What happened

Shares of biotech Moderna (NASDAQ: MRNA), maker of a COVID-19 vaccine, dropped 31.6% in December, according to data from S&P Global Market Intelligence.

For context, the S&P 500 returned 3.8% last month.

Image source: Getty Images.

So what

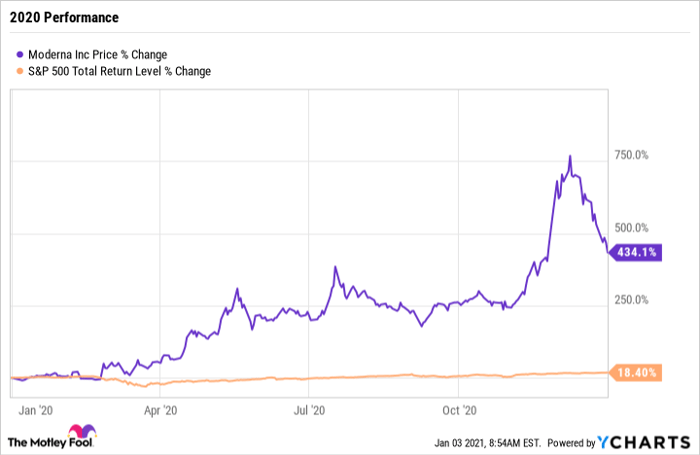

We can attribute Moderna stock's 32% drop last month to profit taking. After all, shares were up a whopping 581% in 2020 through the end of November, so it wasn't surprising that some investors took some money off the table in December. Moderna stock ended the year with a 434% gain.

Shares of Moderna began their long climb early in 2020 when the company announced that it was developing a vaccine to immunize against COVID-19, the disease caused by the novel coronavirus.

As the below chart shows, the stock had a sharp run-up in November. It skyrocketed 126% in that month, driven by a string of great news about mRNA-1273, which was then a messenger RNA-based vaccine candidate. On Nov. 30, Moderna announced the positive final results from its phase 3 study. As I previously wrote, "It found its vaccine candidate to be 94.1% effective in preventing COVID-19, and it uncovered no serious safety concerns. Moreover, the company said that it had submitted a request with the U.S. Food and Drug Administration (FDA) for Emergency Use Authorization (EUA) for mRNA-1273."

Then on Dec. 18 came "the big news": Moderna announced the FDA had authorized the emergency use of mRNA-1273. Shares, which had been moving downward throughout December, fell nearly 3% that day. The reason shares dropped on such terrific news is that this news was widely expected and already priced in during November.

The U.S. distribution of the vaccine began the next day, and administration of the first of the two-dose vaccine started on Dec. 20.

Data by YCharts.

Now what

On Dec. 18, Moderna said that it expected to deliver about 20 million doses to the U.S. government by the end of December 2020. It also expects to have between 100 million and 125 million doses available globally in the first quarter of 2021, with 85 to 100 million of those available in the U.S. A total of 200 million doses was ordered by the U.S government, which has the option to purchase up to an additional 300 million doses.

The rollout of Moderna's vaccine to the states was slower than anticipated in December, but that's not its fault. The federal government's Operation Warp Speed is in charge of distribution.

10 stocks we like better than Moderna INC

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and Moderna INC wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of November 20, 2020

Beth McKenna has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.