For a while, yesterday’s drop in stocks felt like the real thing. After it looked as if the market was going to ignore the highest levels of inflation since 1982, sellers took over and the last four hours of trading saw consistent declines. That pattern, and the fact that it was triggered by actual data rather than trading dynamics or the anticipation of something negative, both suggested that this was considered selling, not a knee-jerk reaction. That all points to the kind of move that is more than just a short-term reversal, and that could be the start of a big selloff but, so far this morning, indications are that the opposite is true.

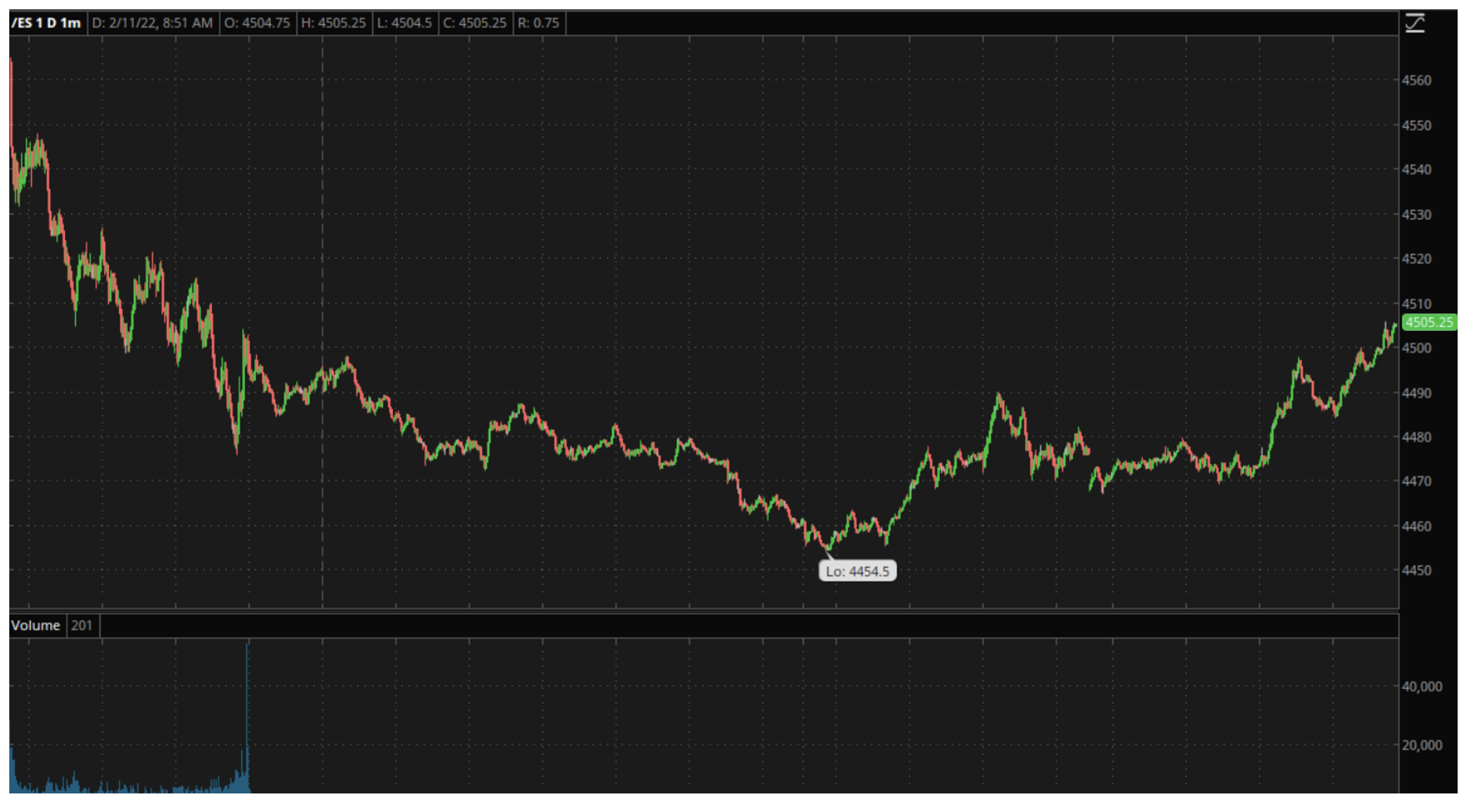

As I wrote this, the 1-minute chart for the E-Mini S&P 500 futures contract (ES) shows that while selling continued after the close yesterday, it reversed around midnight to the point where it indicated a higher opening today. We learned yesterday not to put too much faith in early morning levels but, even so, that is significant. It shows that panic isn’t the order of the day and there are buyers at certain levels:

Yesterday, I wrote that the data was expected and priced into stocks, but what was scaring traders was the thought that the Fed may be pushed into extreme measures. Just a few weeks ago the consensus was for three 25 basis point hikes this year, but now there is talk of seven, and of jumps of 50 basis points.

That is scary, but it is just talk. The data was worse than expected, but is it enough to prompt a Fed that has consistently erred on the side of caution to double both the frequency and size of future rate hikes? Maybe not. If the assumption that inflation and a reasonable number of rate hikes were priced into the market after last month’s ten percent drop is true, thoughts turn to what might bounce back strongly and provide a market-beating return.

I am looking for two things here: stocks that have been hit hard on the way down and that may have overshot their logical lows, and companies that will actually benefit from inflation. One stock that fits both of those descriptions is Block (SQ), Jack Dorsey’s payments and fintech company, formerly known as Square.

SQ has certainly been hit hard, being down 65% from its high six months ago to the low earlier this week. The dramatic drop is because the stock represents everything the market hated during that time. It had a triple digit P/E based on massive pandemic era growth and had gained over 890% from its Covid lockdown lows. In that sense, the selloff is understandable, but even as it occurred, Block has continued to grow revenue and, at around twenty percent above pre-pandemic levels, it is definitely looking a bit oversold.

The biggest reason to like SQ in this environment, though, is what inflation means for the company. It is not one of the cash-poor, highly leveraged firms for whom rising rates mean soaring, unmanageable debt service costs. Square has roughly the same amount of cash on hand as debt outstanding, with good free cash flow. Their problem until now has been skinny margins, but inflation will help with that. Their core business is payment processing, where they take a percentage of every transaction they process for their clients. Inflation means that those transactions will be for higher amounts, enabling margin expansion and growth, even if they themselves just stand still.

It is always dangerous to go bottom fishing for a stock that has lost two thirds of its value, and this is no exception. That is why, if buying it around here, it is important to set and stick to a stop loss level just below the $99.50 low. With that protection in place, the potential benefit from inflation to a stock that has dropped by over 65% from its highs makes the risk one well worth taking.

Do you want more articles and analysis like this? If you are familiar with Martin’s work, you will know that he brings a unique perspective to markets and actionable ideas based on that perspective. In addition to writing here, Martin also writes a free newsletter with in-depth analysis and trade ideas focused on just one, long-time underperforming sector that is bouncing fast. To find out more and sign up for the free newsletter, just click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.