What happened

Shares of Yandex (NASDAQ: YNDX), MicroStrategy (NASDAQ: MSTR), Blackbaud (NASDAQ: BLKB), and Yelp (NYSE: YELP) tumbled on Thursday as the U.S. stock market logged its worst day in decades. Escalating fears surrounding the novel coronavirus pandemic and the associated economic impact pushed the S&P 500 down around 9.5%.

There was no company-specific news for these four software and internet stocks. When the selling is this intense, nearly every stock gets hit. Here's how they fared on Thursday:

|

Stock |

% Change |

|---|---|

|

Yandex |

(10.5%) |

|

MicroStrategy |

(12.6%) |

|

Blackbaud |

(10.7%) |

|

Yelp |

(10.6%) |

Data source: Yahoo! Finance.

So what

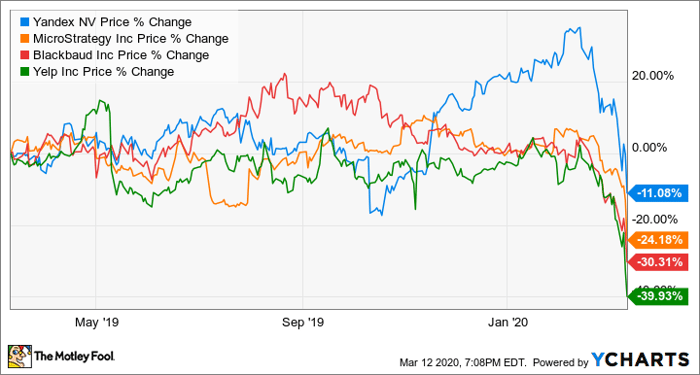

With Thursday's plunge, all four stocks are now down substantially over the past year.

While shares of Russian Internet company Yandex are down the least over the past year, they've fallen hard since peaking a few weeks ago. The stock is down about 34% from its 52-week high. In addition to the panic over the novel coronavirus pandemic, the drama in the oil markets involving Russia could be weighing on the stock.

MicroStrategy gave investors some good news back in January when it handily beat analyst estimates with its fourth-quarter report. The company reported revenue of $133.5 million and earnings per share of $1.18, beating expectations by $2.54 million and $0.35, respectively. However, revenue barely grew, as subscription growth was partially offset by a decline in product license revenue.

Cloud software company Blackbaud posted solid results of its own in February, beating analyst estimates across the board. Revenue was up 7.5% to $237.8 million, and adjusted earnings per share (EPS) were $0.51. Revenue beat expectations by $5.7 million, and EPS beat by $0.01. Of course, none of that matters when the market is in panic mode.

Yelp hasn't been doing as well, missing expectations when it reported in February. Yelp reported 10% revenue growth, but a larger-than-expected seasonal reduction by small- and medium-sized business customers knocked down the growth rate. EPS were $0.24, down from $0.37 in the prior-year period.

Yelp may be in deep trouble if the pandemic leads to a severe decline in consumer activity in the U.S. Its business customers won't have much reason to advertise, and some could be forced to shut down as demand falls off a cliff.

Yelp guided for 2020 revenue growth between 10% and 12%, but hitting that range looks unlikely given the current situation.

Image source: Getty Images.

Now what

The novel coronavirus pandemic is going to affect nearly every company to some degree. There's a tremendous amount of uncertainty, and that uncertainty is manifesting itself as a severe stock market sell-off.

If you're a long-term investor in a company you believe will have no trouble surviving this crisis and thriving after the dust has settled, prices are as low as they've been in a long time. How these four software and internet stocks fare in the short term is anyone's guess. In the long term, the stock performance will depend on how the business itself performs.

10 stocks we like better than Yelp

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and Yelp wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of December 1, 2019

Timothy Green has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Yandex. The Motley Fool recommends Blackbaud, MicroStrategy, and Yelp. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.