What happened

Shares of mobile-gaming platform company Skillz (NYSE: SKLZ) plunged on Wednesday, possibly due to some confusion regarding the redemption of the company's warrants. However, a lot of other stocks were also down sharply during the session, so perhaps the majority of Skillz's plunge was just due to general market volatility. Either way, the stock closed 14% lower.

So what

According to a filing with the Securities and Exchange Commission Tuesday, Skillz appeared to be redeeming its public warrants. However, the filing was a mistake. According to a new filing with the SEC Wednesday, Skillz described the prior filing as "the result of human error by the financial printer." For the record, a financial printer is a company that helps with documents as private companies transition into the public markets.

Image source: Getty Images.

Skillz went public via a special purpose acquisition company (SPAC) in 2020. A SPAC will sell units in an initial public offering (IPO) consisting of common shares and warrants. For Skillz, there are over 17 million public warrants from the IPO that the company could exercise when the stock price is over $18 per share -- which, of course, it is. Those holding warrants would be entitled to buy common shares of Skillz stock for $11.50 per share. This would mean more cash for the company (up to around $200 million), but it would also add to Skillz's growing share count.

At the time of Skillz's fourth-quarter report, there were almost 428 million fully diluted shares of Skillz stock. Since then, the company announced it's selling 17 million more shares. The stock fell when this news was first announced.

Now what

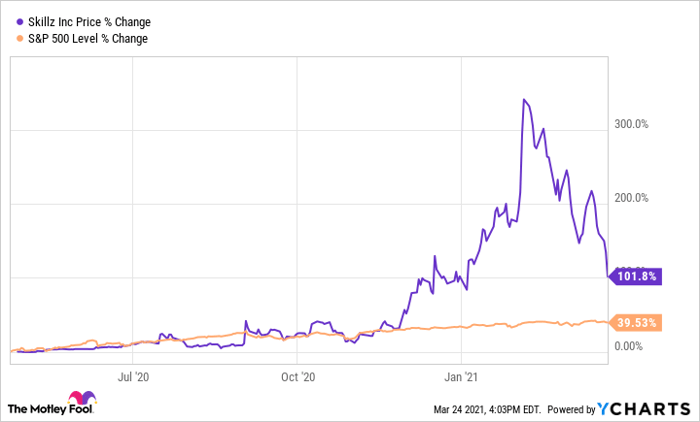

Skillz stock is now down over 50% from highs reached earlier this year. But even after this tumble, it still trades at over $18 per share. Therefore, even though today isn't the day, investors can expect the company to exercise its warrants soon. But when the announcement eventually comes, nothing really changes for shareholders. After all, the impact of those public warrants is already factored into the fully diluted share count. Therefore, this doesn't impact the question of whether this stock is a buy or not.

However, if you hold public warrants for Skillz stock, you need to pay attention. When the company exercises its redemption option, you'll have a brief window to use your warrants. If you don't purchase shares within the window, you'll forfeit your warrants forever. This has already happened to some investors with other SPACs -- their warrants expired and became worthless because they weren't paying attention.

Find out why Skillz Inc. is one of the 10 best stocks to buy now

Motley Fool co-founders Tom and David Gardner have spent more than a decade beating the market. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

Tom and David just revealed their ten top stock picks for investors to buy right now. Skillz Inc. is on the list -- but there are nine others you may be overlooking.

Click here to get access to the full list!

*Stock Advisor returns as of February 24, 2021

Jon Quast has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Skillz Inc. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.