Why Should We Focus on the Nasdaq-100® Index in the Post-pandemic Era?

This article was first published in ZUU online on June 24, 2022. Click here for the original article in Japanese.

Inflation is accelerating around the world against rising resource and energy prices. Monetary authorities in key countries are shifting from “easing their monetary policy and lowering interest rates” to “tightening monetary policy and raising interest rates” to control inflation, requiring investors to change their investment strategies to align with the post-pandemic era.

Under these circumstances, a portion of investment funds is now heading toward U.S. stocks, creating a “U.S. stock boom.” However, there is less information available on U.S. stocks than on Japanese ones, and many Japanese investors are still unsure of what to buy. Therefore, we would like to introduce the Nasdaq-100® (or NDX®), which allows investors to invest in U.S. stocks that have high-growth potential and also offers the advantage of index investing. Let us explain the appeal of the Nasdaq-100, which has been attracting investor attention worldwide due to its characteristics and growth potential.

Inflation-proof investment models critical in the post-pandemic era

In Japan, investing in U.S. stocks has increased significantly over the past few years. Their long-term upward trend, the projected continued growth of the U.S. population, and the presence of many of the world’s leading global companies on US exchanges have led to an increased focus on U.S. stocks in Japan too.

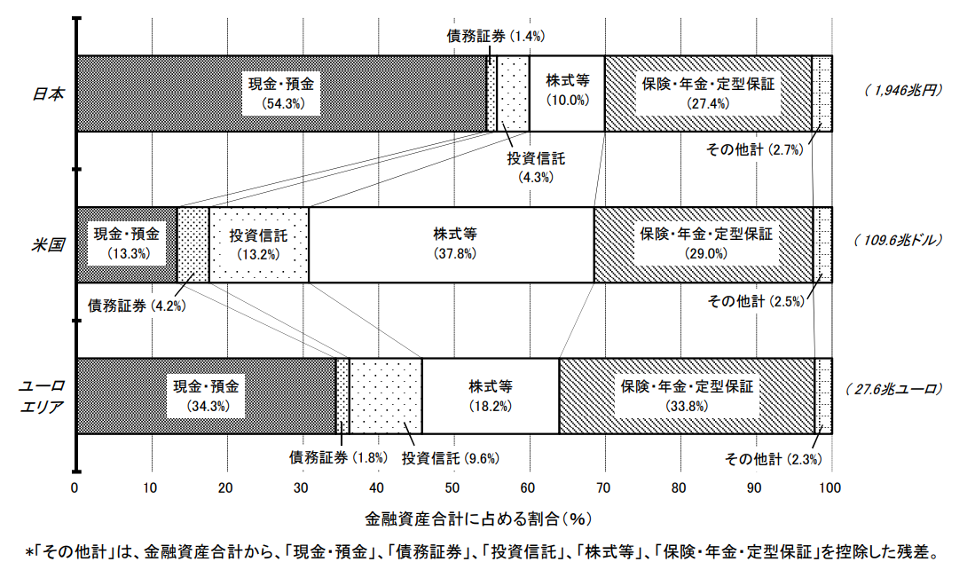

Until now, the ratio of cash and deposits amongst Japanese households has been high at around 50%, while the ratio of stocks and investment trusts has remained at around 10% (Source: Bank of Japan, November 1, 2021), reflecting an ultra-conservative trend. Since the burst of the bubble economy in 1991, Japan’s economy has stagnated and entered a period of prolonged deflation. In a deflationary economy, the relative value of money rises, so there is no need to worry about asset value declining if assets were held in cash or savings.

Household Financial Asset Composition

However, we are now about to enter a time of global inflation against rising resource and energy prices. Japan is no exception. If Japan continues to follow a conservative investment strategy of holding most of its assets in cash and savings, the real value of its assets may only decrease due to inflation, which will cause the value of money to diminish. As the world, including Japan, moves into a “post-pandemic” phase, it is important to have a long-term investment model that is able to withstand inflation.

After the collapse of the bubble economy in 1991, Japan’s stock market has been in a slump for what has been called the “lost 30 years”. But since 2012, the market has been in a long-term uptrend, and by 2021, the Nikkei Stock Average reached the 30,000-point mark for the first time in 31 years. However, it has yet to reach its all-time high of 38,957 points, as seen in December 1989.

On the other hand, U.S. stocks have recovered from the shock of numerous crashes, such as Black Monday in 1987, the Lehman Shock in 2008, and the Corona Shock in 2020, and they have continued to reach new all-time highs. In other words, no matter when you bought U.S. stocks in the past, you are currently in a positive position. The “long-term upside potential” is the main reason why U.S. stocks are favored by investors around the world.

Diversification into non-Japanese stocks is essential to mitigate risk

In order to avoid the diminution of assets due to inflation, investors are required to invest in higher risky assets than cash, such as stocks, however, investing in stocks also entails risk. Diversification is an important way to mitigate this risk. There are three types of diversification investment: asset diversification, time diversification and geographic diversification.

The diversification of assets includes not only Japanese stocks but investments in countries other than Japan. This is because a portfolio consisting only of Japanese stocks cannot avoid problems specific to Japan, such as a declining population and sluggish demand. To mitigate such investment risks while at the same time achieving the desired investment returns, it is necessary to diversify into non-Japanese equities.

Nasdaq is attracting attention from investors around the world

So, which markets outside of Japan are promising investment targets? The most promising market would be U.S. equities. One of the reasons for this is the historically high performance of U.S. stocks.

The Nasdaq Stock Exchange is home to many of the world’s leading technology companies, including the “GAFAM” line-up (Google [Alphabet], Apple, Facebook [now Meta], Amazon.com and Microsoft), which have rapidly grown into mega-corporations in recent years. Nasdaq is widely considered to be the exchange of choice for innovative companies in technology as well as other sectors that are disproportionately driving U.S. economic growth. If you are looking for higher returns, you should consider investing in the stocks listed on the Nasdaq market.

As of year-end 2021, Nasdaq-listed companies accounted for just under one-half of the market capitalization of all U.S. equities. The long-running trends of globalization, digitization, and technology-driven innovation are well-represented by Nasdaq-listed companies and have only accelerated in recent years, solidifying their reputation as a major source of growth.

Let us take a look at various indexes. Outside of Nasdaq, there are other world-renowned indices, such as the Dow Jones Industrial Average and the S&P 500 in the U.S., which also track companies listed on the New York Stock Exchange. Over the past almost decade and a half, the Nasdaq Composite has clearly outperformed the other indices, with a total return of 591% vs. 333% for the S&P 500 and 290% for the Dow Jones (as of December 31, 2021).

After 2020, real economic activities across the world were paused due to the pandemic, but companies in the IT, digital, and technology sectors grew significantly. As a result, the Nasdaq index probably outperformed the New York Dow, S&P 500, and other indices by a wide margin.

Nasdaq-100 index shows strong price movement despite COVID-19 turmoil

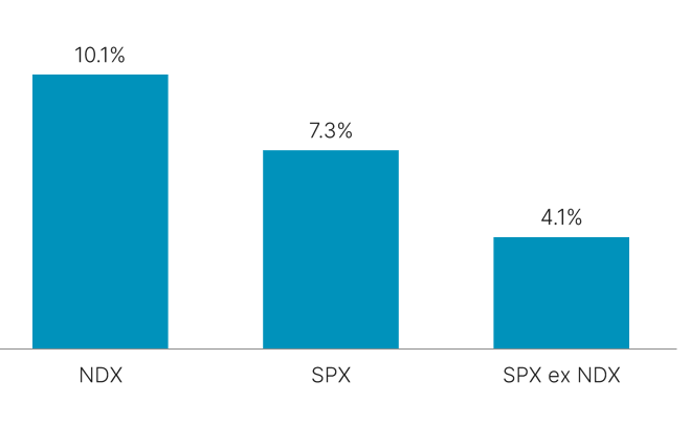

Of particular note is the Nasdaq-100 index, which consists of 100 major stocks listed on Nasdaq.

Whereas the Nasdaq Composite is the broadest option for tracking Nasdaq-listed companies, it is not the most investable. The Nasdaq-100, which tracks 100 of the largest non-financial companies listed on Nasdaq, offers investors the ability to track one of the most liquid index ecosystems in the world, with a focus on large-cap growth.

Its performance has been even stronger than that of the Nasdaq Composite, with a total return of 803% for the 14-year period ending on December 31, 2021. Performance through the first four months of 2022 has been weak so far, down 21%, as the broader U.S. equity market reacted to negative macroeconomic headlines around rising interest rates and inflation, as well as geopolitical turmoil driven by Russia’s invasion of Ukraine. At the same time, the S&P 500 has declined by approximately 13% year-to-date.

Total Return Trends for the Nasdaq-100 and S&P 500

The strong historical price performance of the Nasdaq-100 has been supported by the fundamental strength and growth of its constituents.

Nasdaq-100 companies have also, on average, grown their earnings, dividends and investments into R&D at a much faster rate over the past two decades.

Weighted Average Annual R&D Expense (January - December 2021, $bn)

Weighted Average R&D as % of Sales (January - December 2021)

The strong resilience of the Nasdaq-100 throughout 2020, when the pandemic began, can be attributed to the fact that many of these companies were central in leading the world through its recovery. After the so-called “COVID-19 Shock” of February to March 2020, the Nasdaq-100 had already rebounded to the same level as the beginning of the year by mid-April. In early September of that year, it reached an all-time high. This occurred as many of the components of the Nasdaq-100 became the enablers of a hyper-digitalized pandemic-era economy, which persists to varying degrees today. Companies such as Zoom, Cisco and Microsoft facilitated a monumental transition to working from home, while other companies, including Facebook, Google, Amazon, Netflix and Airbnb, provided the ability to shop, learn, entertain and relax from home.

Many technology companies driving the global economy are listed on Nasdaq

When delving into the growth factors of the U.S. market, “technology-driven growth and innovation” is at its core. With a 50-year track record of nurturing and growing high-tech brands, the Nasdaq stock market has been widely recognized as the core platform for high-tech stock-driven investment trends: Apple went public in 1980, Cisco in 1990, and Google in 2004. The continuing attraction of Nasdaq is the result of many other leading technology companies choosing to list on the exchange year after year, including global companies based outside of the U.S.

Major high-tech and biotech stocks are included in Nasdaq-100

| Company | Symbol | Summary |

|---|---|---|

| Apple | AAPL | Manufacturing and sales of iPhones and iPads are the mainstays of the company. Subscriptions such as Apple Watch and Apple TV are growing and profitability is improving. The share price has been rising almost consistently, and in January 2022, the company became the first in the world to achieve a market capitalization of $3 trillion. |

| Microsoft | MSFT | It once dominated the world with its Windows operating system (mission-critical software) and Office suite. Currently, it is shifting to a subscription business that combines PC and mobile accounts into one. Amid fierce competition with Amazon, cloud services are also growing. |

| Amazon.com | AMZN | The world’s largest online retailer. In addition, the cloud service AWS (Amazon Web Services) is expanding rapidly; in the fourth quarter of 2021 (October-December), AWS sales grew 40% y/y to $17.8 billion, accelerating growth. |

| Tesla | TSLA | The largest EV (electric vehicle) manufacturer. Disrupting the market for conventional gas-powered vehicles, the company has quickly emerged as the top automotive company in terms of market capitalization. Sales volume has grown significantly, driven by the trend toward decarbonization. Its stock price has risen nearly 40-fold since it was added to the Nasdaq-100 in July 2013 through year-end 2021. |

| Alphabet | GOOGL | The holding company for Google, the largest search site, and other companies, has acquired and grown numerous platforms, including YouTube and Android. Advertising is the main source of revenue, but the company continues to grow with promising startups in life sciences, self-driving, and other fields. |

| Meta Platforms | META | In 2021, the former Facebook announced it would shift its business focus from the advertising revenue business through social networking to the highly promising metaverse (giant virtual space) and changed its name to Meta Platforms. This was the beginning of worldwide recognition of the metaverse. |

| Netflix | NFLX | World leader in video streaming services. It has over 220 million subscribers. The company’s original films have become more influential than Hollywood films in terms of the number of Academy Award nominations. |

| Starbucks | SBUX | The company operates cafes mainly in North America and East Asia, with the number of stores growing from 7,000 in 2003 to more than 32,000 by 2020. The company’s management is characterized by directly operated stores. The company’s strength lies in the stability of its existing stores, which are characterized by their “fashionable” and “upscale” atmosphere. |

| Moderna | MRNA | An up-and-coming biotech venture that went public in 2018. It is known for its development capabilities and has succeeded in developing a vaccine for the new coronavirus ahead of other companies. The share price increased about 24x from the end of December 2019 through July 2021 but is currently adjusting and now stands at a cumulative return from December 31, 2019, through April 30, 2022, of 587%. |

| Illumina | ILMN | A world leader in the field of genetic analysis, with a dominant share of the DNA sequencing equipment market. In addition to cancer and other diseases, the company conducts research in a wide range of fields, including agriculture and fertility treatment. The company’s financial and earnings structure is solid, but the stock price has been in adjustment for the past six months. |

The Nasdaq-100 index is one of the most promising investment targets in U.S. equities

In addition to high-tech companies with “core technologies” such as Apple and Microsoft, which are revolutionizing the global economy, many other promising companies have been selected for inclusion in the Nasdaq-100 Index. Companies such as Amazon, PayPal, Starbucks, Tesla and Netflix, which people in Japan are familiar with and use in their daily lives, are also included in the Nasdaq-100. Outside of the two biggest sectors for the index – technology and consumer – there are other important innovators in areas such as healthcare and, specifically, biotechnology. Moderna and AstraZeneca developed two of the earliest Covid-19 vaccines, while Regeneron and Gilead brought to market two therapeutics against the virus, which were approved in Japan in 2021 and 2020, respectively. Other biotech constituents of note include Illumina, which has been at the forefront of genomics, as well as Amgen and Biogen. These companies have become leaders in their respective industries and, in many cases, are still experiencing strong growth in their businesses even in the post-pandemic era.

We have described the characteristics of the Nasdaq-100 and the growth potential of its constituents. When looking to invest in individual promising companies in U.S. equities, researching stocks from companies selected for the Nasdaq-100 can be a powerful selection method.

There are also a number of investment products that are linked to the Nasdaq-100 Index, such as ETFs and index funds that are denominated in US dollars or hedged against foreign exchange rates. By investing in investment products linked to the Nasdaq-100, one can diversify investments across a wide range of industries while focusing on growth companies, thereby reducing investment risk. If you are considering investing in U.S. stocks in the future, the Nasdaq-100 is an index that you should definitely check out.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.