Stating the obvious: no one enjoys watching their portfolio balance decline. And advisors know all too well how clients can feel uneasy about “staying the course” as their nest eggs get smaller in periods of volatility.

However, rushing for the exit when the market goes south can actually stunt long-term portfolio growth. “Timing the market”—ideally buying at lows and selling at the highs—can be incredibly difficult and lead to unintended outcomes. Good timing on entries and exits might help you avoid some losses, but it could also cause you to miss the market’s best days.

That’s why we put together our latest resource, The Top 10 Visuals for Clients & Prospects. This free slide deck is filled with informative visuals that illustrate concepts which often come up in many client and prospect conversations, including why “time in the market” is more important than “timing the market”.

The Effect of Missing the Market’s Best Days

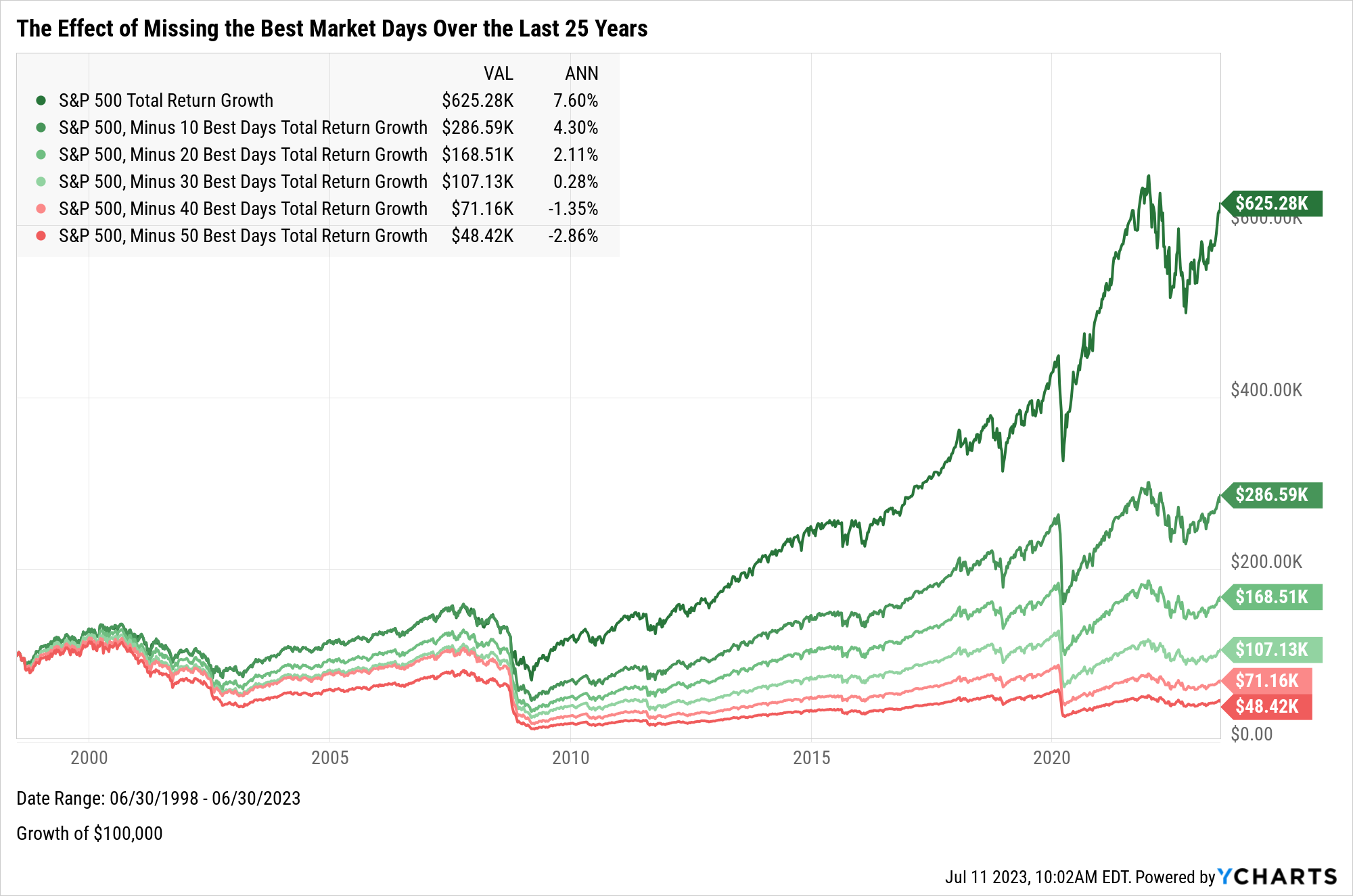

The 25-year period between July 1998 and June 2023 consisted of around 6,200 trading days. Being uninvested for just the best 10 days of that stretch would have significantly diminished long-term total returns.

Using an all-stock S&P 500 portfolio as an example, moving to cash for each of the 10 best days in the last 25 years resulted in an annualized total return that was 3.3 points lower versus simply remaining invested in the market. In other words, a portfolio that missed the 10 best days since July 1998 would be worth less than half of one that remained fully invested through Q2 2023.

Notably, missing the 40 best days in the last 25 years span actually resulted in a negative return.

Download: The Top 10 Visuals for Clients and Prospects

When Were the Best Market Days in the Last 25 Years?

The S&P 500 index saw single-day gains of 5% or more in 19 of its 20 best days over the last 25 years. More importantly, the market’s best days often occurred during periods of volatility. Despite the large declines resulting from the Dot-Com Bubble, Great Financial Crisis, and the COVID-19 pandemic, these events also produced the market’s best days.

It’s never fun swimming in a sea of red. But when the tides of the market turn, they often do so quickly but vigorously. Attempting to time the market during these periods might have meant missing out on its best days, resulting in diminished long-term returns.

Download: The Top 10 Visuals for Clients and Prospects

This article was originally published on YCharts.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.