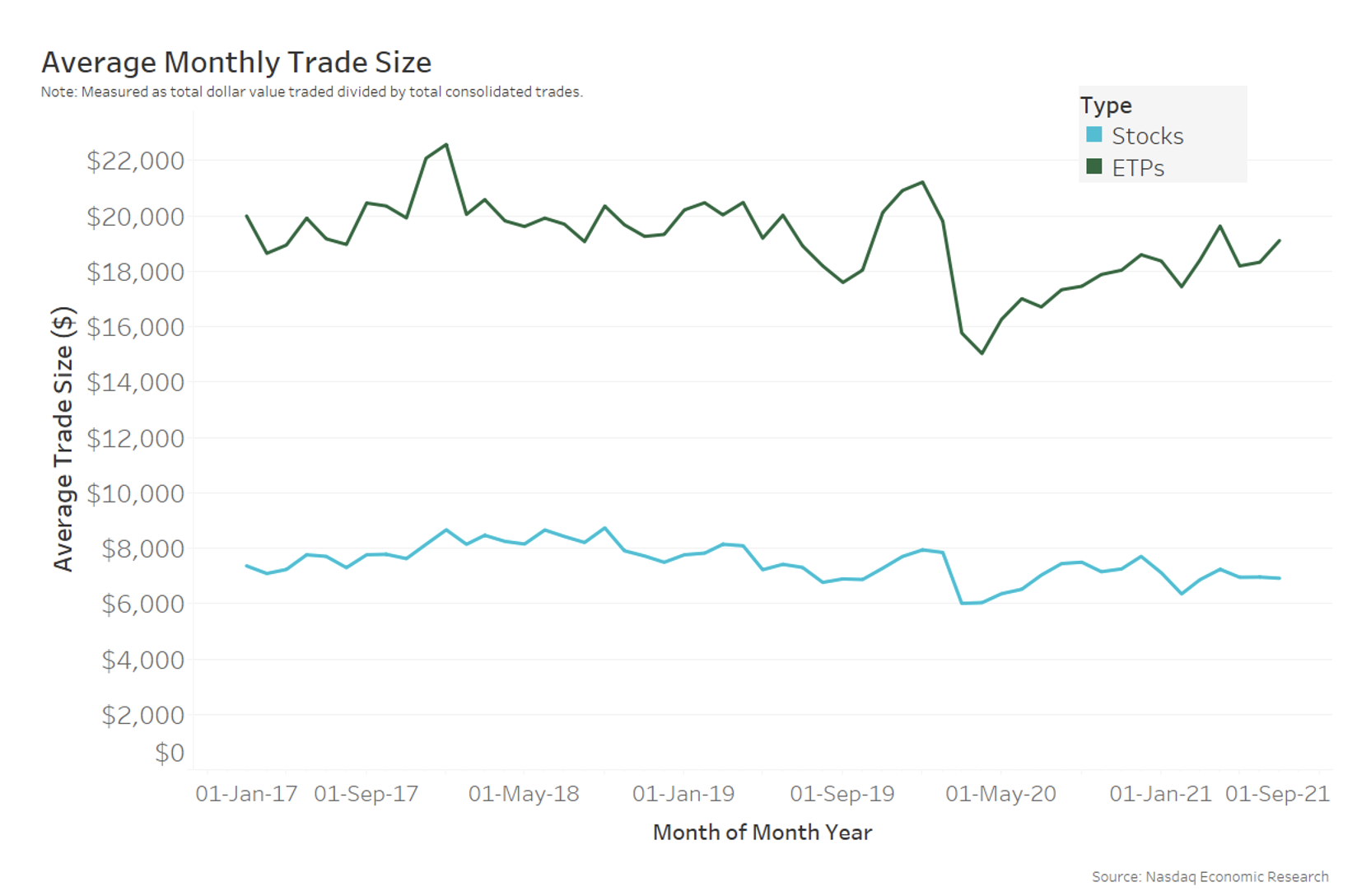

Trade sizes have changed little even as stock prices have climbed

Given the drop in stock splits and the rise of average stock prices, as well as the link between higher stock prices and higher average trade sizes, you might expect that average trade sizes have been rising.

Surprisingly, the opposite has happened. The average trade size has actually fallen slightly over time.

Chart 4: Trade sizes by security type

What’s the point of this analysis?

It’s easy to think all stocks trade the same. However, even a simple look at different securities and corporates across market capitalizations shows stocks trade very differently. It’s one reason ADV and notional trading market shares are so different.

It’s also interesting to see how ETF issuers are much more focused on “right pricing” most of their products to maximize tradability and minimize costs for investors, while most corporate stock prices climb ever higher even as trade sizes continue to shrink. No wonder we have so many more odd lots.

Robert Jankiewicz, Research Specialist for Economic and Statistical Research at Nasdaq, contributed to this article.