Owl Rock Capital Corporation ORCC is well-poised for growth on the back of a robust portfolio, solid fourth-quarter results and strategic measures.

ORCC is the third-largest BDC with a market capitalization of $5.85 billion. The miscellaneous financial services provider has a portfolio size of $12.7 billion across 143 companies. Moreover, its dominance in the market is evident from its $13.3 billion worth of assets.

Over the past seven days, ORCC has witnessed its 2022 earnings estimate move 0.7% north.

In the fourth quarter, Owl Rock Capital reported earnings per share of 35 cents, beating the Zacks Consensus Estimate of 33 cents on the back of higher investment income. The figure also increased from the year-ago quarter’s earnings of 29 cents per share. New investment commitments totaled $1.58 billion at the end of 2021. ORCC exited 2021 with fundings of $1.46 billion.

Despite the current market uncertainty, ORCC managed to deploy capital to attractive investments and drive an incremental yield in the portfolio. Owl Rock Capital continues to seek opportunities in stable, large and recession-resistant businesses. The strong fourth-quarter results were supported by higher income from interest, dividends and other sources from non-controlled and non-affiliated investments. Also, better new investment commitments in the December quarter benefited the results.

Now let’s see what makes this currently Zacks Rank #3 (Hold) player an investors’ favorite.

Owl Rock Capital has been enjoying meaty investment income since its inception in 2015. In fact, its investment income saw a CAGR of 129.8% during the 2016-2020 forecast period, which is impressive. In 2021, total investment income rose 27.2% year over year on the back of an expanded investment portfolio.

Its inorganic growth story also impresses. Owl Rock Capital Group and Owl Capital Partners announced their merger with Baltimore Acquisition Corp, a special purpose acquisition company.

All these strategic moves poise it well for long-term growth.

In the fourth quarter, net funded investment activity came in at $550 million.

Despite the COVID-19 scenario, ORCC continued with capital deployment owing to its strong balance sheet. This is pretty evident from its dividend yield of 8.3%, which is way higher than the industry's average of 2%.

During 2021, ORCC through its agent repurchased shares worth $2.6 million as part of the $100-million buyback program approved by its board in November 2020. Owl Rock Capital resorted to paying dividends of $1.24 per share for the full year.

However, ORCC's expenses rose over the last few years, which might put pressure on the margins.

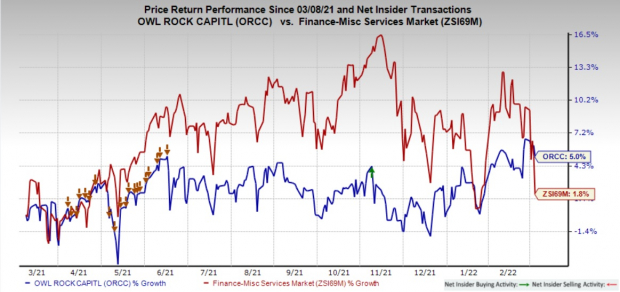

Shares of ORCC have gained 5% in a year’s time, outperforming the industry's growth of 1.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the same space are Columbia Financial Inc. CLBK, Houlihan Lokey, Inc. HLI and Virtu Financial, Inc. VIRT. VIRT sports a Zacks Rank of 1, while CLBK and HLI hold a Zacks Rank #2 (Buy) at present.

Columbia Financial Inc. operates as an investment holding company. CLBK's bottom line managed to beat estimates in three of its trailing four quarters (missing the mark in one), the average beat being 17.63%.

Houlihan Lokey is an investment bank, focusing on mergers and acquisitions, financings, financial restructurings and financial advisory services. HLI delivered a trailing four-quarter surprise of 28.08%, on average.

Virtu Financial is a market-leading financial services firm that leverages cutting-edge technology to provide execution services and data, analytics and connectivity products to its clients and deliver liquidity to the global markets. Earnings of VIRT managed to beat estimates in three of its trailing four quarters (missing the mark in one), the average beat being 24.76%.

Shares of CLBK, HLI and VIRT have gained 21.7%, 47.5% and 28%, respectively in a year’s time.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year's 2021 Zacks Top 10 Stocks portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Owl Rock Capital Corporation (ORCC): Free Stock Analysis Report

Virtu Financial, Inc. (VIRT): Free Stock Analysis Report

Houlihan Lokey, Inc. (HLI): Free Stock Analysis Report

Columbia Financial (CLBK): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.