Shares of e-commerce software company Shopify (NYSE: SHOP) skyrocketed 47.8% during November, according to data provided by S&P Global Market Intelligence. The company helps businesses sell products online, and these merchant customers are doing quite well right now.

Shopify uses a metric called gross merchandise volume (GMV). This isn't its revenue but rather the value of all of its customers' sales. On Nov. 12, Shopify reported financial results for the third quarter of 2024. And during the quarter, its GMV was nearly $70 billion. This was up a strong 24% year over year and marked its fifth straight quarter of greater-than 20% GMV growth.

To put things simply, the businesses that use Shopify's software are doing well. And that's good for Shopify itself. Indeed, the company's Q3 revenue was up a robust 26% year over year to nearly $2.2 billion. Moreover, its free-cash-flow margin hit 19%, which is quite strong.

On Nov. 30, Shopify co-founder and CEO Tobi Lütke shared on social media that the company had Black Friday GMV of $5 billion, which was up 22% from Black Friday in 2023. This further excited investors.

Shopify is growing and getting a grip on profits

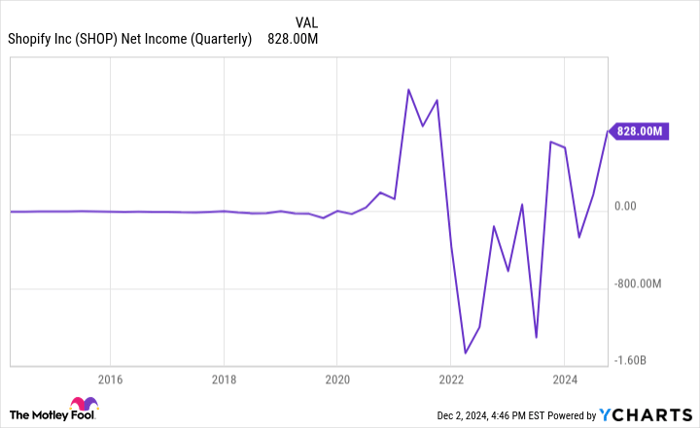

Shopify's top-line growth has long been impressive -- it's one of investors' favorite reasons to buy Shopify stock. But profitability has been volatile in recent years as it's pivoted in and out of the logistics space, among other things. Q3 net income of $828 million got a nice boost from the value of some of its equity investments in other companies. But even without this, it was solidly profitable with $344 million in adjusted net income.

SHOP Net Income (Quarterly) data by YCharts.

In light of its strong growth and profits in Q3, many professional analysts on Wall Street raised their price targets for Shopify stock. A price target is basically just the price that someone thinks it can reach in about a year or so. The main point is that many pros looked at the numbers and decided that Shopify stock could climb higher than they previously thought, which was something that helped rally investors.

Shopify's profits are good news

Don't get me wrong: Shopify's financial results are fantastic, and investors are rightly enthused. But its valuation is creeping up, which underscores its need to maintain strong growth for an extended time period.

I believe Shopify's profit improvement, particularly its free cash flow, is encouraging in this regard. The company doesn't really repurchase shares, and it doesn't pay a dividend. Rather, its free cash flow is invested right back into growing the business. In the Q3 earnings call, President Harley Finkelstein said that he was pleased with the free cash flow "Because it gives us the ability to grow the business and invest in the future."

Shareholders should keep tabs on the growth rate and the free-cash-flow margin. But after November, there's plenty of reason for long-term optimism.

Should you invest $1,000 in Shopify right now?

Before you buy stock in Shopify, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Shopify wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $847,211!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 2, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Shopify. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.