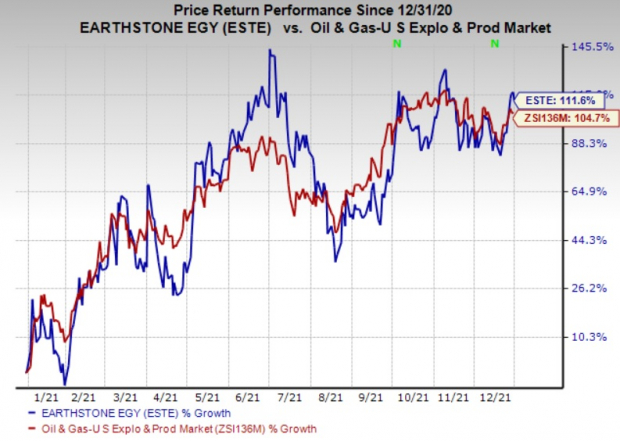

Earthstone Energy, Inc. ESTE has witnessed upward earnings estimate revisions for 2021 and 2022 in the past 30 days. So far this year, the stock — sporting a Zacks Rank #1 (Strong Buy) — has gained 111.6%, outpacing the 104.7% improvement of the composite stocks belonging to the industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

What's Favoring the Stock?

The price of West Texas Intermediate (WTI) crude has currently jumped massively to more than 76 per barrel from below $49 at the beginning of this year. The significant improvement in crude price is primarily owing to coronavirus vaccines that are being rolled out on a massive scale.

The positive trajectory in the oil price is a boon for Earthstone Energy’s upstream operations. This is because Earthstone Energy is a leading explorer and producer having a strong footprint in prolific resources like the Midland basin of west Texas and the Eagle Ford Trend of south Texas.

A notable announcement that impressed investors this year is Earthstone Energy’s recent deal to acquire Northern Delaware Basin assets for roughly $604 million. With the accord, as announced on Dec 16, Earthstone Energy will likely expand its presence in the Permian basin by more than 35% to roughly 138,000 net acres. ESTE expects the deal to boost net production by 39% and free cash flow by 100% in 2022.

Earthstone Energy boasted that it is set to expand its footprint in the Permian — the most prolific basin in the United States — by 400%, taking into consideration the completion of prior four acquisitions this year and the recent deal that is likely to close by first-quarter 2022.

ESTE has a conservative balance sheet, with lower exposure to debt capital. In the past several years, Earthstone Energy’s total debt to capitalization ratio has consistently been lower than the composite stocks belonging to the industry.

Other Stocks to Consider

Other prospective players in the energy space include PDC Energy, Inc. PDCE, Sunoco LP SUN and Vermilion Energy Inc. VET, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PDC Energy is focusing on significant value creation, with a strong presence in the Delaware Basin, a sub-basin of Permian, wherein the company’s operations are spread across roughly 25,000 net acres. PDC Energy has done pretty well this year despite the coronavirus pandemic and projects 2021 free cash flow of more than $900 million. So far this year, PDC Energy has gained 138.9%, outpacing the 104.8% improvement of the composite stocks belonging to the industry.

PDC Energy also focuses on debt reduction. In order to further strengthen its balance sheet, PDC Energy is aiming at reducing its debt load by more than 40% in 2021.

Sunoco LP generates stable cash flows since it is a leading independent fuel distributor in the United States. With a growing energy infrastructure platform, Sunoco LP secures roughly 2,500 commercial customers.

Over the past 60 days, Sunoco LP has witnessed upward earnings estimate revisions for 2021 and 2022. With the demand for traditional motor fuels likely to remain steady, Sunoco LP is well placed to continue generating stable cash flows.

Vermilion Energy is a leading energy player that is engaged in exploiting light oil and liquids-rich natural gas conventional resource plays in North America. Having a global presence, Vermilion Energy is also involved in developing conventional natural gas and oil resources in Europe and Australia.

High margin and low decline assets have positioned Vermilion Energy to capitalize on the favorable commodity pricing environment in 2021. A recent noteworthy announcement that overwhelmed investors this year is Vermilion Energy’s agreement to acquire a 36.5% interest of Equinor Energy Ireland Limited in the Corrib offshore gas project in Ireland. So far this year, VET has gained 182.2%, outpacing the 107.1% surge of the composite stocks belonging to the industry.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sunoco LP (SUN): Free Stock Analysis Report

PDC Energy, Inc. (PDCE): Free Stock Analysis Report

Vermilion Energy Inc. (VET): Free Stock Analysis Report

Earthstone Energy, Inc. (ESTE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.