What happened

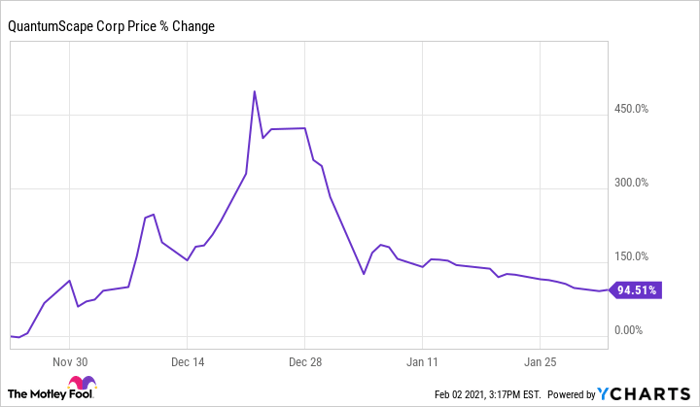

Shares of QuantumScape (NYSE: QS) fell 48.2% in January, according to data provided by S&P Global Market Intelligence, basically giving back the stock's gains from December. But investors who have held QuantumScape stock since the company first became public in November shouldn't be too upset: They have still almost doubled their money in a very short amount of time.

So what

QuantumScape has experienced more drama in a matter of months than most stocks experience in a year. The company is developing a solid-state lithium-metal battery that in theory would be a massive upgrade over the lithium-ion batteries now used by automakers, offering greater energy storage, lower costs, and better stability.

The company joined public markets in November via a merger with a special purpose acquisition company, or SPAC, at a moment when investors couldn't get enough of SPAC stocks.

Image source: Getty Images.

We said in early January that the stock's run was likely unsustainable, and indeed QuantumScape came back down to Earth quite a bit in the first month of 2021. This is still a company with a lot of promise, but it is going to take years for that promise to translate into profits. At its peak, QuantumScape was valued higher than Ford Motor Company, so the January swoon shouldn't be much of a surprise.

Now what

For all the volatility in the stock, the investment case for QuantumScape has not changed much in the months since it first landed on public investors' radars. There's a lot to like about this company, including its partnership with shareholder Volkswagen, which figures to be a key customer assuming QuantumScape batteries are as good as the hype.

The important thing to remember, however, is that questions about whether the product is viable and can be produced at scale at a market-competitive cost are still unanswered. This company could end up a roaring success, or it could amount to nothing, and we won't know for years.

Even after the January fall, QuantumScape is still a $15 billion company. Investors who are intrigued by its promise should limit the stock to a small piece of a well-diversified portfolio, and understand that even if the stock is more affordable now than it was in December, it could still fall further in the months to come.

10 stocks we like better than QuantumScape Corporation

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and QuantumScape Corporation wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of November 20, 2020

Lou Whiteman owns shares of Ford and QuantumScape. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.