Shares of Target (NYSE: TGT) were sliding last month, as a broader recovery in the stock market wasn't enough to overcome another disappointing earnings report from the retail giant.

Target missed estimates on the top and bottom lines and cut its guidance. It's still struggling with weak consumer discretionary spending and challenges with inventory management.

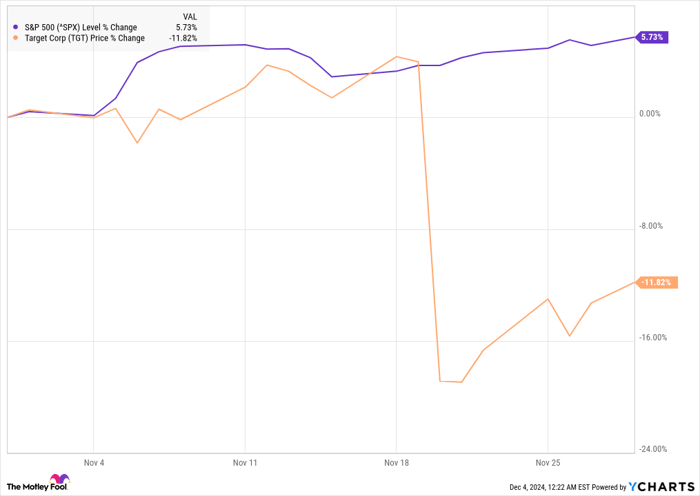

According to data from S&P Global Market Intelligence, the stock finished the month down 12%. Target was trading similarly to the S&P 500 for most of the month before plunging on its earnings report.

Target's troubles continue

Target has struggled to find its groove after its pandemic-driven boom ended, and that pattern continued in its third-quarter earnings report.

Comparable sales in the quarter rose just 0.3%, lagging behind competitors such as Walmart. The company saw guest traffic rise 2.4% but it struggled to convert that into revenue growth.

Inventory rose, which weighed on margins, and the company also spent more on selling, general, and administrative expenses. As a result, adjusted earnings per share fell 12% to $1.85. Target said it stocked up on merchandise to avoid any delays from the port strike, which should be a one-time issue.

Target missed estimates on both the top and bottom lines and cut its guidance. It now sees adjusted earnings per share of $8.30-$8.90, down from its prior range of $9.00-$9.70.

Investors are understandably disappointed, and several Wall Street analysts downgraded the stock on the results. Later in the month, The Wall Street Journal reported that customers are growing increasingly frustrated with the retailer, complaining about missing items, long lines, and overpriced groceries.

Image source: Target.

Can Target bounce back?

Target is one of only a handful of multicategory retailers, along with Walmart and Costco, which gives the business some protection. But it still needs to execute, and it seems quite clear that the company needs to improve the nuts and bolts of its business.

Looking ahead, consumer spending is expected to improve as interest rates come down, though tariffs under a Trump administration could also pose some challenges.

The company's guidance for the fourth quarter was also disappointing, calling for just flat comparable sales growth.

The good news is that Target stock is cheap enough, at a price-to-earnings ratio of 15, that it would soar if it returns to steady growth. But that isn't a given right now. At this point, the company's struggles have gone on too long for it to blame macro headwinds alone.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $359,445!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $45,374!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $484,143!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 2, 2024

Jeremy Bowman has positions in Target. The Motley Fool recommends Costco Wholesale, Target, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.