What happened

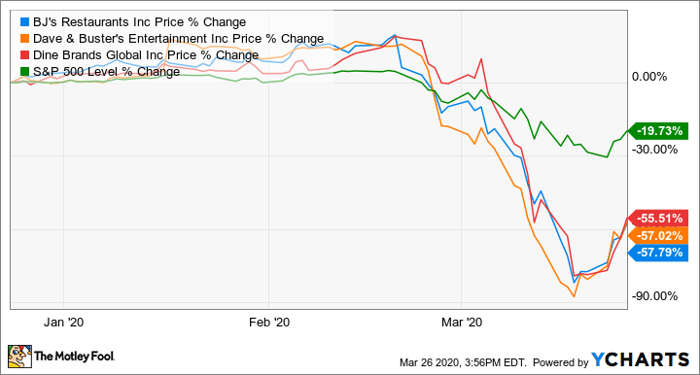

Shares of BJ's Restaurants (NASDAQ: BJRI), Dave & Buster's Entertainment (NASDAQ: PLAY), and Dine Brands Global (NYSE: DIN), are up 15%, 19%, and 22% respectively on Thursday afternoon, after the $2 trillion coronavirus relief package cleared the U.S. Senate and was passed on to the House.

So what

The S&P 500 and Dow Jones Industrial Average surged 5% and 4.7% Thursday afternoon, respectively, despite a historic spike in unemployment claims. New claims exploded to a record 3.283 million, a figure much higher than expected, and even above levels seen after the 2008 financial crisis.

But the markets' surge today, despite those frightening figures, emphasizes that many believe the economy will be able to snap back after the virus is under control. The gains also show that sometimes Wall Street prefers to have concrete numbers and data, rather than uncertainty, even when the numbers are brutal.

While the relief package seems promising, there's no question the restaurant industry has been one of the hardest-hit industries. Between some restaurant chains closing their doors, some going to carryout or delivery only, and the overall uncertainty of how long social distancing will be required, restaurant stocks have plunged. In fact, data from OpenTable shows that the year-over-year number of seated diners crashed 35% for March 13, and the trend is likely to get much worse with new data.

Image source: Getty Images.

Thursday brought some relief with the previously mentioned companies' double-digit bounces, but the truth is that many restaurants will need help, or decisive actions, to get through this:

- Dave & Buster's lost food, gaming, and liquor sales all in one swoop, and it's not well-equipped to offset those losses with drive-through or delivery.

- BJ's Restaurants took action by suspending future quarterly dividends until the COVID-19 crisis and its economic impact have passed, but will that prove to be enough additional liquidity?

- Dine Brands announced it had drawn $223 million of its total $225 million available under its revolving financing facility.

Now what

The harsh truth is that the restaurant industry is wildly competitive, and many restaurants aren't prepared to handle an environment in which revenue goes to zero -- some restaurants aren't prepared for even a sizable drop or slowdown.

While restaurant stocks have rebounded on the hope of aid, and a possible faster snapback in economic activity once the outbreak passes, investors should take the gains with a grain of salt. If you're looking for bargains, you must do your due diligence: Dig into financials and see whether a restaurant chain has a strong enough balance sheet to weather the storm. Broader markets will almost certainly rebound from COVID-19 and its impacts, but not all stocks will, so invest wisely.

10 stocks we like better than Dine Brands Global

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and Dine Brands Global wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of March 18, 2020

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool recommends BJ's Restaurants and Dave & Buster's Entertainment. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.